Sea-Intelligence said prior to the pandemic, there was a rough "rule of thumb" that global container demand tended to grow approximately in line with global gross domestic product (GDP).

It added that in decades past, there also used to even be a multiplier on top of this, but that had vanished in the pre-pandemic period.

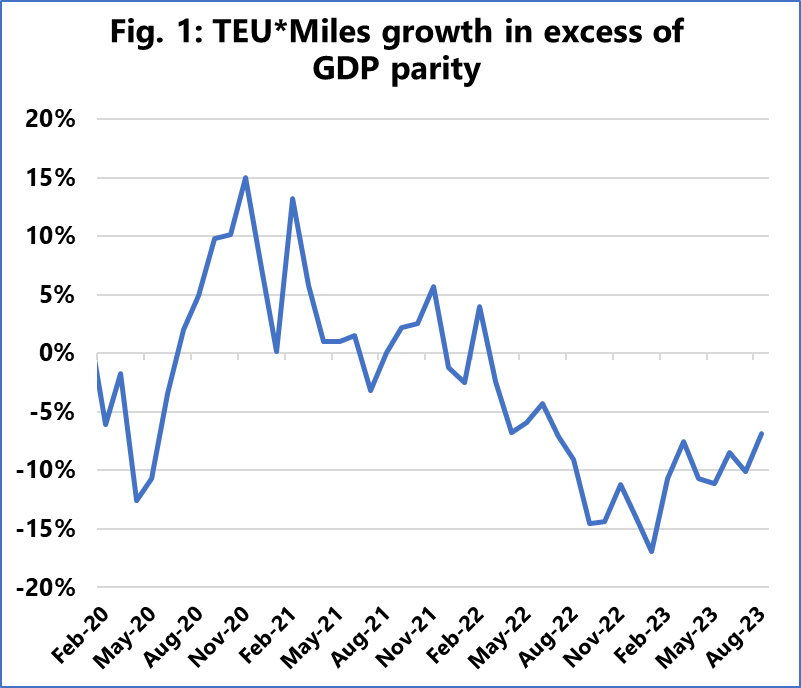

"Since we know the global GDP growth in 2020-2022 (and using the current estimate for 2023), we can calculate how much global TEUs should have grown versus 2019 if they had followed the GDP development," the Danish maritime data analysis firm said.

It added that knowing the actual TEU growth versus 2019, in turn, allows us to calculate how much global TEUs grow in excess of what the global GDP would otherwise indicate.

"What we see is that compared to the growth rate one would expect based on global GDP, the container markets are -5.9% below," the Sea-Intelligence report said, adding that comparisons with TEUs tend to be a coarse measure of global demand, and TEU*Miles is better at capturing a meaningful number when seen in the context of the global container vessel fleet capacity.

[Source: Sea-Intelligence]

"In Figure 1, we calculate the difference between the GDP-implied growth rate and the actual TEU*Miles growth rate," it said.

Sea-Intelligence noted that as of August 2023, global demand has a shortfall of -6.8% compared to a growth pattern which would have followed global GDP growth.

"This is not good for the carriers, which are in the process of taking delivery of a sizeable order book," commented Alan Murphy, co-founder and CEO, at Sea-Intelligence.