Growth in the global pool of shipping containers is picking up pace on rising trade prospects and slowing box productivity, as disruption in the Red Sea and Panama Canal lengthen voyage transit time.

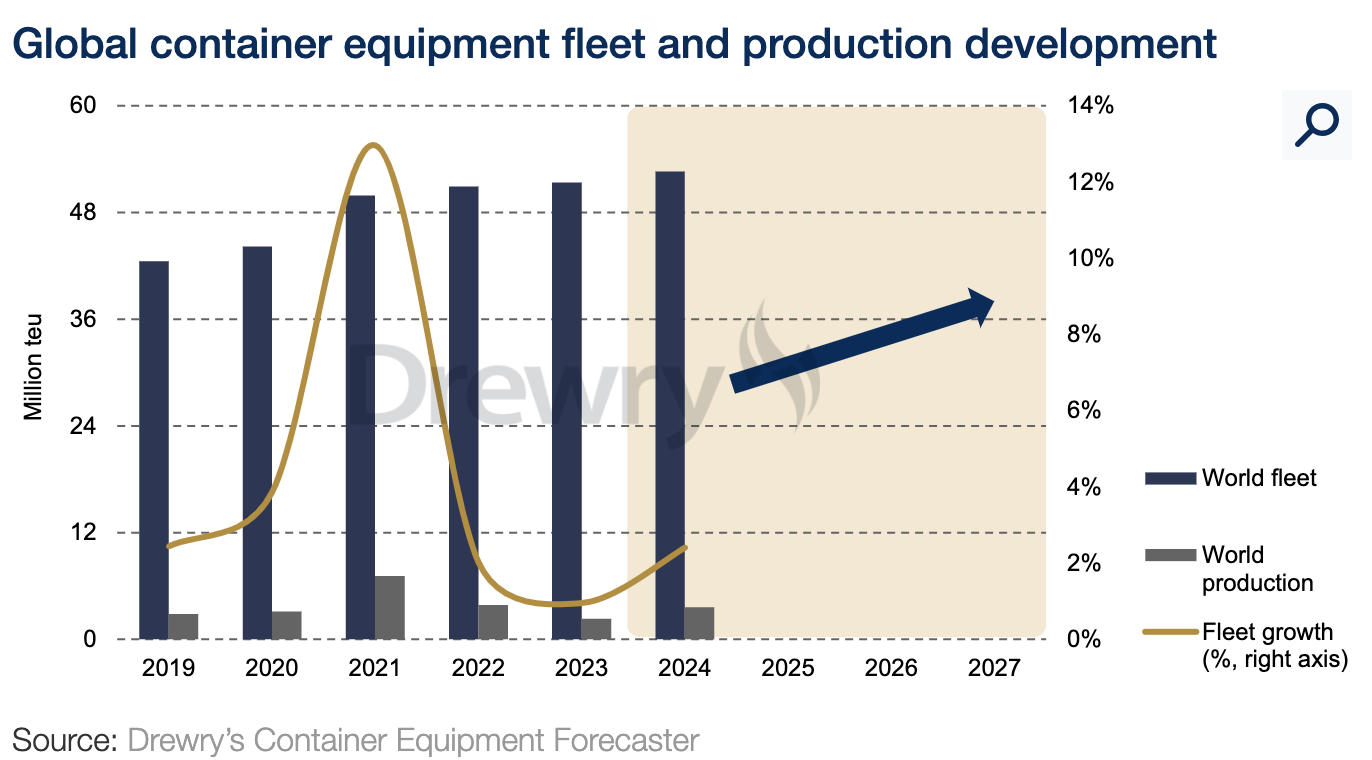

The latest analysis from Drewry's recently published Container Equipment Forecaster report estimates that the global box fleet rose 1% last year to 51.4 mteu, as a pickup in newbuild output in the final months of the year boosted inventories that had hitherto registered declines.

And for 2024 it has upgraded its fleet projection with the expectation that the global pool will expand a further 2.3% over the year.

"Slightly higher rates of growth in trade and lower levels of box productivity are the key drivers of Drewry's revised projections," the independent maritime research consultancy firm said.

It added that the latter had worsened this year as a consequence of ongoing draught restrictions in the Panama Canal and ocean carriers rerouting ships from Suez Canal transits to round the Cape of Good Hope sailings as a result of attacks on ships in the Red Sea by Houthi rebels.

"With containers spending longer on ships and taking more time to complete their journeys, sales into the secondary market have slowed, and the stock of empty containers, especially in depots and factory yards in China, have been largely eroded," Drewry said.

Meanwhile, it noted that once again, the liner shipping industry's vulnerabilities and those of its customers have been exposed by geopolitical events and operational constraints, this time on two of its main arteries.

The report pointed out that in January, the number of containership transits around the Cape had risen to 605, up from 164 a year ago, while the number of voyages through the Suez Canal over the same period declined to 62 compared to 328 in January 2023.

"Voyage delays arising from a Cape diversion range from 10 days for vessels heading to Northern European ports such as Rotterdam, to 15 days for the Mediterranean ports such as Genoa," it said.

In the case of the Panama Canal, Drewry noted that it mainly affects the trade between Asia and the US East Coast. Ocean carriers are also using various options, including discharge at US West Coast ports and intermodal services to the East Coast, land-bridging via the Panama Canal Railway, and sailings from Asia via the Cape of Good Hope.

6-7M TEUs impacted by Suez, Panama Canal issues

The maritime consultancy firm said while the impact of disruption in the Panama Canal is not proving to be as significant as that of the Suez Canal, it is estimated that between six-and-seven million teu have been affected by the two incidents.

"At the same time, in October and November 2023, factories in China cut prices for new containers as they sought orders for the final weeks of what had proved to be a very challenging year for manufacturers," it said.

"With prices for 20ft containers falling to about US$1,850 in some weeks, orders increased strongly with ocean carriers the main buyers. The availability of capacity in the factories means these containers are also being delivered very quickly," Drewry added.

On the trading front, Drewry said it expects 2024 to be significantly stronger than 2023, with global container handling throughput forecast to increase by 2.3%.

This compares with minimal growth in 2023.

"Furthermore, Drewry projects that ocean carrier’s box-to-slot ratios will increase in the short term as buffer stocks of equipment are increased to cope with the current supply chain challenges," the independent maritime research consultancy firm, added.