Worldwide air cargo rates and tonnages edged up further in the final full week of September and the month as a whole, ahead of what is expected to be a strong peak season.

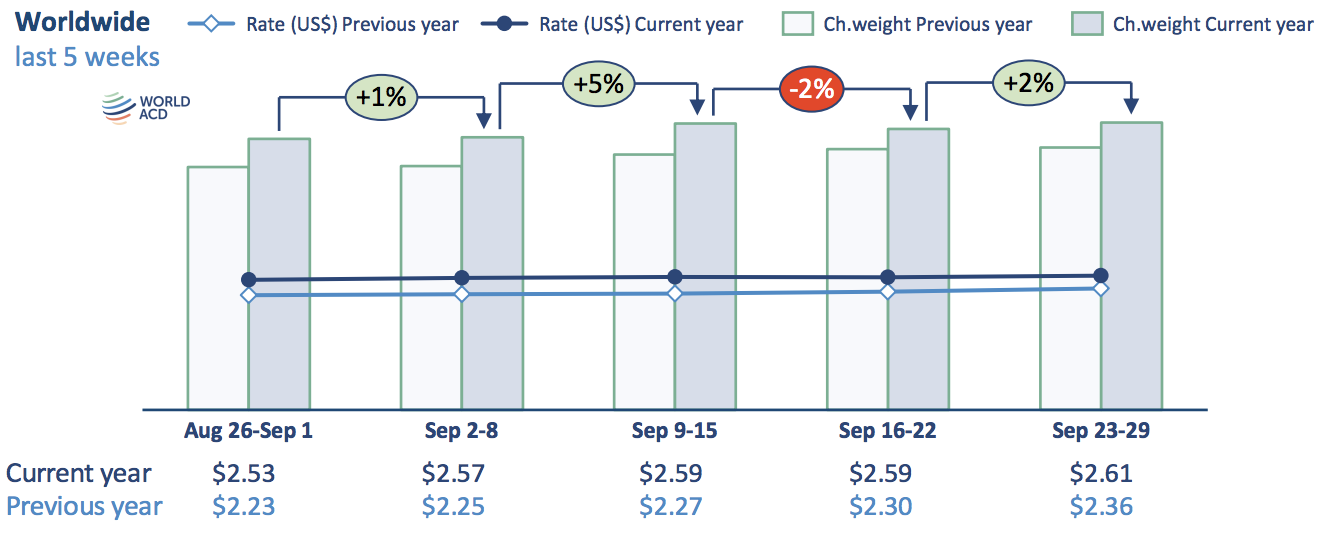

According to the latest weekly figures and analysis from WorldACD Market Data, after contracting by 2% the previous week due to national holidays in China, South Korea, and Chile, total global chargeable weight rebounded in week 39 (September 23-29) with a 2% week-on-week (WoW) increase, raising worldwide tonnages in week 39 to around 10% above their equivalent levels this time last year.

