Non-alliance container lines have seen a "very substantial increase" in the share of capacity offered outside the alliances during the Covid-19 pandemic — particularly on Transpacific, according to a new report by Sea-Intelligence.

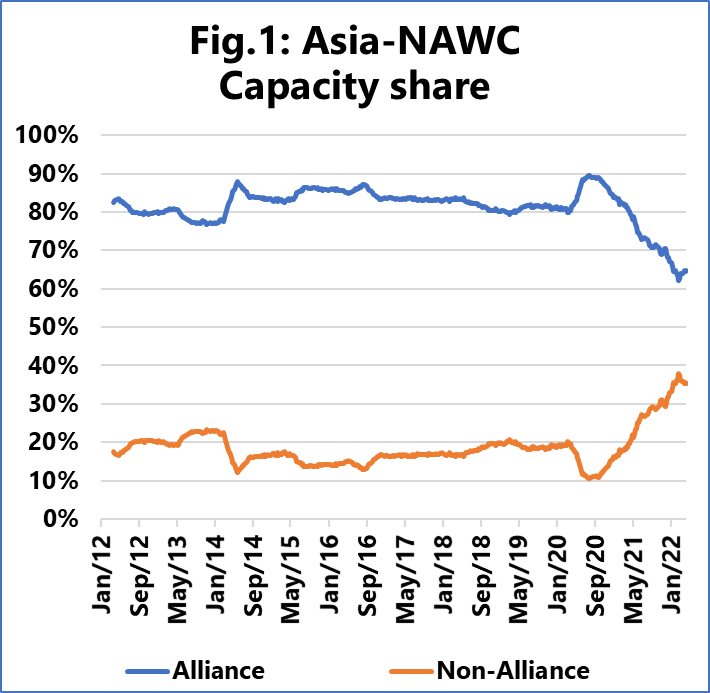

The maritime analyst noted that based on a 13-week rolling average, there is the relatively stable share in 2012-2020 with a rough 15-20% / 80-85% split between non-alliances and alliances, despite the changes in alliance and VSA constellations over this 8-year period.

The second element is the sharp decrease in non-alliance capacity in the first part of 2020.

"Clearly, the immediate impact of the pandemic was that non-alliance services were much more likely to be blanked than alliance services," Sea-Intel said in its report.

"The third element is the development seen over the past 18 months, where there has been a very substantial increase in the share of capacity offered outside the alliances," it added.

Presently, it said we are now at a point where 35% of the capacity offered is on non-alliance services.

Increase of non-alliance services

Sea-Intel said Asia-North America East Coast, which was fully served by alliance services in 2019-2021, saw an increase in non-alliance services from the second half of 2020 to a point where 10% of the capacity in the market is currently serviced by non-alliance services.

It added that the development on Asia-Europe is, however, "starkly different" than on Asia-North America.

It said for this market, trade is nearly fully serviced by alliances.

"The recent market disruption has done little to change this situation. A few non-alliance services have been seen; however, the number of such sailings and the small size of the vessels being used, means that this has an overall insignificant effect on the total capacity in the market," the maritime analyst added.

"What this development implies is that the barriers of entry on the Asia-North America trades are much lower than on the Asia-Europe trades."