The re-routing of mainline vessels via the Cape of Good Hope has resulted in a steep downturn in vessel call capacity across East and Central Mediterranean hub ports, but West Mediterranean ports have shown more resilience, according to a new report by Drewry.

The independent maritime research consultancy firm said with no resolution to the security situation in the Red Sea, carriers continue to divert mainline vessels trading between Asia and Europe via the Cape of Good Hope.

"After an initial period of disruption, during which scheduled arrival dates were missed due to the longer diversion route, port calls in West Med have largely stabilised," Drewry said.

It added that although container throughput fell 1.4% year-on-year (YoY) at Algeciras in January 2024, volumes were up 11% YoY at both Valencia and Barcelona.

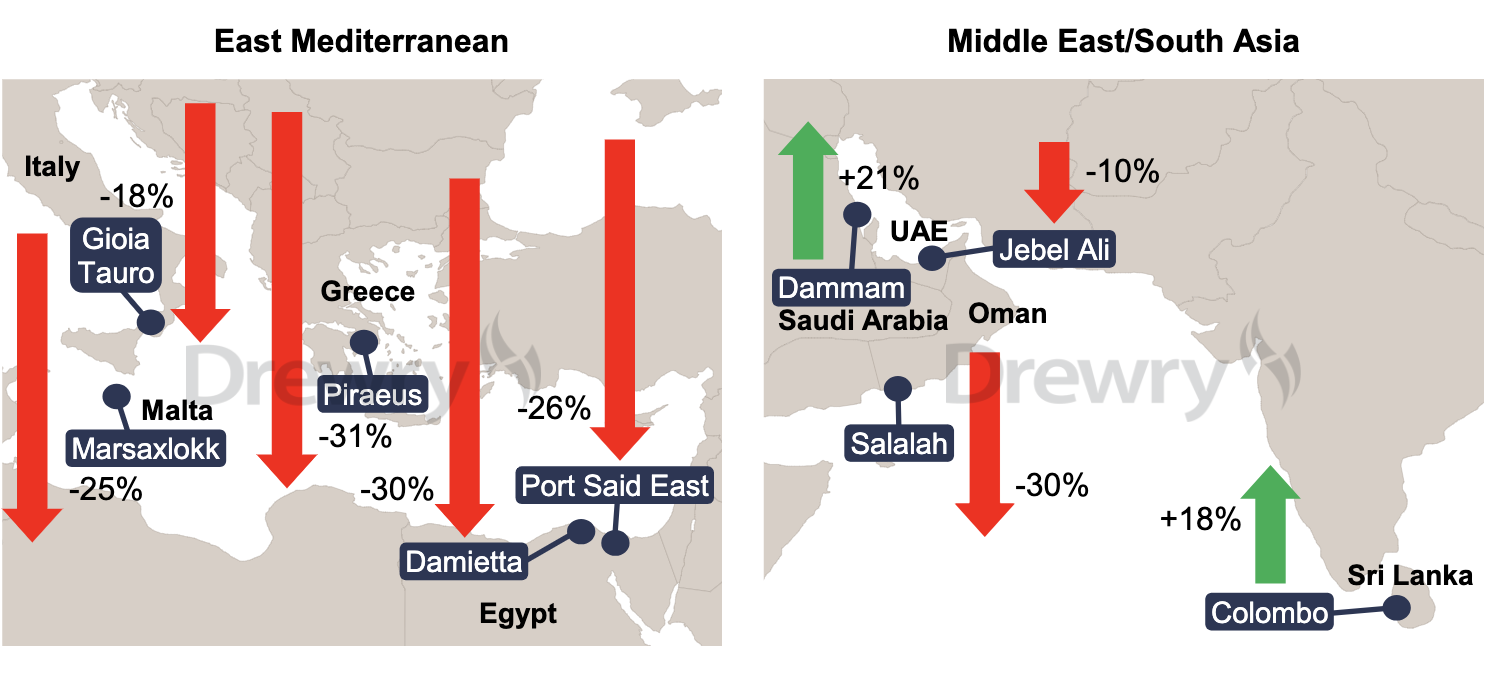

In contrast, East and Central Med hubs have seen steep reductions in average weekly vessel capacity during Q1 2024, ranging from an 18% decline at Gioia Tauro to a 31% drop at Piraeus.

The analysis noted that in January 2024, volumes handled at the Piraeus Container Terminal were down 13% YoY, while traffic at the Suez Canal Container Terminal fell 3%.

[Source: Drewry]

Meanwhile, the average weekly capacity of container vessel calls at the main Red Sea ports has dropped steeply.

"While a number of carriers continue to service Jeddah and King Abdullah, they have substituted mainline vessel calls with smaller shuttle services from Mediterranean hubs that provide a dedicated link to the northern Red Sea," Drewry said.

It added that Dammam has picked up some additional calls in Q1 2024, but the high percentage growth rate is in part due to the relatively low base of Q4 2023.

The report said, "The Sri Lankan port of Colombo is emerging as a key transhipment hub, offering carriers the opportunity to tranship cargo between services diverting via the Cape and services to/from the Middle East."

"It has recorded an 18% upturn in average weekly vessel capacity in Q1 2024, while YTD throughput had increased 30% as at end February," Drewry added.