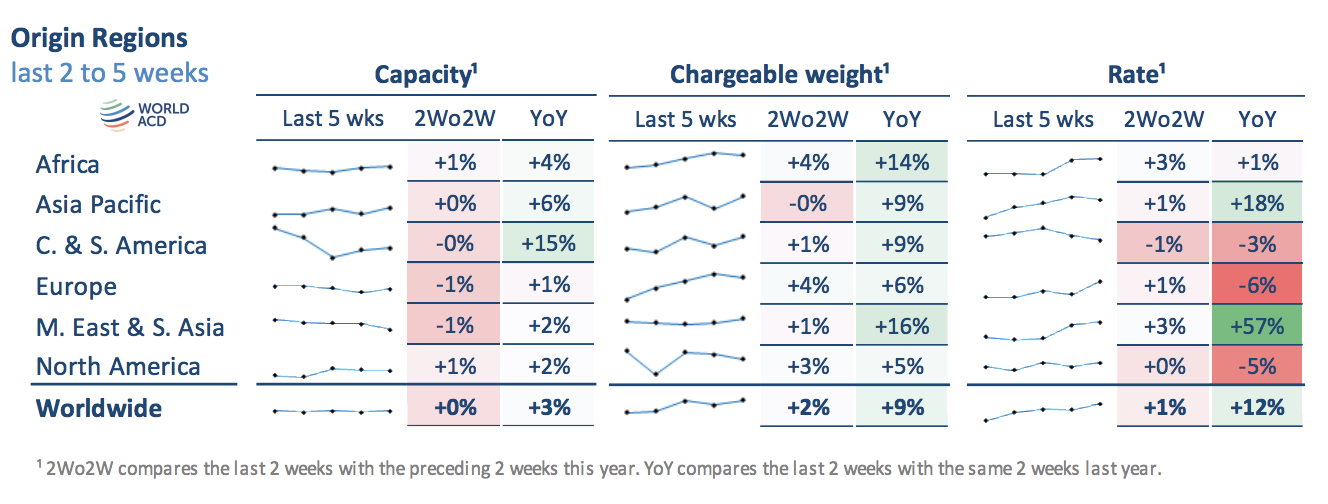

That WoW increase in week 39 included traffic rebounding from Asia Pacific (up 6%) and Central & South America (CSA, up 4%)—a recovery effect from the holidays the previous week.

The air cargo market data provider noted that combined with an increase from Middle East & South Asia (MESA, up 2%) origins, these increases more than compensated for 2% WoW declines from Europe and North America.

Analysis of the Asia Pacific to Europe market highlights some big WoW tonnage increases in week 39 from individual countries, including China (up 9%), South Korea (up 26%) and Taiwan (up 16%), but these mostly reflect a rebound following last week's mid-autumn festival holidays.

However, tonnages from Hong Kong to Europe have risen consistently in the last five weeks (up 19% compared with week 34) to their highest levels for several months.

Meanwhile, tonnages from China and the wider Asia Pacific market to the US were both up by 5%, WoW, and there were big WoW increases to the USA from MESA (up 11%), including from India (up 16%) and Bangladesh (up 12%).

[Source: WorldACD]

On the pricing side, average worldwide rates—based on a full-market average of spot and contract rates—edged up slightly (up 1%, WoW) to US$2.61 per kilo in week 39, taking them 10% higher year on year (YoY).

WorldACD noted that the changes to spot rates are more pronounced for both WoW and YoY comparisons.

It added that the biggest WoW increase came from North America (up 6%) and Europe (up 5%) origins, although there were notable further increases from Asia Pacific (up 3% to US$4.14) and MESA (up 2% to US$3.62 per kilo), taking spot rates from those two regions 26% and 86% higher, respectively, YoY.

MESA, Bangladesh disruptions continue

"Whereas demand and rates from most MESA origins have been highly elevated for much of this year, bolstered by the disruptions to ocean freight supply chains caused by the attacks on shipping in the Red Sea, Bangladesh continues to face additional major challenges, resulting from ongoing political instability and logistics disruptions," WorldACD's report said.

It noted that tonnages flown to Europe from Bangladesh in September were down by around 15% year over year, and Bangladesh to Europe spot rates remained extremely high throughout the month, at well above US$5 per kilo.

[Source: WorldACD]

Meanwhile, Bangladesh to the US tonnages were up "substantially" year over year, according to WorldACD, by around 50% in September. Bangladesh to the US spot rates of more than US$7 per kilo throughout September were more than three times their equivalent levels last year.

"Amid rising tensions in the Middle East, continuing disruptions to container shipping in that region, and anticipation of US port strikes, tonnages flown from the whole MESA region to the USA have risen in the last four weeks by around 13%," the air cargo market data provider said.

"In addition to the higher volumes from Bangladesh, tonnages from multimodal hubs such as Colombo and Dubai to the US are up very substantially, YoY," it added.

Provisional full-month figures for September indicate that chargeable weight rose by a further 1% compared with August, taking tonnages 9% above last year's levels.

WorldACD noted that that's a slightly smaller year-over-year percentage tonnage increase compared with most months this year, although tonnages last September had already begun picking up significantly, driven by rising cross-border e-commerce air cargo levels.

Full-month average worldwide rates in September, meanwhile, rose by a further 3%, month-on-month – a stronger MoM increase than in previous months.

Compared with September 2023, average worldwide (combined contract and spot) rates were up 14% year over year, with spot rates up 22% year over year to US$2.80 per kilo in September.

APAC, MESA markets drive Q3 growth

"The YoY increases in both tonnages and rates – in September, Q3, and throughout this year – have clearly been largely driven by Asia Pacific and MESA markets, and these two origin regions look set to be key factors in the final quarter of 2024," WorldACD said.

"It's unclear to what extent the still unresolved US port disputes will contribute to air cargo demand, but further disruption to container shipping there can only add to the pressure on an already stretched air cargo system – facing very strong expected demand and limited available capacity from both of those regions in Q4," it added.