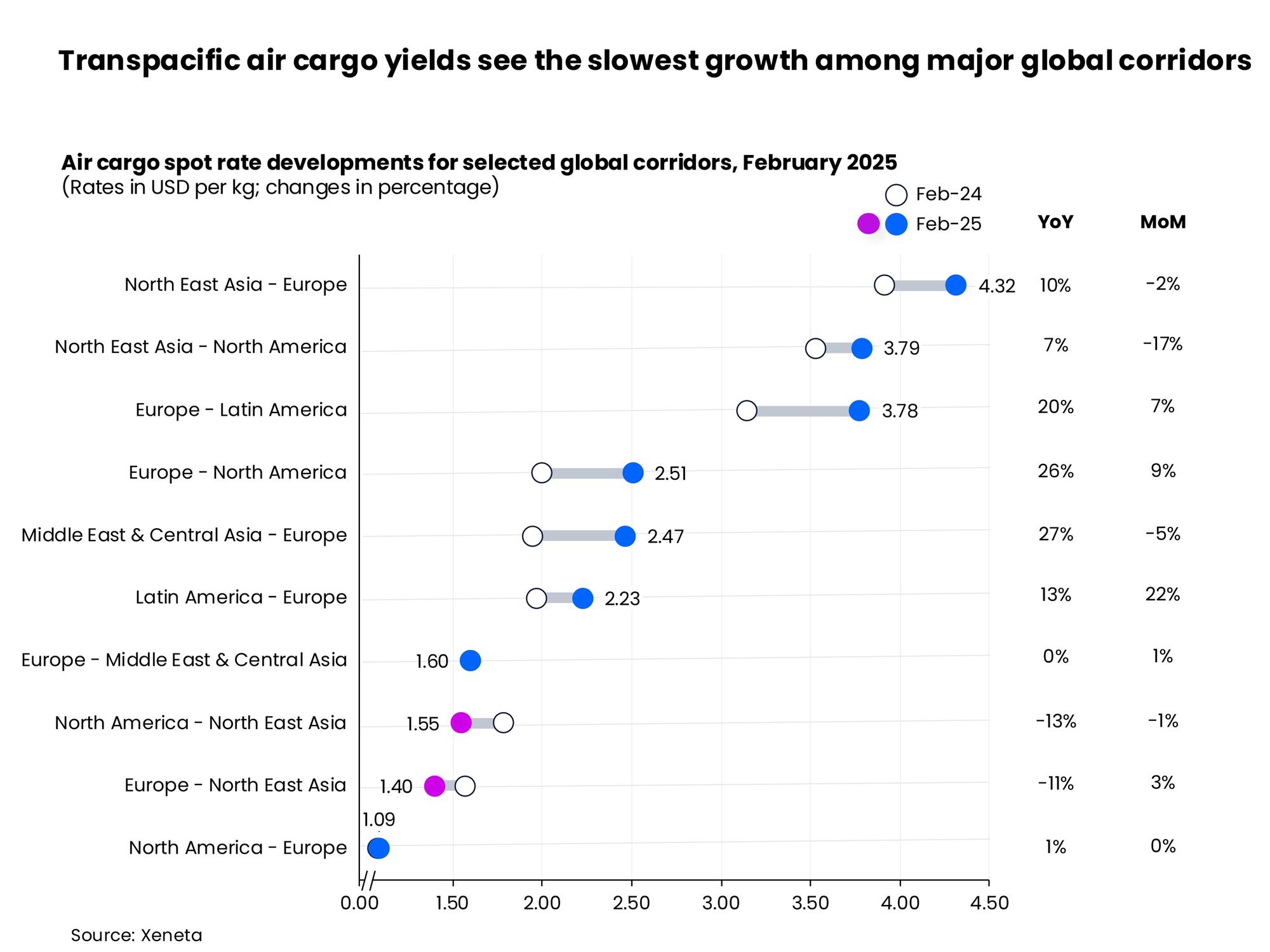

The political game of 'cat and mouse' between some of the world's biggest trading nations may have taken its first nibble at international e-commerce volumes in February's global air cargo market data, with spot rates from Shanghai to the US dropping 29% month-on-month to US$3.23 per kg, according to the latest industry analysis by Xeneta.

