Despite gloomy predictions, the global economy remains remarkably resilient, with steady growth and inflation slowing almost as quickly as it rose despite supply-chain disruptions in the aftermath of the pandemic, an energy and food crisis triggered by Russia's war on Ukraine, and a considerable surge in inflation, followed by a globally synchronized monetary policy tightening, according to a new analysis released by the International Monetary Fund (IMF).

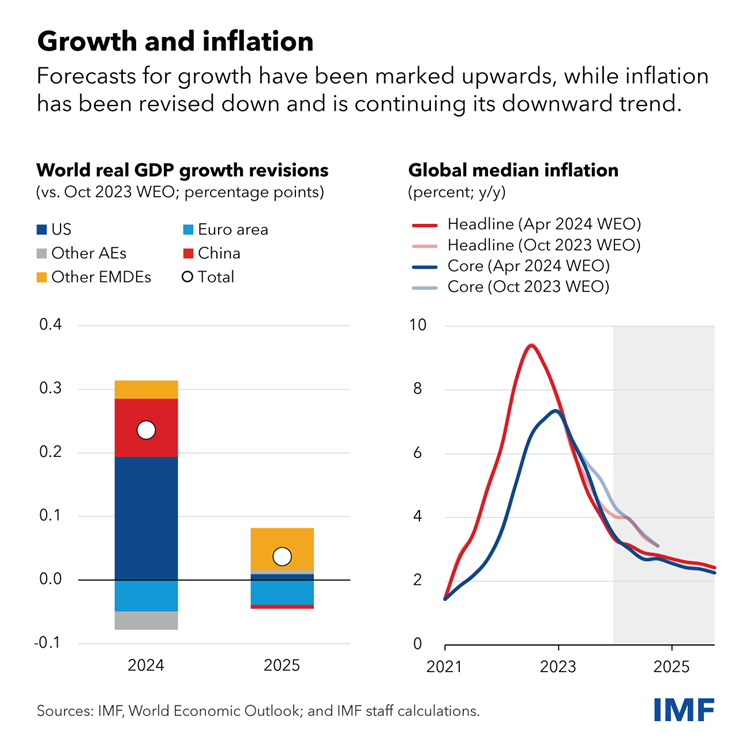

The report said global growth bottomed out at the end of 2022, at 2.3%, shortly after median headline inflation peaked at 9.4%.

"According to our latest World Economic Outlook projections, growth this year and next will hold steady at 3.2%, with median headline inflation declining from 2.8% at the end of 2024 to 2.4% at the end of 2025," IMF said.

"Most indicators continue to point to a soft landing," it added.

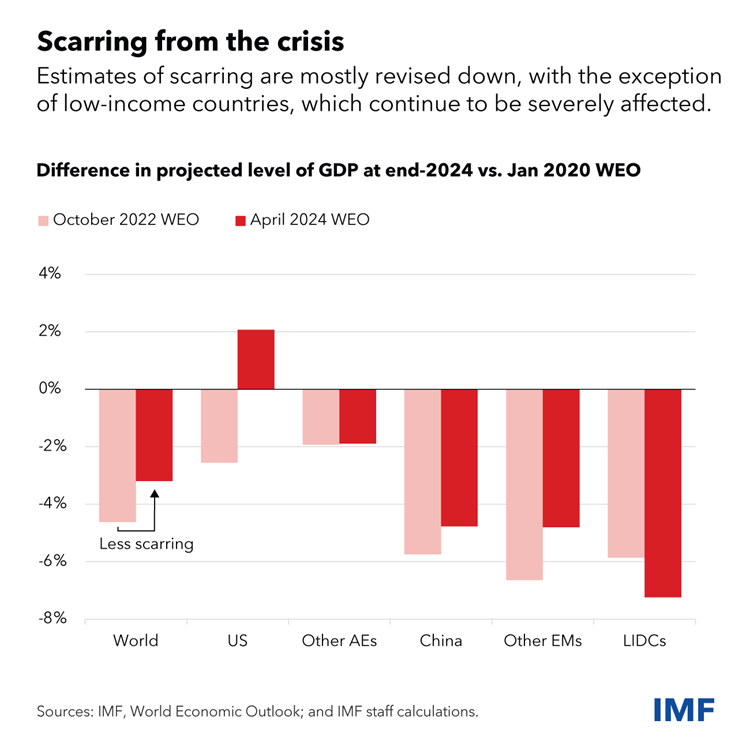

The IMF also project "less economic scarring from the crises of the past four years, although estimates vary across countries."

It said that the US economy has already surged past its prepandemic trend.

"But we now estimate that there will be more scarring for low-income developing countries, many of which are still struggling to turn the page from the pandemic and cost-of-living crises," the report added.

The IMF pointed to resilient growth and rapid disinflation, pointing toward favourable supply developments, including the fading of energy price shocks and a striking rebound in labour supply supported by strong immigration in many advanced economies.

It noted that monetary policy actions have helped anchor inflation expectations even if its transmission may have been more muted as fixed-rate mortgages became more prevalent.

"Despite these welcome developments, numerous challenges remain, and decisive actions are needed," the IMF said.

Inflation risks remain

The major financial agency of the United Nations (UN) said bringing inflation back to target should remain the priority.

It noted that while inflation trends are encouraging, "we are not there yet."

"Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year," the IMF said. "This could be a temporary setback, but there are reasons to remain vigilant."

It noted that most of the good news on inflation came from the decline in energy prices and in goods inflation — the latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices.

But the IMF said oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high.

