Shipping between Asia and Europe continues to be restricted by ongoing supply chain issues — further dragged by low demand and port congestion in some of Europe's major gateways.

In its latest analysis, Flexport said there is continued rate pressure on spot rates due to lower demand.

On the capacity side, it added that space is available but it is impacted by additional blank sailings and delays due to the port congestion in Europe.

"No peak season" between Asia-Europe

"There is no peak season and demand has been slowing down," Flexport said in its freight market update on September 6, adding that supply is still "relatively tight" due to a large number of blank sailings, vessel sliding, and port omissions.

"The port congestion in Europe, particularly Hamburg and Rotterdam, has reached critical levels causing further delays and late return of vessels to Asia," it added.

For Asia-North America, the freight forwarder said demand and rates continue to drop.

"The expected demand and TPEB volume from shippers to get ahead of Golden Week is in question this year as the Freight All Kinds (FAK) market continues to soften and mitigations are frequent," Flexport said.

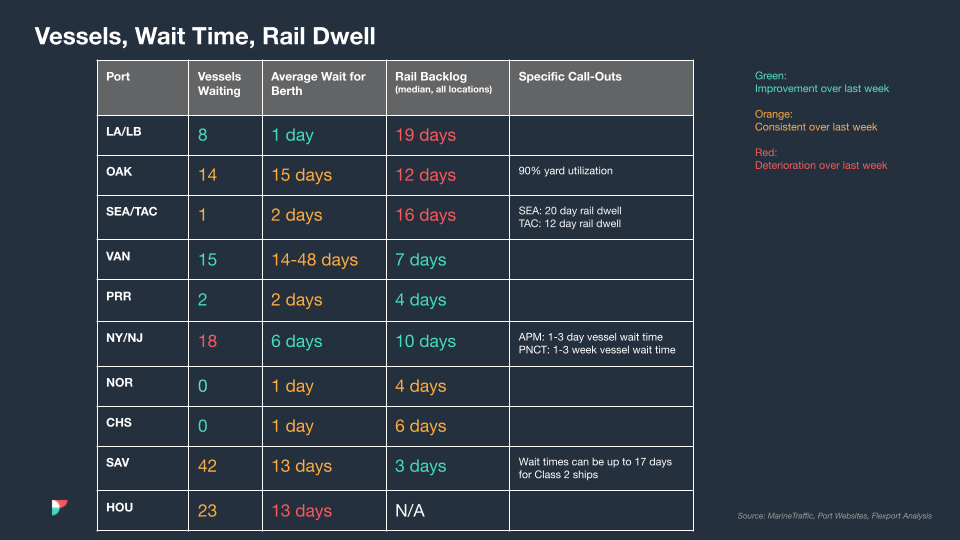

"Blank sailings continue to spot the market for September as the carriers look to reduce the total number of anchored vessels at the ports, especially U.S. East Coast (USEC)—currently 40 at Savannah—and U.S. Gulf Coast (USGC)—currently 21 at Houston," it added.

For Europe-North America, Flexport said space is still very tight on the USEC with some space open for direct routing to the U.S. West Coast (USWC).

Congestion still high at US East Coast ports

Meanwhile, in terms of rates, the freight forwarder said there are no revisions downwards that have been announced by carriers at the moment. Levels remain stable at high levels with the expectation for this to remain through the end of Q4 2022.

"Only 8 vessels waiting outside Los Angeles/Long Beach which is the lowest number since October 2020. Also, yard congestion is improving. Different story for USEC where congestion is still hitting hard," Flexport said.

Photo: Flexport

In its analysis, Flexport noted that in terms of air freight, in North China — which includes Shanghai — demand in the market is low and the overall market remains unstable due to more Covid restrictions.

"The market is weak due to low demand. TPEB rates to the west coast have dropped while east coast and Far East Westbound (FEWB) rates maintain at similar levels to last week," the freight forwarder said.

"The Chengdu (CTU) airport lockdown has been extended until September 7, manufacturers are working under close-loop management and production has almost recovered. A special permit is required for trucking services which have impacted shipment pick-ups and road transportation," it added.

For South China — Shenzhen, Guangzhou, Dongguan, and Hong Kong — Flexport the market "remains soft" although the cross-border issue between Shenzhen and Hong Kong has started to ease.

"The market remains soft and rate levels similar to last week, but demand is expected to increase later this month," Flexport said. "The SZX-HKG cross border situation continues to improve, however, expect 1-2 days additional transit time."

For Europe, the freight forwarder said Transatlantic Westbound (TAWB) capacity has surpassed pre-Covid levels and demand remains consistent and is expected to pick up towards the end of September.

Meanwhile, FEWB demand into Europe affected by newly introduced lockdowns in the Chengdu Region and restrictions in Shenzhen. Flexport said further capacity constraints are expected as the Covid measures ease and the start of the peak season.

For the Americas, the freight forwarder noted that a heavy travel season in and out of Canada is putting a strain on the infrastructure of major airports (Vancouver and Toronto in particular) which is having a trickle-down effect on cargo operations and resulting in longer than normal dwell times for both import and export cargo.

It added that export demand remains steady from all markets and US airports are running at a normal pace.

"Capacity is opening up further, especially into Europe, where most carriers have increased the number of passenger flights for their summer schedules," Flexport said.

"Shipments into Europe could experience additional destination dwell time due to the labour shortages in some western European hubs," it added.