Niall van de Wouw, chief airfreight officer at Xeneta, said even allowing for the earlier Lunar New Year and the seasonal e-commerce slowdown at the start of the year, the fall in Shanghai-US spot rates, following the United States' temporary removal of the de minimis exemption on Chinese shipments, may be one of the first indicators that "the regulatory/political conversations are starting to affect the air cargo market."

"When the e-commerce boom took off, it very quickly clogged up the Hong Kong and southern China market because of so much outbound demand. So, the e-commerce market started to venture eastwards to Shanghai, even though it was less desirable due to additional cost."

"If a fall in e-commerce volumes means there's currently more available capacity to do business out of Hong Kong and southern China again, we would expect Shanghai to be the first market to feel this impact, and that's what we saw in February."

van de Wouw added: "This may be short-term, but the uncertainty around e-commerce is impacting the market."

In comparison, the Shanghai-to-Europe spot rate declined only modestly, or 2% month over month, to US$3.86 per kg.

Slowdown in air cargo growth

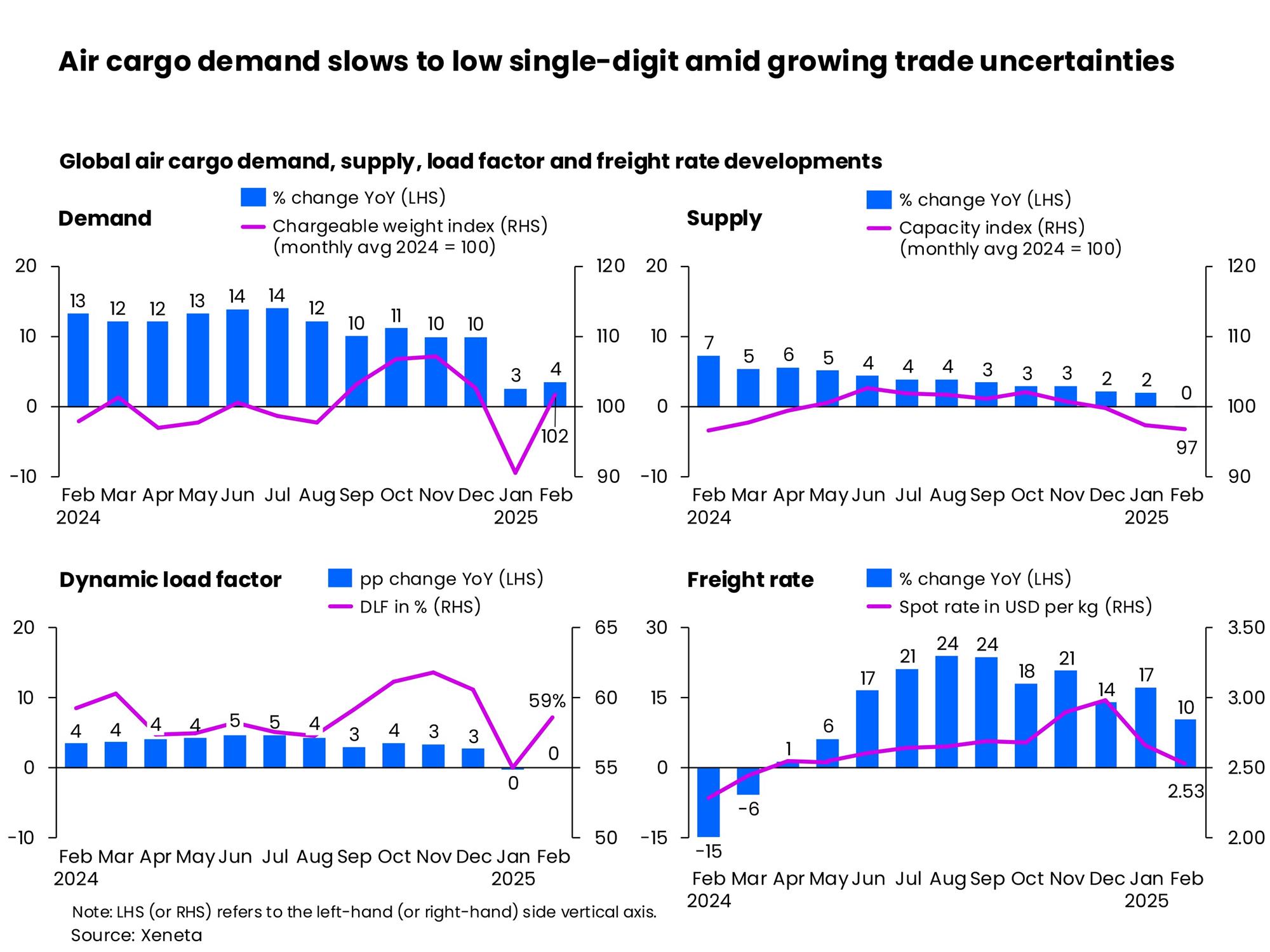

The Xeneta report said overall, global air cargo demand grew by 4% year-on-year in February, marking a continued slowdown from the double-digit growth seen in every month of 2024.

By adjusting the timing of this year's Lunar New Year, the total air cargo demand for January and February increased by a modest 3% compared to the previous year.

In addition to the US "de minimis change," Xeneta said other factors likely influencing the monthly performance included a high comparison base in 2024 and the diminishing impact of Red Sea disruptions on air cargo volumes as supply chains continued to adapt to longer transit times.

Supply of global air cargo capacity in February also stayed flat compared to a year ago.

The combined January and February capacity edged up by just 1%, while the dynamic load factor for the first two months of 2025 remained unchanged from a year ago at 59% in February.

Dynamic load factor is Xeneta's measurement of capacity utilisation based on the volume and weight of cargo flown alongside available capacity.

Meanwhile, the global air cargo spot rate (valid for one month) in February increased at its slowest pace year-on-year since June 2024, rising by 10% to US$2.53 per kg.

In contrast, Xeneta noted that the global seasonal rate (valid for longer than one month) dropped 1% year-on-year to US$2.21 per kg, reflecting the market's changing supply/demand dynamics.

