The Port of Hamburg emerged as the biggest beneficiary of the recent reshuffling of ocean carrier alliances, gaining the most additional vessel capacity among European ports as new service networks took effect.

Sea-Intelligence analysed the impact of the 2025 carrier alliance reshuffle on Europe's major container ports. It said that with the new service networks fully executed and stable as of July 2025, the analysis of the vital Asia-Europe trade lane reveals a significant consolidation of market power into hubs like Hamburg and Valencia, at the expense of established gateways such as Antwerp and Tangier.

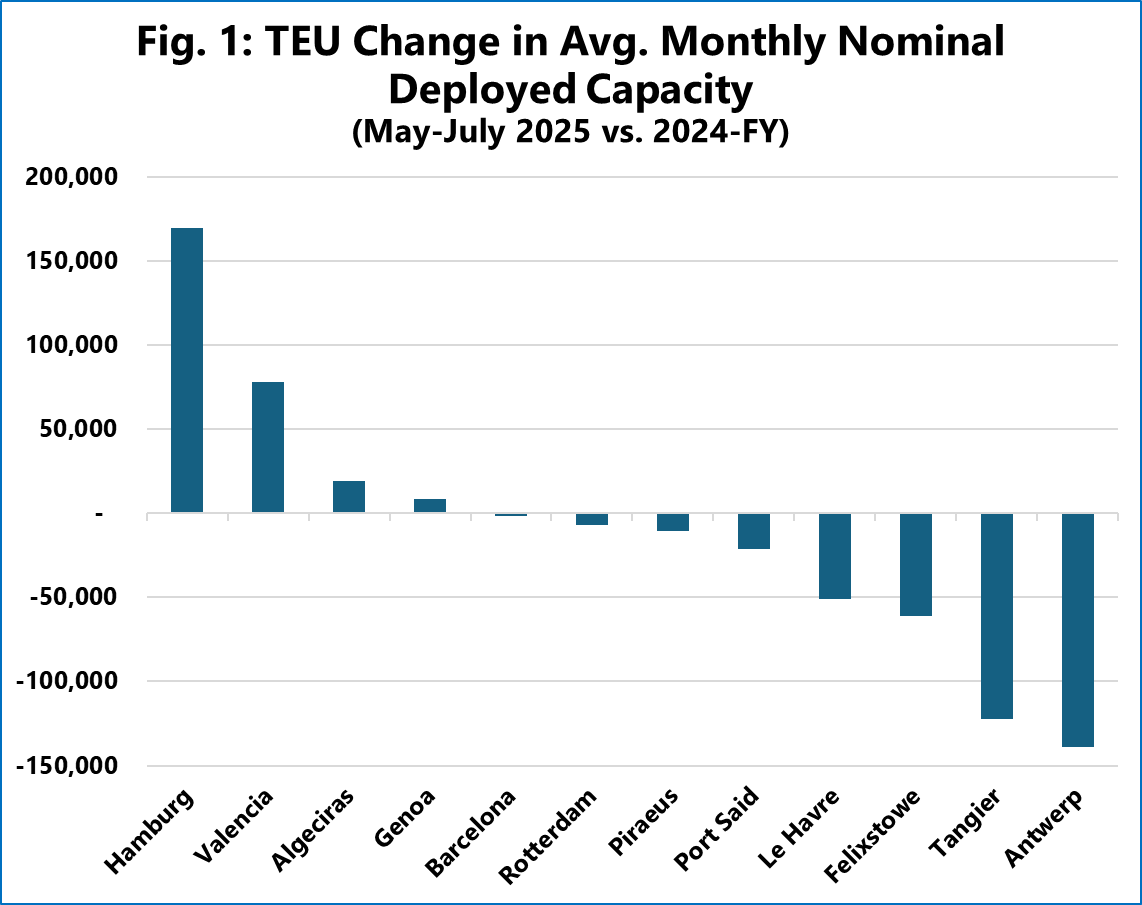

To measure the shift, the maritime analytics and consultancy firm analysed the total deployed TEU capacity directed to each major European port, comparing the post-reshuffle period of May-July 2025 against the 2024-FY baseline. This metric provided the clearest picture of the strategic realignment underway.

"It is important to note, however, that these TEU figures refer to the vessel's nominal capacity – its theoretical maximum – which serves as a proxy for market size and deployed assets," Sea-Intelligence said, noting that this represents the maximum cargo opportunity directed to each gateway and is not a representation of the actual cargo volumes exchanged per call.

[Source: Sea-Intelligence]

Hamburg, clear winner in alliance reshuffle

"Our analysis revealed that the undisputed primary winner is Hamburg, which gained an enormous 169,000 TEU in average monthly nominal vessel capacity," Alan Murphy, CEO of Sea-Intelligence, said.

"This, along with the increase in port call frequency and vessel size has translated into a huge boost in its overall market power."

Sea-Intelligence added that Valencia was the other clear winner, adding over 78,000 TEU per month in nominal vessel capacity and cementing its status as a rising power in the Mediterranean.

Conversely, the data reveals a significant strategic pivot away from several major hubs.

The analysis found that Antwerp lost 138,000 TEUs and the transshipment hub of Tangier dropped 122,000 TEUs in average monthly nominal vessel capacity.

Rotterdam, on the other hand, remains in a league of its own, cementing its unshakable position as Europe's dominant gateway port.