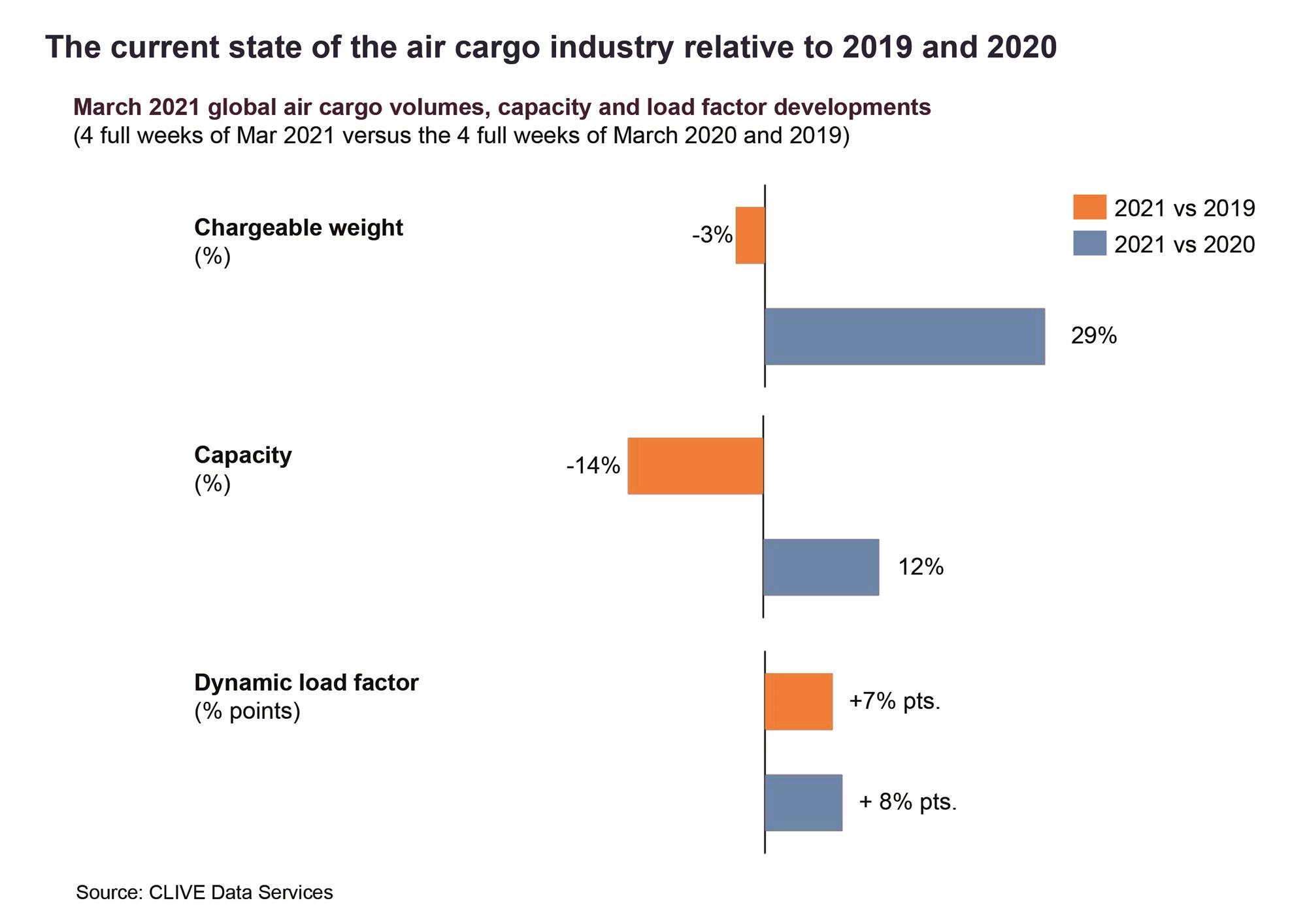

The recovery in global air cargo volumes stalled in March as volumes dropped by 3% versus comparative data for March 2019, but reduced airline capacity levels saw the ‘dynamic load factor’ and prices remain ‘relentlessly high,’ according to the latest market data from industry analysts CLIVE Data Services and TAC Index.

