The International Air Transport Association (IATA) reported that air cargo demand continued its upward trajectory in February as conditions favour the growth in air transport — surpassing levels seen prior to the drag brought by both the US-China trade standoff, as well as the lingering coronavirus pandemic.

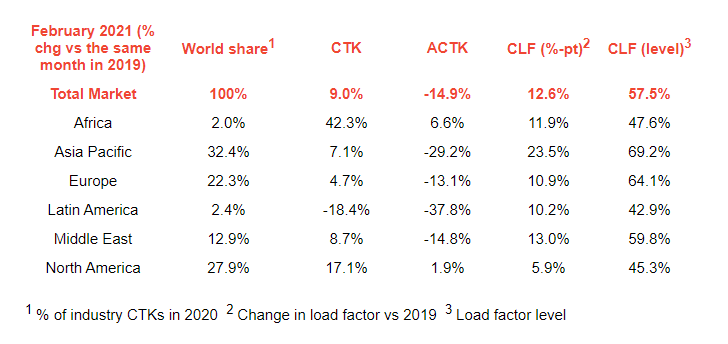

According to its latest data for February 2021 for global air cargo markets, air cargo demand continued to outperform pre-COVID levels with demand up 9% over February 2019.

IATA said February demand also showed strong month-on-month growth over January 2021 levels as "volumes have now returned to 2018 levels seen prior to the US-China trade war."

In a statement, it said global demand, measured in cargo tonne-kilometres (CTKs) also increased by 1.5% compared to January 2021 — with all regions except for Latin America showing an improvement in air cargo demand compared to pre-COVID levels.

IATA noted that North America and Africa were also the strongest performers.

"The recovery in global capacity, measured in available cargo tonne-kilometres (ACTKs), stalled owing to new capacity cuts on the passenger side as governments tightened travel restrictions due to the recent spike in COVID-19 cases. Capacity shrank 14.9% compared to February 2019," IATA said.

Conditions favour air cargo transport

The aviation association noted that "operating conditions remain supportive for air cargo." For example, it said conditions in the manufacturing sector are robust despite the recent spike in COVID-19 outbreaks; the new export orders component of the manufacturing PMI – a leading indicator of air cargo demand– also picked up compared to January.

"Supply chain disruptions and the resulting delivery delays have led to long supplier delivery times – the second-longest in the history of the manufacturing PMI. This typically means manufacturers use air transport, which is quicker, to recover time lost during the production process," it added.

Furthermore, IATA said the level of inventories remains relatively low compared to sales volumes. Historically, this has meant that businesses had to quickly refill their stocks, for which they also used air cargo.

Willie Walsh, IATA’s new Director-General, noted that air cargo is no longer just recovering — but rather posting growth in February.

“Air cargo demand is not just recovering from the COVID-19 crisis, it is growing. With demand at 9% above pre-crisis levels (Feb 2019), one of the main challenges for air cargo is finding sufficient capacity. This makes cargo yields a bright spot in an otherwise bleak industry situation,” he said.

“It also highlights the need for clarity on government plans for a safe industry restart. Understanding how passenger demand could recover will indicate how much belly capacity will be available for air cargo. Being able to efficiently plan that into air cargo operations will be a key element for overall recovery,” Walsh added.

- Asia-Pacific airlines saw demand for international air cargo rise 10.5% in February 2021 compared to the same month in 2019.

IATA said as the main global manufacturing hub, the region has benefited from the pickup in economic activity. Demand in the majority of the region’s key international trade lanes has returned to pre-COVID-19 levels, although international capacity remained constrained in the region, down 23.6% versus February 2019.

- North American carriers also saw a 17.4% increase in international demand in February year-on-year as economic activity in the US continues to recover, supported by the rising demand for e-commerce amid lockdown restrictions.

IATA noted that demand grew 39% on the Asia – North America route vs February 2019. "The business environment for air cargo remains supportive; the US$1,400 stimulus checks to US households will likely drive further growth in e-commerce and the level of inventories remains relatively low compared to sales volumes," it added. - European carriers posted a 4.7% increase in demand as it was "largely unaffected" by the new lockdowns in Europe and the operating conditions remain supportive for air cargo, according to IATA.

- Middle Eastern carriers posted an 8.8% rise in international cargo volumes. IATA said of the region’s key international routes, Middle East-Asia and Middle East-North America have provided the most significant support, rising 27% year-on-year, although February capacity was down 14.9% for the same period.

- Latin American carriers meanwhile reported a decline of 20.5% in international cargo volumes in February compared to the 2019 period. IATA said this was a deterioration from January when demand was down the 17.5% on 2019 levels.

"Drivers of air cargo demand in Latin America remain relatively less supportive than in the other regions as international capacity also decreased 43% compared to February 2019.

IATA said, "weakness within the Central and South America markets continued to outweigh the full recovery seen on North – Central America routes." - African airlines saw cargo demand in February increased a massive 44.2% compared to the same month in 2019 — which IATA noted is the strongest of all regions.

It said robust expansion on the Asia-Africa trade lanes contributed to the strong growth. February international capacity grew by 9.8% compared to February 2019.

IATA said because comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, all comparisons to follow are to February 2019 which followed a normal demand pattern.