Global airfreight tonnage fell for a second straight week in week 32, slipping 2% from the previous week. That followed a 1% drop in week 31 compared with week 30, according to WorldACD data covering more than 500,000 weekly transactions.

Only Africa (+3%) and Central & South America (+1%) recorded growth in the latest week. Volumes declined out of North America (-5%), the Middle East & South Asia (-4%), and Europe (-3%), while tonnage from Asia Pacific was unchanged. Aside from a 1% gain in week 30, global volumes have fallen in three of the past four weeks, albeit in relatively small increments.

The latest dip also pulled down the two‑weeks‑over‑two‑weeks (2Wo2W) comparison, which now shows a 1% decline versus the preceding two‑week period.

On a year‑over‑year basis, however, week 32 chargeable weight rose from all regions except Europe and Africa, which were unchanged. The strongest growth came from Asia Pacific (+7%), followed by Central & South America (+6%).

[Source: WorldACD]

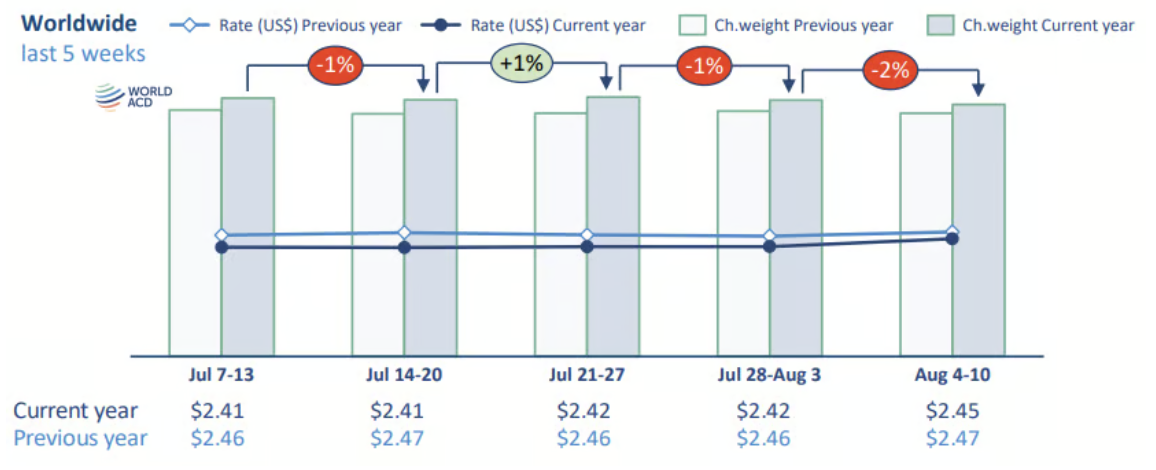

Meanwhile, with global capacity largely unchanged week on week (WoW), average pricing rose 1%, lifted by higher rates from Europe (+3%) and Asia Pacific (+1%). Year over year, global rates were down 1%, with declines from all origins except Africa (+9%) and Europe (+7%). Rates from Asia Pacific, CSA and North America slipped in low single digits, while MESA prices fell 14%, reflecting a normalization from last year’s Red Sea‑driven spike.

Aside from a 7% increase in rates from CSA to Europe and a 4% drop from MESA to Europe, inter‑regional rate shifts in the 2Wo2W comparison have remained within a narrow range, consistent with the current slow‑season pattern.

Asia Pacific export dynamics shift slightly from Europe to US

Export tonnage from Asia Pacific to Europe and North America showed divergent trends in the latest period. Chargeable weight to Europe slipped 1%, extending its decline to a fourth straight week. Westbound volumes rose from Japan, Hong Kong and Taiwan, but fell 3% out of China and plunged by double digits from South Korea (-10%) and Indonesia (-18%).

Tonnage out of China to Europe has fallen for the past four weeks. Still, YoY volume from Asia Pacific to Europe was up 7%, mainly driven by gains of 29% from Vietnam, 21% from Hong Kong and 8% from China.

In contrast to the recent slowdown in Europe-bound tonnage, chargeable weight from China to the USA grew 1% WoW, following flat growth in week 31 and a 5% increase in week 30. After being under last year's volumes since mid-April, this is the first week now showing a YoY growth of 5%.

"The opposing developments on sectors to Europe and North America suggest a potential rebalancing of Chinese airfreight exports and a re-engagement with the USA as more tariffs are finalized," WorldACD said.

Nevertheless, it noted that spot rates from China to the US are still 11% lower than a year ago, despite a +5% rise WoW.

Pricing from Asia Pacific to the US rose 2% WoW but remains 14% down year on year, reflecting stark contrasts between trade lanes. Rates from Taiwan to the USA jumped 9% WoW but dropped 5% out of South Korea and 2% each from Japan, Vietnam and Singapore.

South Korea's 5% drop in pricing followed a slump of 10% the previous week, which erased previous YoY gains.

WorldACD noted that Taiwan is the only market in the region to show higher rates (+9%) to the US on a year on year basis. Declines range from 8% in prices out of Thailand to 29% out of Vietnam.

Spot rates from Asia Pacific to Europe were steady compared with the previous week, though still 3% lower year over year. Week‑on‑week declines from China (-3%), Hong Kong and Singapore (-2% each), and South Korea, Taiwan and Thailand (all -1%) were offset by gains from Vietnam (+4%) and from Japan, Malaysia and Indonesia (all +3%).

Since a 5% drop in early May, pricing on this lane has changed little on a weekly basis. Rates have generally trailed last year’s levels since mid‑June. In week 32, only Thailand (+2%) and Japan (+1%) posted year‑over‑year increases among Asia Pacific origins to Europe.