Local air traders in Hong Kong are looking ahead to a peak season that is "stronger or comparable" to last year's despite a bleak overall outlook for the last quarter of 2024.

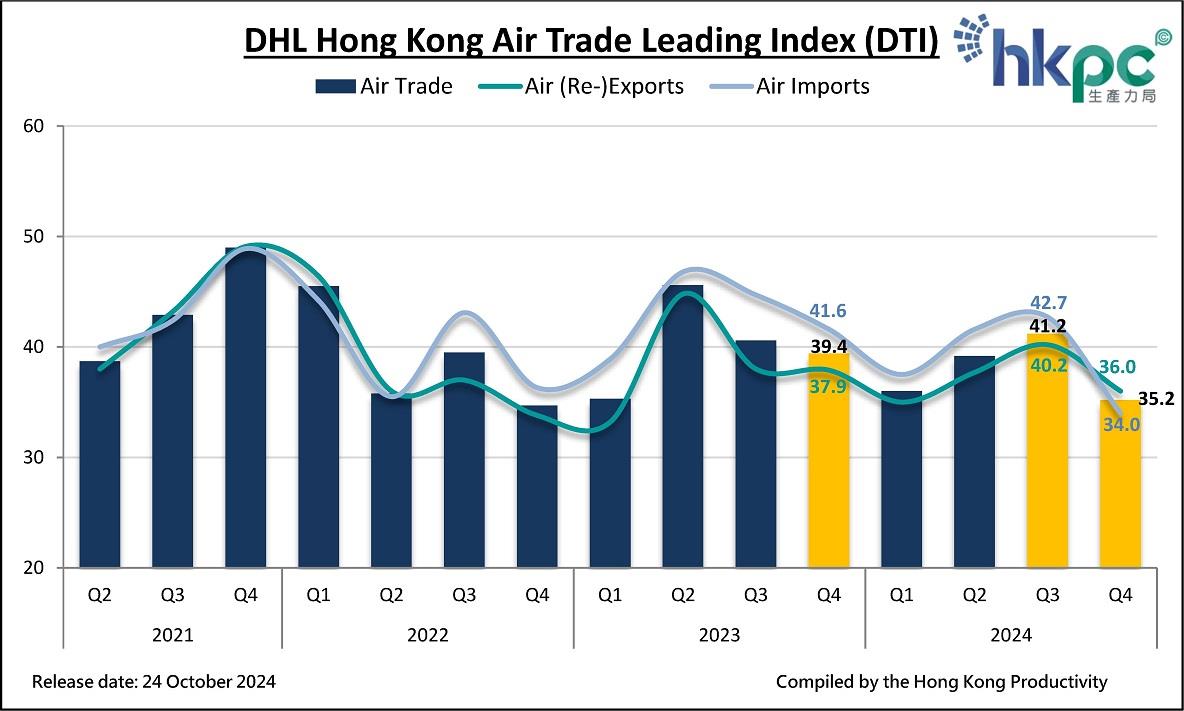

The latest DHL Hong Kong Air Trade Leading Index (DTI) —commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council (HKPC) — found that the overall trade index experienced a notable decline of 6 points, with both (Re-)Exports and Imports indices declining.

The drop in the Import index was more pronounced (-8.7 points).

[Source: DHL]

Similar to the previous year, approximately 70% of local air traders have a positive or neutral outlook for the upcoming traditional peak season (Thanksgiving and Christmas Eve), with 20% of local air traders holding a positive view and 49% of them holding a neutral view.

The online B2C index showed an increase in product variety (up 2.2 points) while experiencing a decline in sales volume (-1.8 points), indicating that "lots of variety in fewer quantities" is becoming the new normal.

On price adjustments in 2025, around a third of air traders indicated the plan to adjust their price at the usual rate (35%), while 5% expect to implement price increases beyond the usual rate.

The DHL Hong Kong Air Trade Leading Index also found that in terms of the most promising markets in 2025, air traders still consider Asian markets to have greater potential. China remains the top choice, followed by Malaysia and Thailand in second place and Vietnam in third place.

"The air trade index declined by 6 points in 2024 Q4, with the import index experiencing a more significant drop (-8.7 points), indicating weakened confidence among air traders," commented Edmond Lai, chief digital officer of HKPC.

He added that market indices fell generally, particularly the downturn in Europe reflecting "economic recession."

"Looking ahead to the upcoming year, local air traders are adopting a more conservative pricing strategy for 2025; over half of the local air traders are reluctant to raise prices under insufficient orders and intensified market competition," Lai said, adding that in terms of the most potential markets in 2025, 11% air traders still consider China as the single market with the greatest potential.

"Additionally, the online B2C index saw an increase in product variety alongside a decrease in sales volume, suggesting that a wider range of products with lower quantities is becoming the new market trend, and small orders and customisation have become the new norm," the HKPC chief digital officer, further said.

Meanwhile, in terms of sustainable development, the overall willingness of air traders to participate in carbon emission reduction increased by 10 percentage points compared to the second half of the previous year, highlighting a positive trend towards green operations among enterprises.

Despite this, among local air traders who are not participating in carbon emission reduction (30%), half cited the lack of ESG implementation as the reason for inaction. This suggests that companies may lack the necessary frameworks, policies, or strategies to address these challenges.