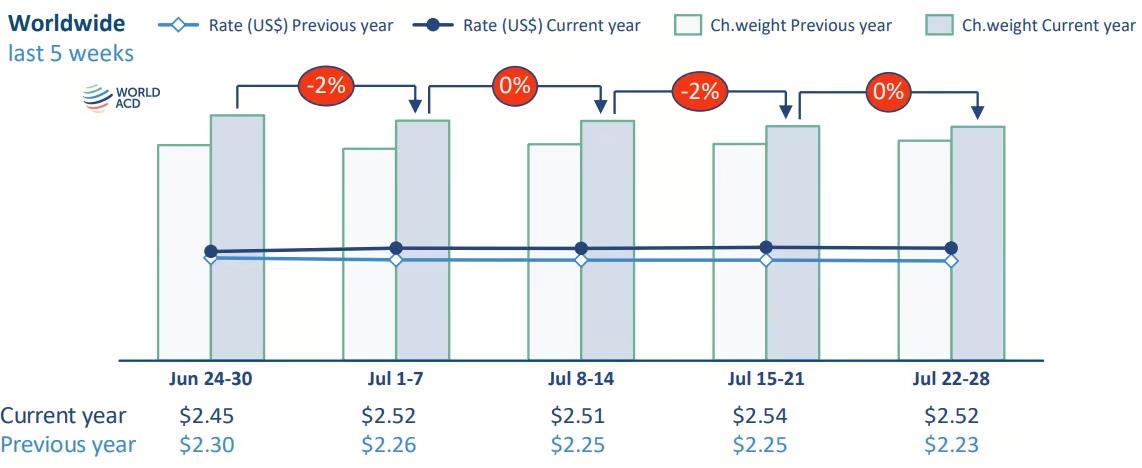

Worldwide air cargo tonnages remained flat in the last full week of July, having dropped around 2% the previous week, taking them around 5% below their level at the end of June, according to the latest weekly figures from WorldACD Market Data.

The air cargo market data provider said there is no clear evidence that the relatively subdued tonnages in the last two full weeks are linked to the IT outages in many countries on July 19. However, it noted that tonnages flown from Bangladesh have been down significantly since mid-July, due to disruptions caused by political protests that led to blackouts of internet services for several days.

[Source: WorldACD]

WorldACD said tonnages flown from Bangladesh to Europe declined by 29% in week 29, compared with the week before, although volumes bounced back slightly in week 30, regaining 6% week-on-week (WoW).

It added that both weeks are down by around 50% YoY from a market that has generally seen some "substantial" YoY growth in 2024.

Regional data for week 30 (July 22-28) indicates that tonnages fell from four of the six main world regions on a WoW basis, including declines of 4% from Central and South America and 1% from Asia Pacific, North America and Africa.

However, tonnages rose 2% in Europe and 1% in the Middle East and South Asia, keeping overall worldwide tonnages stable compared with the previous week.

WorldACD said worldwide tonnages were up by 6% year over year compared with last year, although that compares with an average of 12% in the first half of 2024, an 11% rise in the second quarter, and a 10% increase in June.

"Combining the figures for weeks 29 and 30 gives a 7% YoY increase, suggesting a possible slowdown in YoY growth in the latter part of July," the report said.

Rates remain relatively firm

Meanwhile, WorldACD noted that based on a full-market average of spot rates and contract rates, global rates slipped slightly (1%) in week 30, but they remained stable on a two-week basis.

Rates of US$2.52 per kilo are up 13% compared with last year, thanks to 55% YoY increases from MESA, 24% from Asia Pacific, and a 9% rise from African origins.

Compared with the last pre-Covid equivalent period, average worldwide rates remain significantly higher or up 45%, compared with July 2019.