Strong air cargo demand continued in July from all of the main global origin regions, including double-digit year-on-year (YoY) percentage increases in tonnages from four of the six main regions, according to the latest figures and analysis from WorldACD market data.

The air cargo market data provider noted that although there's been much talk this year about the growth of cross-border e-commerce driving air cargo, especially from China and Hong Kong, its analysis highlights that there has also been significant growth from most major regions and among various special cargo categories this year, alongside the strong growth of general cargo traffic that has been boosted by buoyant e-commerce volumes.

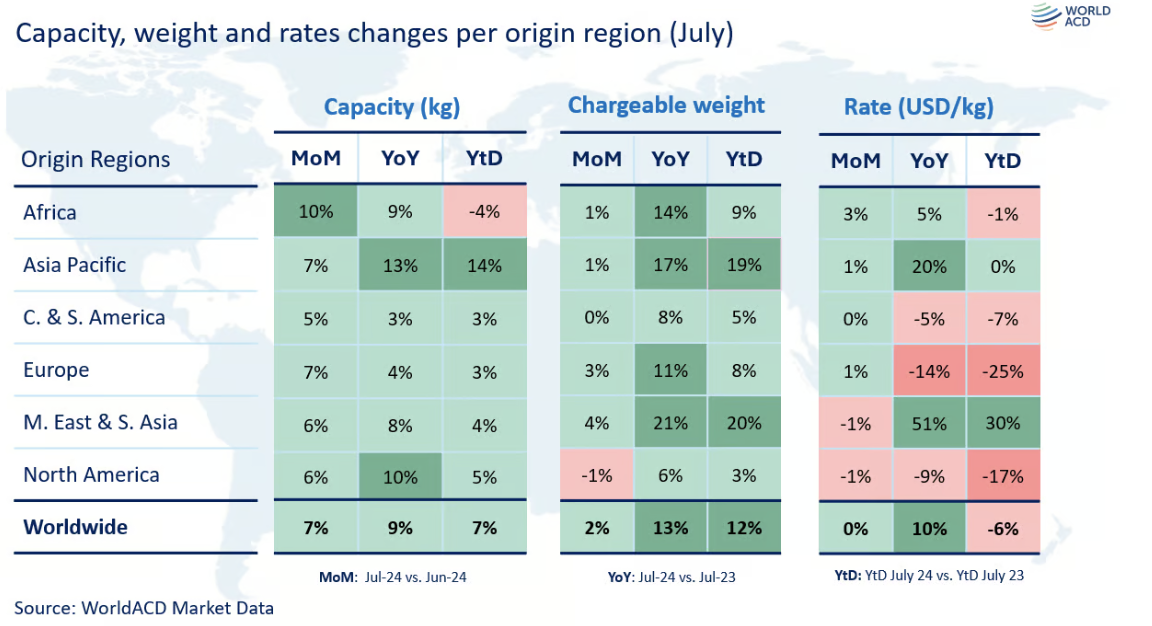

For the period, WorldACD said the Middle East and South Asia (MESA) and Asia Pacific led in terms of the year-on-year (YoY) percentage tonnage increases in July, with 21% and 17%, respectively. They were followed by Africa (up 14%), Europe (up 11%), Central & South America (CSA, up 8%) and North America (up 6%), taking worldwide growth to an increase of 13%.

This is broadly consistent with the pattern for the year to date, with tonnages for the first seven months up globally by 12% compared with January to July 2023.

