Air cargo demand continued its upward momentum in August, driven by improving global trade, a surge in e-commerce, and persistent capacity issues in maritime shipping.

The International Air Transport Association (IATA) released data for August 2024 global air cargo markets showing continued strong annual growth in demand.

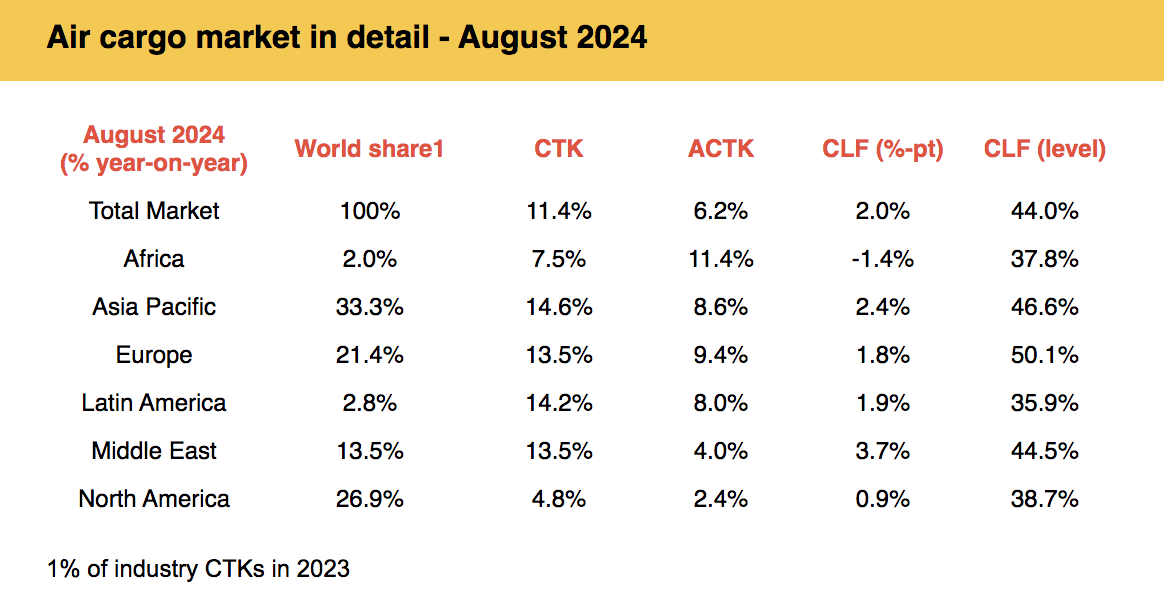

The International Air Transport Association (IATA) released data for August 2024 global air cargo markets showing continuing strong annual growth with total demand — measured in cargo tonne-kilometers (CTKs) — up by 11.4% year-on-year (12.4% for international operations).

This is the ninth consecutive month of double-digit year-on-year growth, with overall levels reaching heights not seen since the record peaks of 2021.

Record-high demand

"We continue to see very good news in air cargo markets. The sector recorded a second consecutive month of record high demand year-to-date," said Willie Walsh, director-general at IATA. "Even with record levels of capacity, yields are up 11.7% in 2023, 2% on the previous month, and 46% above pre-pandemic levels."

"This strong performance is underpinned by slow but steady growth in global trade, booming e-commerce, and continuing capacity constraints on maritime shipping," he added.

Meanwhile, IATA said capacity, measured in available cargo tonne-kilometers (ACTKs), increased by 6.2% compared to August 2023 (8.2% for international operations).

This was largely related to the growth in international belly capacity, which rose 10.9% on the strength of passenger markets.

IATA noted that industry-wide capacity has reached an all-time high.

In July, global air cargo markets showed a 13.6% growth in demand compared to July 2023 levels (14.3% for international operations).

[Source: IATA]

[Source: IATA]

August regional performance

For August, IATA said Asia-Pacific airlines saw 14.6% year-on-year demand growth for air cargo — the strongest of all regions.

It noted that demand in the Asia-Africa, Asia-Europe and within-Asia markets grew by 21.2%, 18.4% and 16.1%, respectively. Intra-Asia demand growth decreased by 5.0 percentage points from the previous month, partially linked to the social unrest in Bangladesh and Typhoon Shanshan in Japan – which both impacted local logistics operations with airport closures and flight cancellations. Capacity increased by 8.6% year-on-year.

North American carriers saw 4.8% year-on-year demand growth for air cargo in August, the lowest of all regions, IATA said. Demand on the Asia-North America trade lane, the largest trade lane by volume, grew by 9.3% year-on-year, while the North America-Europe route saw a more modest increase of 6.1%.

European carriers, on the other hand, saw 13.5% year-on-year demand growth for air cargo in August, with the Middle East-Europe trade lane-led growth, up 28.9%, maintaining a streak of double-digit annual growth that originated in September 2023.

The Europe-Asia route, the second largest market, was up 18.4%. Within Europe, growth was also double-digit, up 15.0%.

IATA noted that Middle Eastern carriers saw 13.5% year-on-year demand growth for air cargo in August. Latin American carriers saw 14.2% year-on-year demand growth for air cargo in August.

African airlines, meanwhile, saw 7.5% year-on-year demand growth for air cargo in August, with demand on the Africa-Asia market increasing by 21.1% compared to August 2023. This maintained a streak of double-digit annual growth that originated in the second half of 2023.