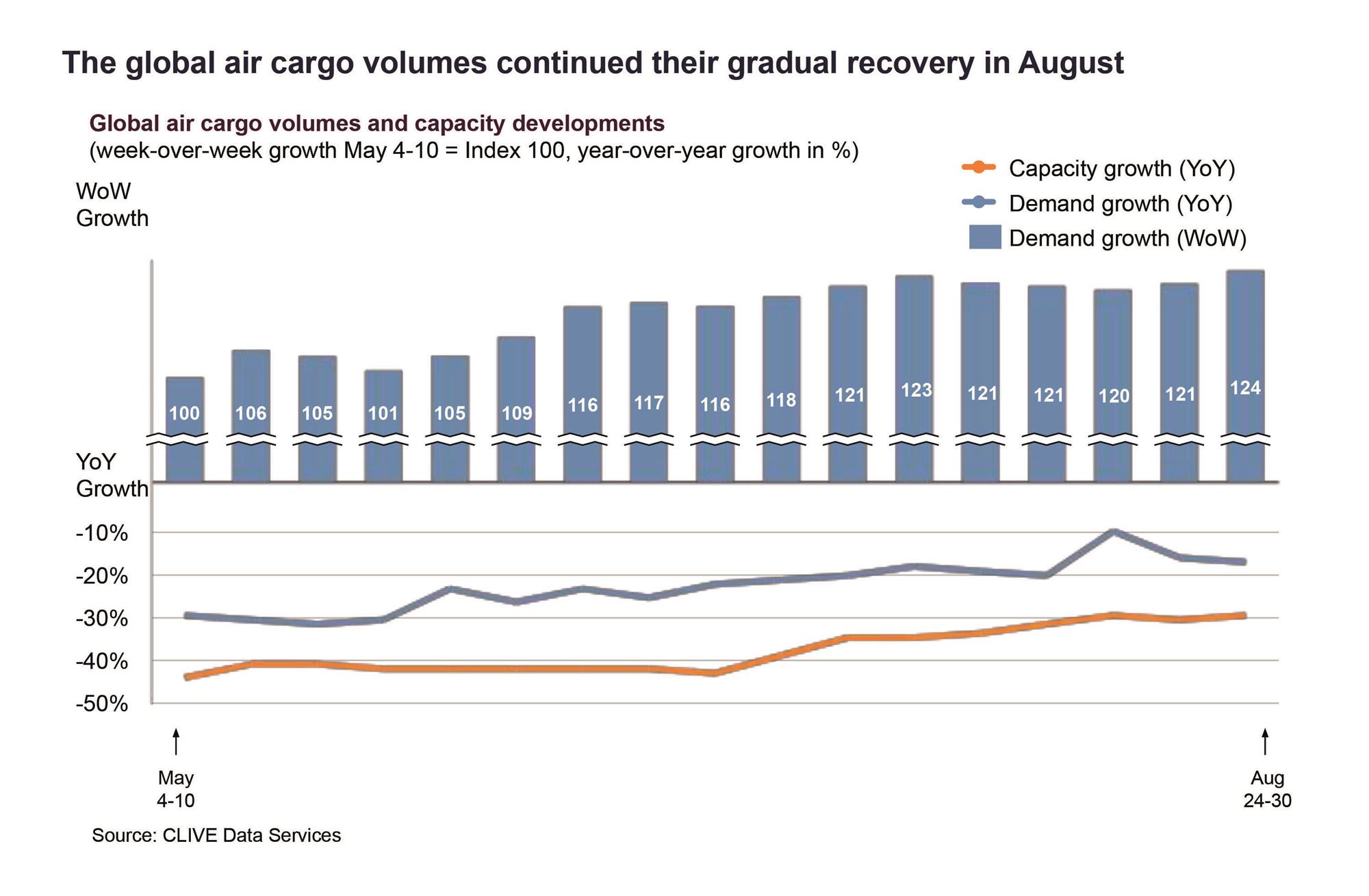

CLIVE Data Services' and TAC Index reported continued improvement in air cargo volume for the fourth consecutive month in August, noting that the capacity crunch is still there but is becoming slightly less and, as a result, load factors and yields are going down and becoming closer to pre-COVID levels, even though they are still elevated.

“Year-on-year growth during August showed a further narrowing of the gap in international air cargo volumes to -17% versus August 2019,” the airfreight market analyst said.

By comparison, it noted that there was a 41% year-on-year disparity between April this year and last year.

Capacity gains, however, have added to the downward pressure on both CLIVE’s ‘dynamic load factor ’ and average yields.

CLIVE said in August, the receding gap in the year-over-year decline between capacity and demand resulted in a global dynamic load factor drop from 70% in July to 68% last month.

"This is still exceptionally high considering that August is traditionally air cargo’s ‘slack season’ – registering at 8% points higher than the corresponding performance in August 2019," it said.

CLIVE noted that looking at traffic flows from China "confirms that previous concerns of hardly any demand for capacity once the PPE peak subsided have not materialized."

Volumes in the last week of August were ‘just’ 4% less than for this same week in 2019, “not great, but by no means a disaster,” said Niall van de Wouw, managing director.

“Our August data shows the year-over-year decline in volumes is decreasing. The capacity crunch is still there but is becoming slightly less and, as a result, load factors and yields are going down and becoming closer to pre-COVID levels, even though they are still elevated.”

It added: “Airline cargo departments have never been in control of their own destiny, and they’re still not, but they are in control of the present and short term in deciding where to place their cargo capacity.”

Cargo: main source of revenue

“Whereas cargo has often been regarded as the ‘freeloader’ of the airline industry because it has always been a by-product of far greater passenger revenues, right now it is passengers who are the ‘freeloaders’ because cargo is the main source of revenue for many airlines and helping to get passenger flights back into the air,” CLIVE said.

With the uncertainty of when passengers will return to flying, the airfreight market analyst said in the meantime, “air cargo will continue to have its day in the sun and combination carriers will have to hope this can sustain their slimmed-down operations until passenger confidence and bookings return.”

“When looking at the general pricing trends, we see the reaction to supply and demand happening more swiftly. This obviously has also to do with most carriers and forwarders breaking their contracts during the crisis and the fact that procurement is now done on a shorter-term basis,” said Robert Frei, business development director at TAC Index.

It added that with shippers also finding forecasting even more difficult during the present conditions, this situation may continue for some time.

He noted that all parties are currently looking at new ways of negotiating contracts, possibly using Index-Linked Agreements (ILA) or new risk management tools outside of the physical market.

“Air freight has for many carriers and forwarders been the main source of revenue over the last couple of months, which also shows in their results. The importance of air cargo to the recovery of global trade has become very visible and recognized,” Frei said.