BIMCO, the largest international shipping association, controlling around 65% of the world’s tonnage, said China has further cemented its position as the dominant player in dry bulk shipping with its imports now accounting for just shy of 50% of the market when measured in tonne-miles.

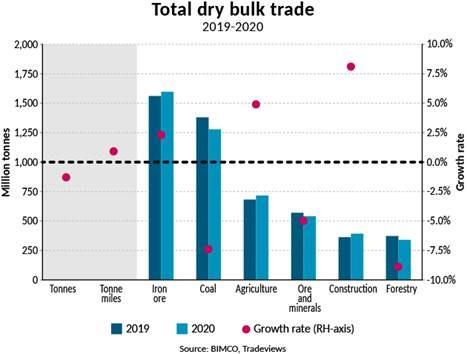

In a statement, it said the overall total tonnes transported by the dry bulk shipping industry fell by 1.3% to 5.49 billion tonnes, from 5.56 billion in 2019, which is however still higher than the 5.46 billion tonnes shipped in 2018.

BIMCO said this overall drop in tonnes marks discrepancies between different dry bulk commodities. Of the three main commodity groups, iron ore and agriculture both increased by 2.3% and 4.9%, while coal is the only one to have fallen in 2020, dropping 7.4%.

It noted that last year's result cemented the iron ore’s position as the highest volume dry bulk good.

In percentage terms, BIMCO noted that the biggest growth has come from construction, which grew by 8.1% in 2020. Meanwhile, the largest percentage drop came from foresty, down 8.9%, or 33 million tonnes: half of this drop comes from wood in rough down by 14.9 million tonnes (-17.4%). It said 10.6m tonnes of the total loss came from lower imports into China.

The largest commodity in the construction category is cement, which saw a 13.4% increase between 2019 and 2020. BIMCO noted that China accounted for half of this 21.5m tonne increase, as the country saw its seaborne cement imports rise by 52.2% (12.7m tonnes).

"For dry bulk shipping, the year can be divided in two, with lower volumes and earnings in the first half followed by a recovery in the second, as China split from the rest of the world, boosting tonne and tonne-mile demand, and sending freight rates to profitable levels. June was the turning point as volumes reached their highest point of the year, and earnings jumped, especially for Capesize ships,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

Chinese imports now account for 48.5% of market

BIMCO said in many ways following the narrative of the year, there is a split between China and the rest of the world. Splitting up the two in terms of dry bulk trade, China grew strongly last year, with volumes rising by 95.3m tonnes (+5.2%).

Amongst other things, Chinese imports of iron ore and soya beans have risen by 7.1% and 12.0% respectively.

"The strong growth in Chinese imports has however not been enough to make up for the fall in imports by the rest of the world when measured in tonnes. Here, demand fell by 4.5%, amounting to 167.7m tonnes, overshadowing the growth in China," the shipping group said.

"The increase in Chinese imports means that the tonne-mile demand from these accounted for 48.5% of total dry bulk tonne miles in 2020, up from 44.7% in 2019. In comparison, when measured in tonnes, China’s share has risen from 32.8% in 2019 to 34.9% om 2020."

Across the board, dry bulk earnings averaged below breakeven levels in 2020, though no sectors experienced average earnings below 2016 levels.

Heading for a "record-breaking" 2021

”We expect 2021 to be a record breaking year for the dry bulk industry both in terms of tonnes and tonne miles, with demand growth likely outpacing that of supply," BIMCO's Sand said.

"However, this will not solve the overcapacity issue that has long plagued the dry bulk market and is an obstacle that will not disappear just because a new year has started or a vaccine has been found,” he added.