BIMCO said the continued disruption in container shipping will ensure the profitability of carriers "well into 2021."

In a statement, the largest international shipping association, controlling around 65% of the world's tonnage, said after a down and up year in container volumes, the "current logjams in the system and unbalanced trades will take months to resolve."

BIMCO said this will allow carriers to profit from high freight rates, and tonnage providers to enjoy lofty charter rates.

"Once the situation normalises, however – and consumers begin spending more on services and less on goods – structural overcapacity will again become a focal point," it added.

Demand drivers and freight rates

BIMCO noted that 2021 started "on a high" for carriers, as the balance in the market, congestion in ports and a general equipment shortage drags on well into the new year.

"It is a much less positive development for shippers, though; as well as having to pay a much higher base freight rate – and, in many cases, considerable surcharges on top of that – they are seeing long delays in their shipments, causing problems for their supply-chain management," the shipping association said.

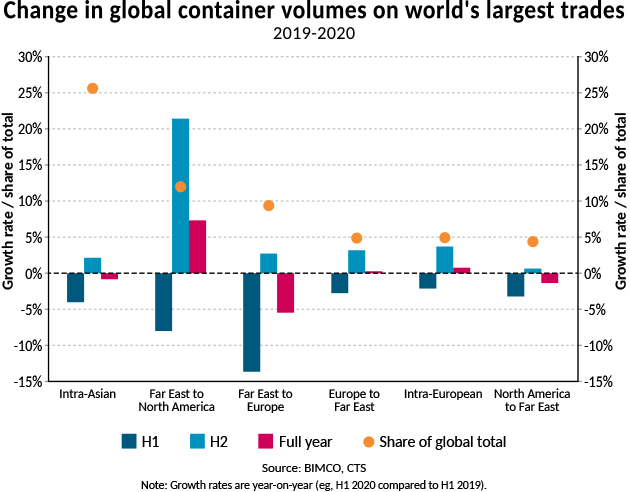

It added that the current disruptions to container shipping can be attributed to several factors, most importantly the stop-start nature of global container shipping demand in 2020, but also the slower turnaround times in ports as social-distancing measures limit shift sizes among port staff.

Positive short and long-term outlooks

Meanwhile, BIMCO noted that the short-term outlook for container shipping "remains positive" as the current backlog of cargoes – and mismatch between where containers are and where they need to be – "will not be resolved for months."

"BIMCO expects carriers to be busy repositioning until at least midway through the year. Furthermore, with the pandemic not yet behind us, and governments still providing support to personal income, spending on goods will continue to be high, promoting demand for container shipping," it added.

Once a wide range of services – including restaurants, themes parks and gyms – re-open, however, and consumers return to spending a larger share of their money on experiences, the share of spending on goods will fall.

The shipping association, noted, however, that the long-term contracts currently being negotiated and fixed "will provide a solid income stream for carriers throughout the year."

"As these account for by far the largest share of transported volumes and carrier income, the current strength of the contract market paints a promising picture for carriers’ bottom lines this year, even if rates on the spot market start falling," BIMCO said.

The association noted, however, that tanker shipping will face a "tough year" ahead as virus mutations and slow vaccine rollout hampers recovery.

"After a turbulent year, low demand looks set to plague the market in the coming months combined with too many ships fighting for too few cargoes in both the crude oil and oil product segments," it said.