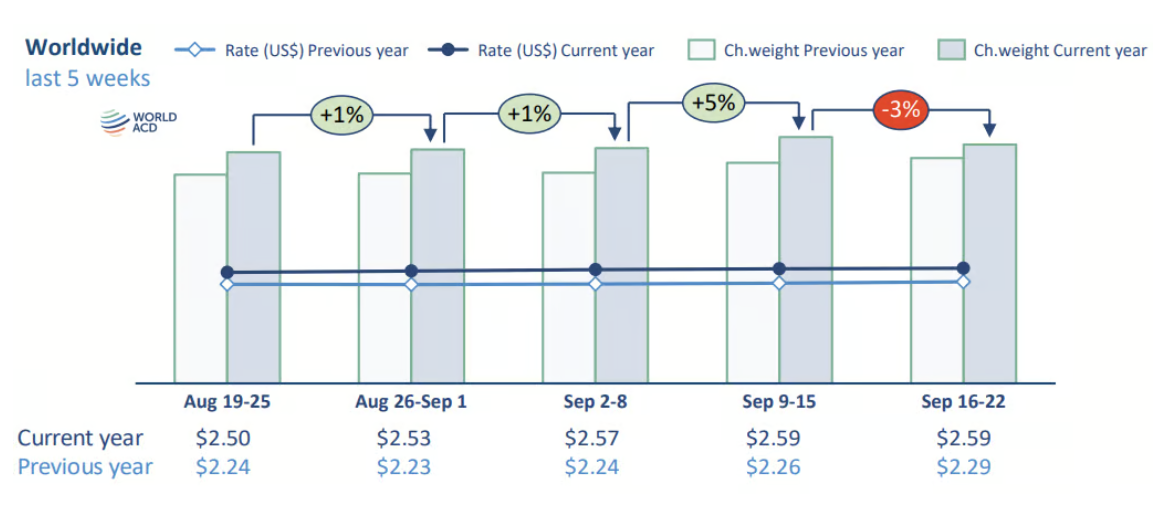

Global air cargo tonnages dipped by around 3% in week 38 (September 16-22), week on week (WoW), with the declines caused mainly by national holidays in China, South Korea, and Chile, according to the latest weekly figures and analysis from WorldACD Market Data

The worldwide 3% fall in flown chargeable weight was mainly driven by Asia Pacific origins, where a 6% WoW decline in tonnages was responsible for almost three-quarters (73%) of the overall global decrease.

WorldACD noted that this Asia Pacific drop was mainly due to the seasonal effects of mid-autumn or harvest festival holidays in various parts of East Asia—this year, they took place from September 16 to 18, within week 38.

The majority (80%) of the drop in Asia Pacific tonnages is explained by a temporary dip in volumes from South Korea (decline of 33% WoW, or 50% of the WoW Asia Pacific decline) and China (drop 6% WoW, or 30% of the WoW Asia Pacific overall decline).

Last year, the mid-autumn festival holidays took place in week 39 ( September 28-29), thus skewing single-week year-on-year (YoY) air cargo comparisons.

The report noted that worldwide tonnages in week 38 this year were just 6% higher than in week 38 last year, compared with double-digit percentage YoY increases throughout most of 2024.

[Source: WorldACD]

WorldACD said a further 12% of the global decrease in tonnages in week 38 this year was caused by a 6% WoW fall in chargeable weight flown from Central & South America (CSA) origins — which is, in turn, almost fully explained by a near 50% drop of tonnages WoW ex-Chile, due to the country's 18-20 September national holidays, including Independence Day.

The analysis — which was based on the more than 450,000 weekly transactions covered by WorldACD's data — indicates that if we eliminate or "correct for" the effects of these seasonal events in Asia Pacific and CSA, global air cargo tonnages would actually be flat, WoW, in week 38.

Rates remain high

Meanwhile, the report noted that this interpretation that the tonnage decline in week 38 is a seasonal blip rather than an overall weakening of the market is further supported by the continuing strong, and in some cases increasing, rates trends, mainly driven by Asia Pacific and Middle East & South Asia (MESA) origin regions, thanks to the ongoing e-commerce boom and continued (and increasing) tensions in the Middle East region, respectively.

Average global rates in week 38 were flat, WoW, with increasing rates ex-Africa (up 4%), Asia Pacific (up 1%) and MESA (up 4%), offset by slightly negative rate trends for the other main origin regions, including a 2% drop ex-North America, based on a full-market average of spot and contract rates.

Average rates ex-Asia Pacific (US$3.42 per kilo, up 22% YoY) and ex-MESA (US$2.94, up 62% YoY) are reaching record highs for this year and are even higher than the fourth-quarter (Q4) peak of 2023 when average rates in December ex-Asia Pacific stood at US$3.33 per kilo.

Bangladesh challenges continue

WorldACD said spot rates from MESA origins have been highly elevated for much of this year, bolstered by the disruptions to ocean freight supply chains caused by the attacks on shipping in the Red Sea, but Bangladesh continues to face additional challenges resulting from ongoing political instability and logistics disruptions.

As a result, spot rates ex-Bangladesh keep on increasing, reaching new highs in week 38 of US$7.83 per kilo to the US (up 4%, WoW)—more than three times their levels this time last year (up 213%)—and US$5.45 per kilo to Europe (WoW up 7%, YoY up 175%).

"These further increases make Bangladesh to US spot rates among the highest of any air cargo market in the world," the report said.

"And continuing disruptions, including to airport cargo security screening capabilities in Dhaka, look set to place further upward pressure on spot rates from Bangladesh," WorldACD added.