In an effort to attract investment to its country, Thailand’s government has embarked on an aggressive economic development scheme it calls Thailand 4.0. The plan, spearheaded by the Thailand Board of Investment (BOI), focuses on higher value manufacturing in food processing, new generation automobiles, robotics, aerospace, biotechnology, alternative energy, smart devices and high-value-added services. The goal is to bring that nation up the value chain in a region that is already regarded hot for foreign direct investment, manufacturing and international trade.

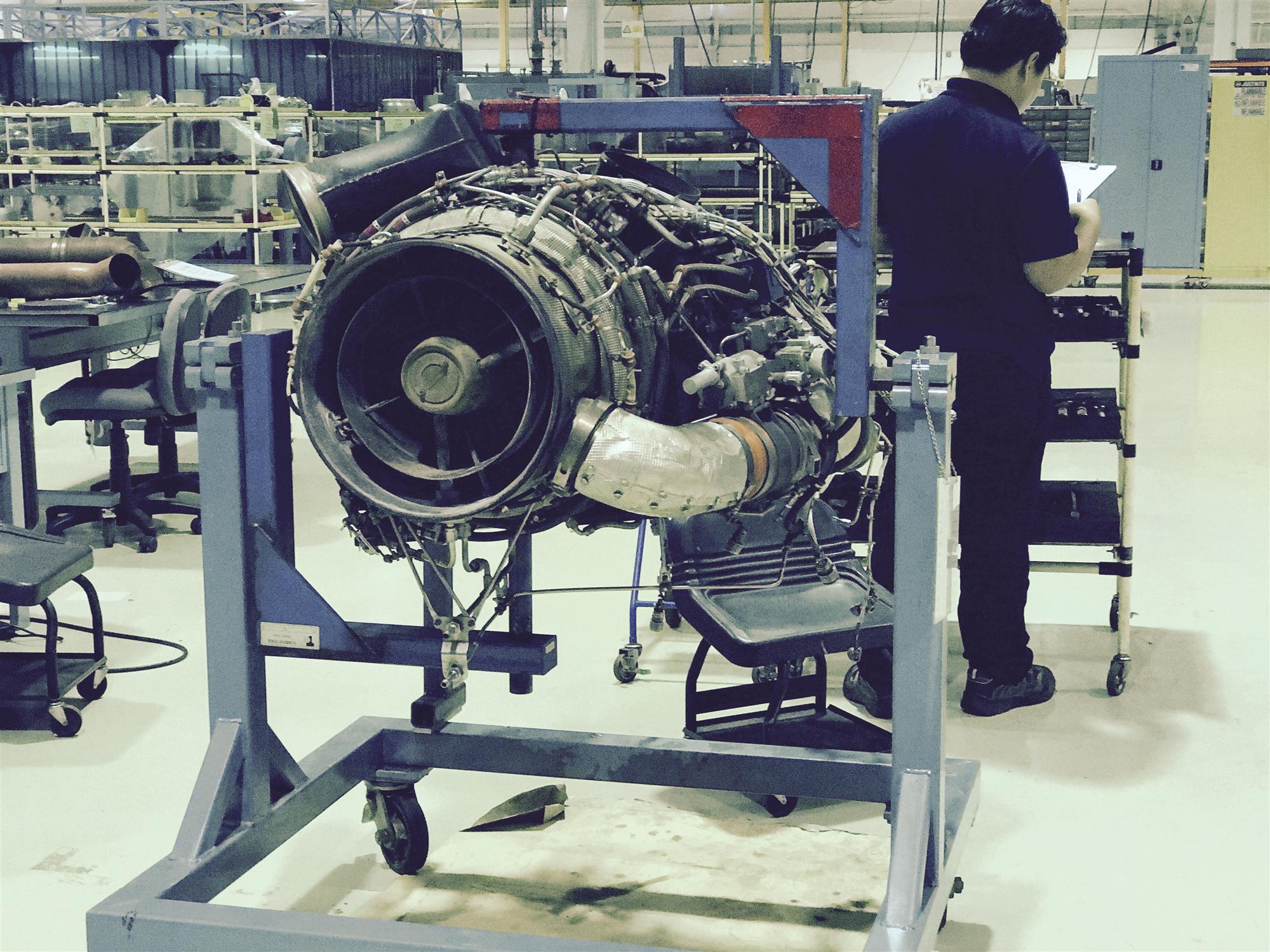

On February 15, Thailand’s top officials, including Prime Minister Prayut Chan-o-cha, promoted Thailand 4.0 during a seminar dubbed Opportunity Thailand. One of the companies featured in an afternoon breakout session during the event was TurbineAero, a provider of independent aerospace component maintenance, repair and overhaul (MRO) services.