Month-on-month, the global air cargo spot rate declined by 5%.

Air cargo market outlook changing

Heading into 2025, Xeneta was forecasting a year of 4-6% growth in the global air cargo market after its strong performance in 2024.

"Growing trade tension since then now places a big question mark over the market’s outlook," van de Wouw said.

"With general cargo demand in the doldrums in recent years, the surge in e-commerce has been the saviour of the air cargo market performance. If this now takes a significant hit, if that happens, it will have a profound effect on airfreight rates around the world," he added.

For now, the Xeneta airfreight chief noted that the big e-commerce players and general cargo shippers are buying time instead of cargo capacity to avoid commitments that might bring added financial risk.

"From the conversations we are hearing, some shippers are clearly looking for ways to minimise the impact of US tariffs, while others will be anticipating lower airfreight rates if e-commerce volumes show a sustained dip."

This is also going to have a knock-on impact on other markets.

"If I was shipping ex-Vietnam to the US right now, for example, I'd be concerned about the impact on rates if more shippers descend on this corridor to lessen the impact caused by tariffs on direct shipments from China to the US," van de Wouw said.

Further complicating the matter is the proposed US port call fees on Chinese-built ships, which could throw ocean shipping schedules into disarray in the short term, driving up container freight rates and even prompting a shift from sea to air.

The tariffs imposed by the Trump administration in the US and the awaited international response are causing increasing ripple effects across the global air cargo market.

Xeneta said this is prompting adjustments from key stakeholders. Airlines, for example, are currently reassessing their freighter capacity strategies, with many opting to shift routes toward Southeast Asia rather than China or repositioning capacity to the Transatlantic market. Some shippers also are postponing annual contract negotiations from Q2 2025 while opting for shorter-term agreements in the first half of the year.

"This is a situation completely outside of the control of the air cargo market and there's a great deal of noise, which is adding to stakeholders' anxiety," van de Wouw said.

"The issue is no one knows what the end game is, and what's going to happen from a regulatory perspective, and how this will impact consumer confidence," he added.