Further trade restrictions on Chinese exports could also push up goods inflation.

Economic divergences widen

The IMF report also pointed to a "resilient global economy" that also masks stark divergence across countries.

"The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated," it said, noting that this calls for a cautious and gradual approach to easing by the Federal Reserve.

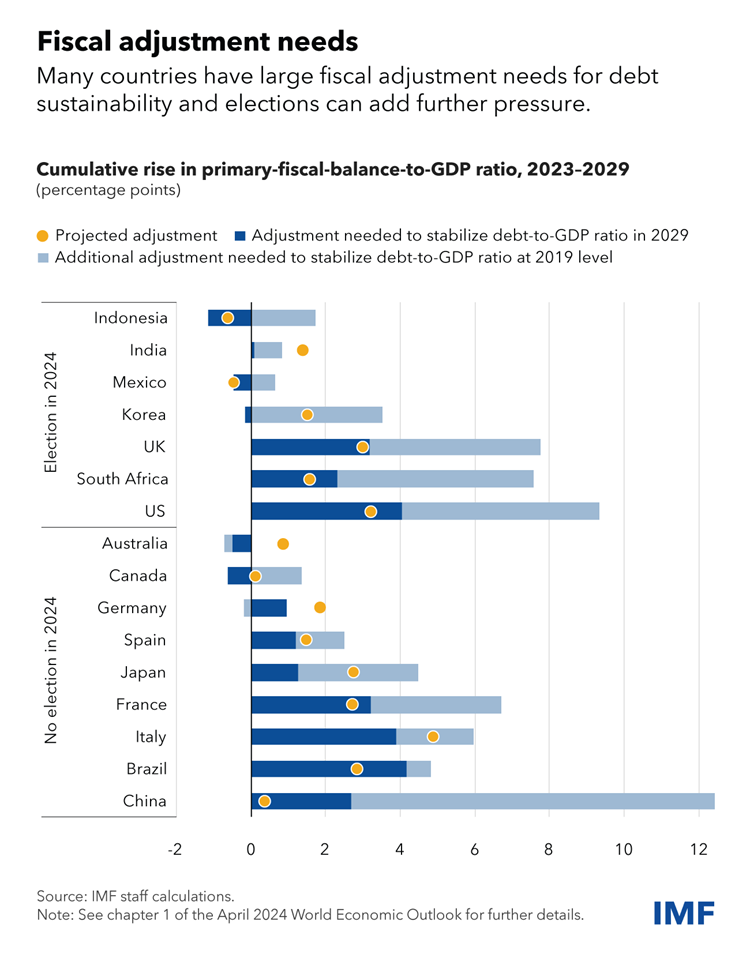

"The fiscal stance, out of line with long-term fiscal sustainability, is of particular concern. It raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy."

"Something will have to give."

The IMF noted that growth in the euro area will rebound but from very low levels, as past shocks and tight monetary policy weigh on activity.

Continued high wage growth and persistent services inflation could delay the return of inflation to target, it added.

"However, unlike in the United States, there is little evidence of overheating, and the European Central Bank will need to carefully calibrate the pivot toward monetary easing to avoid an inflation undershoot," the IMF added.

China's economy impacted by property sector woes

Meanwhile, China's economy remains affected by the downturn in its property sector.

The IMF said credit booms and busts never resolve themselves quickly, and this one is no exception.

It noted that domestic demand would remain lacklustre unless strong measures address the root cause.

The report added that with depressed domestic demand, external surpluses could well rise. This could further exacerbate trade tensions in an already fraught geopolitical environment.

"Many other large emerging market economies are performing strongly, sometimes benefiting from a reconfiguration of global supply chains and rising trade tensions between China and the US," the IMF said.

"These countries' footprint on the global economy is increasing."

The IMF said that going forward, policymakers should prioritize measures that help preserve or even enhance the global economy's resilience, with the first such priority being rebuilding fiscal buffers.

"Fiscal consolidations are never easy, but it is best not to wait until markets dictate their conditions," the IMF said.

"The right approach is to start now, gradually, and credibly."

It added that once inflation is under control, credible multiyear consolidations will help pave the way for further monetary policy easing.

The second priority is to reverse the decline in medium-term growth prospects, and the IMF said artificial intelligence (AI) also gives hope for boosting productivity.

"Harnessing the potential of AI for all will require that countries improve their digital infrastructure, invest in human capital, and coordinate on global rules of the road."

The IMF said rising geoeconomic fragmentation and the surge in trade restrictive and industrial policy measures also harm medium-term growth prospects.

It noted that trade linkages are already changing as a result, with potential losses in efficiency.

"The net effect could well be to make the global economy less, not more, resilient. But the broader damage is to global cooperation. It is still time to reverse course," the IMF added.

Third, the IMF pointed to strengthening of monetary, fiscal and financial policy frameworks especially for emerging market economies.

"This has helped make the global financial system more resilient and avoid a permanent resurgence of inflation. Going forward, it is essential to preserve these improvements. That includes protecting the hard-won independence of central banks."

Major investments in sustainability efforts

Lastly, the IMF pointed out that the green transition requires "major investments."

"Cutting emissions is compatible with growth, and activity has become much less emission-intensive in recent decades. But emissions are still rising. Much more needs to be done and done quickly," it said.

"Green investment has expanded at a healthy pace in advanced economies and China. The greatest effort must now be made by other emerging markets and developing economies, which must massively increase their green investment growth and reduce their fossil fuel investment."

The IMF noted that this will require technology transfer by other advanced economies and China, as well as substantial private and public financing.