TurbineAero, based in the United States, was spun out of one of three divisions of Triumph Aviation Services – Asia (TASA) on February 9. TASA was registered in 2005 by Triumph Group as a Thai subsidiary and formed to become Triumph’s Asia-Pacific aftermarket services headquarters and one-stop service centre for all of Triumph Group’s in-region MRO activity.

While most of Triumph’s companies are based in the United States, Triumph has evolved into a global corporation with a presence in Europe, Asia and Mexico. In 2007 Triumph opened a major maintenance facility in Thailand, and in 2010 opened a manufacturing facility in Zacatecas, Mexico. These operations allow Triumph to expand the services of its US-based companies in closer proximity to the rapidly growing markets they serve.

Triumph has invested over US$50 million in its new facility in Amata Nokorn Industrial Estate in Chonburi southeast of Bangkok, and in a manufacturing site in Rayong in the Eastern Economic Corridor (EEC), BOI’s designation for Thailand’s eastern seaboard.

“In deciding to locate to Thailand, we compared our opportunities to those in China, Singapore, Malaysia and Indonesia,” said Remy Maitam, president of Triumph Aviation Services Asia. “Thailand came on top. Here we have access to infrastructure, a free trade zone and a trained workforce. Thailand promised us a lot of business.”

Maitam said that the TurbineAero spin-off was recently created by the acquisition of three business units within the Triumph Group that are based both in the United States and Thailand. The Gores Group, a global private equity firm based in the United States, led the investment and acquisition process and worked closely with the BOI and Thailand government to ensure TurbineAero’s Thailand facility and business unit were properly and efficiently structured as a Thailand registered entity. According to TurbineAero CEO Rob Higby, what really made the acquisition possible was the partnership with the equity group.

“The Gores Group’s purchase of Triumph’s APU businesses, including the Thailand facility, really taps into what Thailand 4.0 is all about,” commented Higby. “While Singapore is Asia’s MRO hub, the BOI made it possible for a US investment firm to invest capital in Thailand. Thailand is an ideal hub for our Asia and Eastern European business and the BOI has ensured us the right infrastructure and incentives to enable us to hit the ground running.”

Higby emphasized that what made the deal attractive to TurbineAero was the location’s network of transportation options (land, sea and air) in close proximity to the Amata Nokorn Industrial Estate.

“Everyone knows the big hub for aviation in Asia is Singapore,” he said. “But this location has many capabilities in its own right. Thailand is also taking a leadership role in getting manufacturing and engineering talent here to focus on MRO investments. They are taking a leadership role in incentives, especially aerospace. And there is so much business in Asia, other hubs are needed.”

Maitam noted the lack of capacity in Asia for heavy aircraft maintenance. “Even China is full,” he said. “Companies there are having problems dealing with the sheer volume. Although China is trying to catch up as fast as possible by developing the West and Northeast of China, I don’t think they can get to the necessary level in the next five to 10 years. Meanwhile, Southeast Asia will grow as much as China in terms of the number of airplanes.”

This will result in a tremendous growth of spare part shipments in this part of the world. “We are very interested in acquisitions to fill out the gaps in the supply chain,” Higby said.

Higby particularly pointed to U-Tapao Airport in Thailand’s EEC, a region already critical to Thai manufacturers given its proximity to the main cargo airport, Don Muang Airport, Suvarnabhumi International Airport and the deepwater Laem Chabang Port.

U-Tapao Airport, historically known as the US military base for B-52 bombers during the Vietnam War, was built by the US government and can accommodate the largest aircraft worldwide, including the Antonov. It serves as the airfield for the Royal Thai Navy First Air Wing as well as passenger service for Thai AirAsia. It is home to a large Thai Airways MRO facility, which also serves other airlines, including other Star Alliance members.

Plans call to expand the airport’s logistics uses, as well as passenger capacity to 20 million passengers by 2040. Logistics improvements include cold chain operations, transit and express cargo business, e-fulfillment operations and bonded warehousing.

“There are opportunities for repacking facilities, distribution centres, cargo for MRO operations, fruits, vegetables, fish, flowers, garments, aircraft and engine parts, machine parts, auto parts, and jewellery,” said Rear Admiral Worapol Tongpricha, director, U-Tapao Airport Authority. “One thing the airport has is a lot of empty land.” The Category 3 airport encompasses nearly 67,000 acres.

“Right now, we are designing an airport master plan and studying the requirements of industries,” Tongpricha said.

Completion of the master plan is expected this year. Current plans call for adding another runway. U-Tapao Airport is expected to relieve and compliment some of the capacity at Thailand’s Don Muang and Suvarnabhumi Airports.

“In that regard, U-Tapao has it all,” Higby said.

By Karen E. Thuermer

Correspondent | Bangkok