Asia Pacific dominates tonnage growth

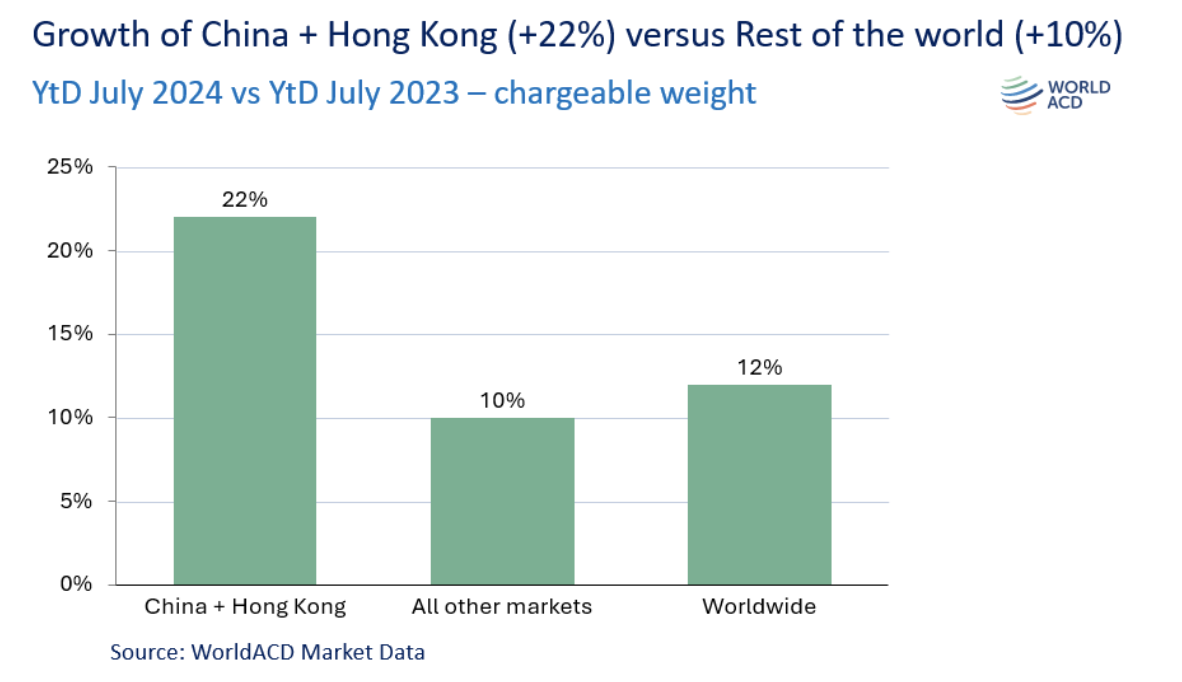

WorldACD found that China, Southeast Asia and Northeast Asia together accounted for more than half (56%) of the YoY worldwide tonnage growth in the first seven months of 2024.

Based on the more than 2 million monthly transactions covered by WorldACD's data, 18 of the world's 23 subregions recorded growth in that period, led by Central Asia (up 55%), the Gulf Area (+33%), Balkan & Southeast Europe (+24%), North Africa (+23%), China (+22%), Southeast Asia (+20%) and South Asia (+20%).

It noted that the only three subregions recording significant declines in tonnage in that period were Mexico (-10%), the Caribbean (-8%), and Levant & Caucasus (-5%).

"Hong Kong once again topped the list of individual airport growth markets in terms of absolute weight increases, with a year-on-year increase of around 21 million kg in July, followed by Bangkok, Shenzhen, Shanghai and Guangzhou," the analysis added.

Dubai recorded the highest inbound increase, with an additional 12 million kg in July (up 24%), followed by Frankfurt, Los Angeles, Amsterdam, and New York.

WorldACD said although China and Hong Kong feature prominently among this year's top air cargo growth markets, with China and Hong Kong together recording a 22% tonnage increase in the year-to-date (YTD) to July, the rest of the world has also achieved strong combined growth of 10% this year.

