Worldwide air cargo finished the year at its lowest year-on-year full-month growth, with global tonnages in December around 6% higher than in the final month of 2023, although they were already at relatively high levels back then.

According to a new WorldACD analysis, average full-market rates in December were around 7% higher, year on year (YoY), half of the growth reported in September.

"This means tonnage growth for both November (+8%) and December (+6%) had softened to single-digit figures, possibly indicating the beginning of a new, more moderate growth trend," it said.

"This does not come as a surprise because Q4 was the first quarter of 2023, showing strong growth, so we are now comparing with a higher base."

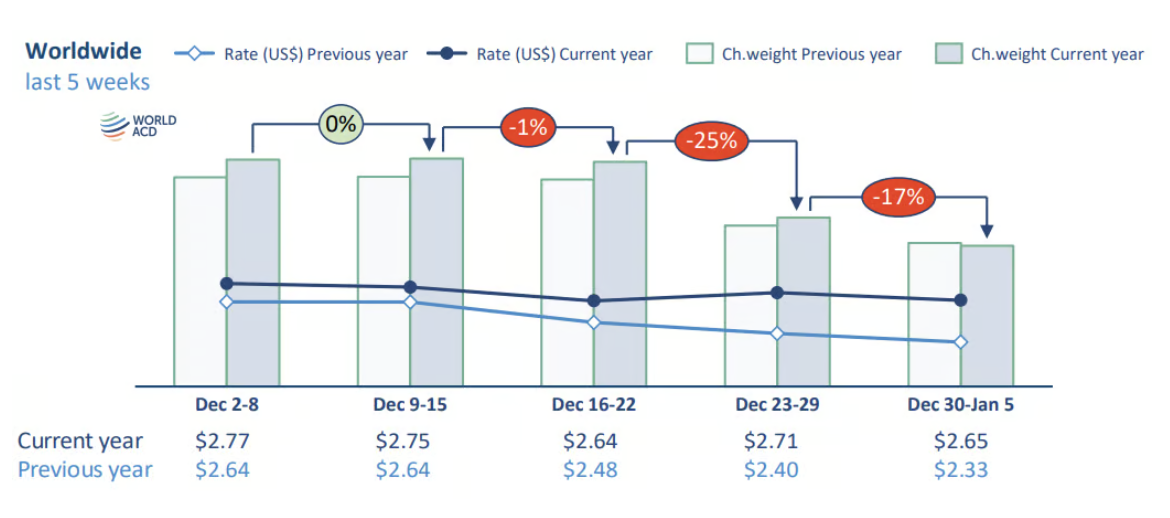

Total worldwide air cargo tonnages at the start of 2025 recorded only 2% YoY growth in week 1 (December 30 to January 5), although a comparison with the previous year is less straightforward due to the seasonal drop this time of the year, as well as the impact of some severe weather conditions, mainly in the US.

Average global spot rates have started the year 22% above their equivalent levels a year ago, thanks to a 23% year-on-year increase from Asia-Pacific origins and a 59% rise from the Middle East & South Asia (MESA) origins, as the relative strength of demand and pricing from those two regions last year looks set to continue into 2025.

[Source: WorldACD]

[Source: WorldACD]

WorldACD said with global contract rates up by 6% YoY, in the first week of 2025, overall average worldwide air cargo rates of US$2.65 per kilo have begun the year 13% higher than this time last year, based on a full-market average of spot rates and contract rates.

Demand ex-Asia Pacific remains strong, but decelerating

Meanwhile, it added that full-month data for December indicate that worldwide chargeable weight dropped back slightly (3%), compared with the peak levels recorded in November, due largely to a 6% month-on-month (MoM) decrease from Europe and a 2% decrease from Asia Pacific origins, taking worldwide tonnages back to around the level between September and October.

"However, tonnages from Asia Pacific origins in December were significantly higher than every other month of 2024, apart from November – reflecting a significant ramp up in tonnages from Asia Pacific origins in the final two months of 2024," WorldACD said.

Quarterly data indicate that tonnages from Asia Pacific origins were still 6% higher in the fourth quarter (Q4) of 2024, compared with Q3, and 11% higher than their levels in Q4 of 2023.

Nevertheless, that represents a softening of the YoY worldwide demand growth pattern in the final quarter of 2024: total worldwide flown chargeable weight was up, YoY, by 12% in the first two quarters of 2024, decreasing to 11%, YoY, in Q3 and 8%, YoY, in Q4, based on the more than 500,000 weekly transactions covered by WorldACD's data.

It noted that those YoY quarterly global increases were largely driven by growth from Asia Pacific origins, which recorded double-digit YoY quarterly increases.

A similar pattern can also be observed for the tonnages from MESA origins, which recorded 27% (YoY) growth in Q1, softening to a 7% YoY quarterly increase in tonnages in Q4.

"This drop partly reflected a tougher comparison period in the final quarter of 2023, when disruptions to container shipping through the Red Sea had already led to some conversion of ocean freight traffic from that region to air cargo," WorldACD said.