For the four full weeks of March 2021, global volumes were ‘unable to continue the recovery seen in January and February, relative to the same month of 2019, CLIVE said, as the 3% decline in demand for these weeks also worsened towards the end of the month, and reached a drop of 4% relative to the start of the month.

Nonetheless, CLIVE noted that the air cargo market is in far better shape than a year ago when the outbreak of the Covid pandemic led to a sudden collapse in global capacity — with March 2021 volumes up 29% up over March 2020, peaking at an increase of 55% in the last two weeks.

With airline cargo capacity down 14%, however, versus 2019, CLIVE Data Services’ said dynamic load factor – which considers volume and weight perspectives of cargo flown and capacity available - remained relentlessly high: 73% for the period, 7% points higher than in 2019.

“This decline in capacity relative to 2019 should be seen, however, in the context of passenger airlines starting their busier traditional summer schedules in March 2019 - which is obviously not the case this time around,” CLIVE said in its report.

Supply-driven market

Niall van de Wouw, managing director of CLIVE Data Services said the March data shows that “the market is still very supply-driven.”

“After indicators that the global air cargo market was seeing some ‘light at the end of the tunnel’ in January and February after a year of such high disruption, this latest industry data will reign in that optimism slightly,” van de Wouw said.

“This may reflect Covid-19 fatigue in the buying habits of businesses and consumers as we see more reports of infection rates creeping up again in many countries, fears of a possible third wave of the virus, more lockdowns and curfews, and concerns over both the supply and effectiveness of vaccines.”

Meanwhile, he noted that although flights are “very full” from a cargo point of view, there's “no recovery in the passenger market.”

van de Wouw added that airline intercontinental operations are still mainly cargo-driven and they need higher prices to make these operations financially viable.

On the Atlantic, CLIVE reports record load factors in both directions, reaching 90% westbound for the last two weeks of March. On eastbound sectors, for example, the Chicago (ORD) to Western Europe route reached levels of 80% earlier in the month, the tipping point at which prices often increase exponentially.

“On this market, they went up by around 25% during this timeframe, even though the load factor increased by ‘just’ 5% points. ‘And the prices came down just as fast again when the load factor dropped below this tipping point,” the CLIVE report stated.

It added that comparing the current China-to-Europe trade lane to 2019 shows a similar pattern at a global level — that the

“push forward in this market seems to be decelerating.”

March 2021 pricing higher than 2020

Analyses by TAC Index also confirmed the impact of high load factors on airfreight pricing.

In the statement, it noted that China and Hong Kong-Europe pricing for the last three years reveals an increase of 30% and 17% respectively year-on-year, or a rise of over 50% versus 2019.

In March 2019, pricing was at US$2.70/kg and it increased to US$3.51/kg in March 2020. By March 2021, pricing rose to US$4.09/kg due to capacity restrictions.

TAC Index noted that a comparison of London Heathrow (LHR)-North America airfreight prices for March over February shows an increase of GPB 0.28/kg or 8% in average pricing. Comparing March 2020 over March 2021, the average price rose by EUR 2.13/kg. The highest price in March 2021 of GPB 4.04 (week 4/2021) represented an increase of nearly 45%.

“Pricing in March and February did not show big volatility month-over-month and, also, the intra-month volatility was not as big as in previous periods. Whether this can now be viewed as a relatively stable situation on a much higher level than in 2019 remains to be seen,” TAC Index said.

“It is definitely interesting to note that pricing on all lanes discussed here are higher than at the end of March 2020 when the PPE impact kicked in,” Robert Frei, Business Development Director at TAC Index said.

To give a meaningful perspective of the air cargo industry’s performance, CLIVE Data Services’ compares the current state of the market to pre-Covid 2019 volume until at least Q3 of this year.