General cargo vs special cargo growth

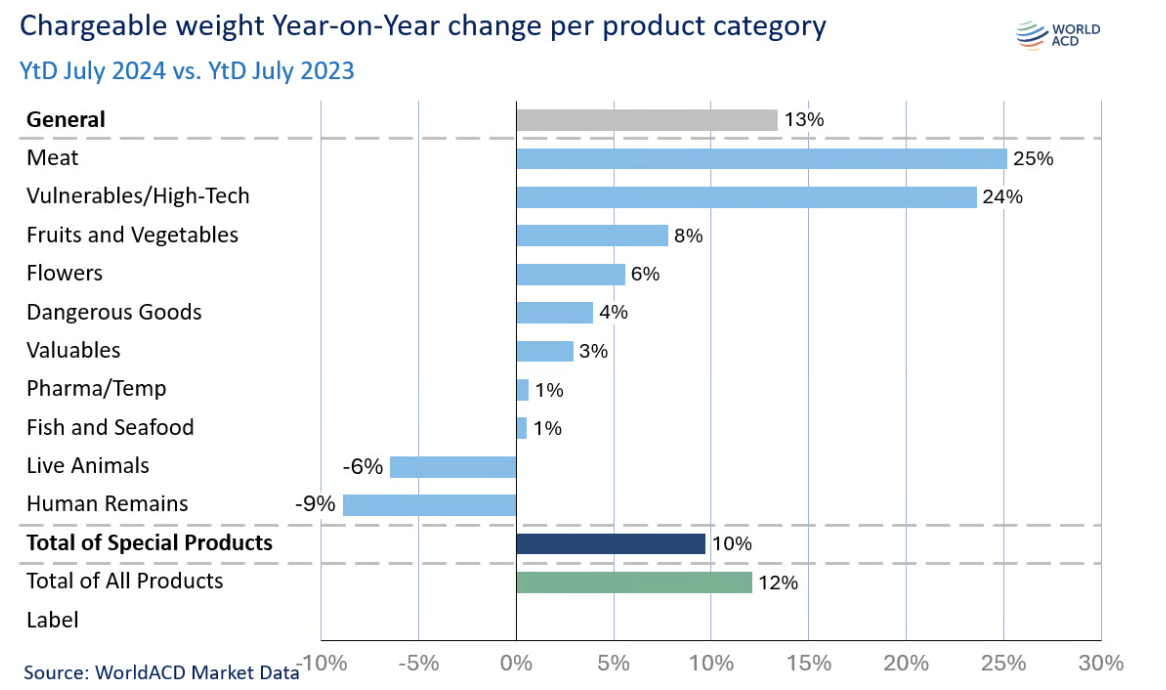

The report said the growth of 'general cargo' air freight tonnages has also been outpacing that of 'special cargo' products this year, with general cargo growing by an average of 13%, YoY, in the YTD January-July period, compared with +10% for special cargo products.

"This change from the longer-term trend is mainly due to the exceptionally strong growth since last autumn in cross-border e-commerce traffic – which often flies as general cargo rather than within a special cargo handling category," WorldACD said.

"But it's also worth highlighting that at 10%, the growth of special cargo products this year is also strong by historical standards," it added.

Among the special cargo product categories, there has been extremely strong YoY growth in worldwide shipments of vulnerable/high-tech cargo and in meat shipments, up 24%. Fruit and vegetable traffic grew by 8%, flowers by 6%, valuables and dangerous goods shipments each grew by 3%, and pharma/temp (temperature-controlled—predominantly pharma—shipments) saw a small increase (1%). Fish & seafood also saw a small increase (1%).

"Globally, the proportion of special cargo products within the total market averaged 35% in the YTD to July," the WorldACD analysis added.

Capacity continues to rebound

The WorldACD analysis revealed that despite the usual seasonal fluctuations, the total amount of air cargo capacity available in the global market had continued to rebound, with capacity in July around 9% higher than in July 2023.

That, in part, reflects a particularly large increase in July 2024, including a 7% increase compared with June, although YTD capacity for the seven months to July was also up by 7% YoY.

"The biggest capacity increase has been from Asia-Pacific, to meet strong demand for uplift for exports from the region, with a capacity increase of 14% for the year to date, and 13% for July 2024, YoY," the report said.

Meanwhile, on the pricing side, WorldACD said average worldwide rates in July were up 10%, year and year, boosted by big rises in prices from MESA (+51%) and Asia Pacific (20%) — based on a full-market average of spot rates and contract rates.

"But if we look at spot rates specifically, the increases this year are even higher, averaging more than +100% from MESA origins to Europe and more than +50% from Asia Pacific origins," it added.