Air cargo tonnages from China to Europe have broadly recovered to their levels prior to China's Golden Week holiday at the start of October, while tonnages from Hong Kong to Europe have risen further in the last six weeks to their highest level this year, indicative of a possible ramping up of e-commerce and wider demand from this key origin market in the final months of the year.

According to the latest weekly figures and analysis from WorldACD Market Data, Hong Kong to Europe tonnages in week 42 (October 14 to 20) were 25% higher than their already strong levels in the equivalent week last year.

Hong Kong to Europe tonnages in weeks 40-42 were 12% higher than their average weekly levels in September.

[Source: WorldACD]

On the pricing side, WorldACD said the average spot rates from Hong Kong to Europe in the last seven weeks have risen above the US$5 per kilo level, fluctuating between US$5.04 and US$5.31 and standing at US$5.15 in week 42, with China to Europe spot rates rebounding to US$4.29 per kilo, taking both to around 13% above last year's levels.

However, there have been some bigger year-on-year (YoY) increases from some other Asia Pacific markets, particularly on the pricing side.

The analysis said other Asia Pacific markets showing significant YoY tonnage increases to Europe in week 42 include Thailand (up 27%) and Vietnam (up 26%). But spot rates from those two markets to Europe were up, YoY, by 87% and 61%, respectively.

"The consistent strengthening of the Hong Kong to Europe market in the last six weeks, despite the normally dampening effects of China's Golden Week holiday period at the start of October, is one of the earliest and only indicators of a potential significant fourth-quarter (Q4) air cargo peak season emerging this year," WorldACD said.

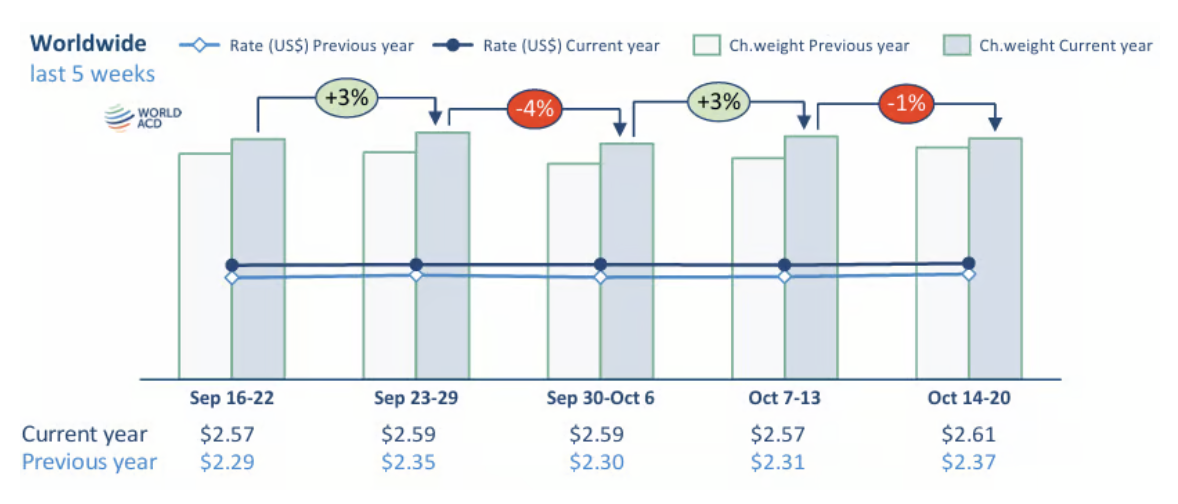

The air cargo market data provider went on to note that, worldwide, average global rates edged up only slightly in the second full week of October, and tonnages nudged downwards from most of the major regions—the biggest decline coming from the Middle East and South Asia (MESA) origins.

"But the patterns in week 42 this year are similar to those of last year, with tonnages having broadly recovered from the effects of China's Golden Week holiday at the start of October and poised for a potential surge in the final weeks of the year, as occurred last year," WorldACD said.

Fall tonnages in MESA

Following a moderate (4%) WoW fall the previous week, tonnages from MESA to Europe dropped by a further 8% in week 42 — more than half of that decline was due to a drop in chargeable weight from Dubai to Europe (down 22%, WoW), although there were continuing declines also from Bangladesh and Sri Lanka origins to Europe.

WorldACD said this drop is most likely a reflection of the recent impact of the increased military and geopolitical tensions in the region.

Tonnages from MESA to the US were also down by 6% in week 42, with tonnages falling from India (down 3%) and with consecutive weeks of double-digit percentage declines to the US from Bangladesh and Sri Lanka origins.

Average spot rates from MESA to the US have also fallen in recent weeks from US$5.02 in week 40 to US$4.69 per kilo, although they are still 80% higher than this time last year.

On a worldwide basis, tonnages in week 42 slipped 1% compared with the previous week, taking them just 4% above their levels this time last year. All the world's main origin regions were ahead by between 2% and 5% year over year.

Average global rates edged up by a further 2%, WoW, taking them +10% above last year’s levels – based on a full-market average of spot and contract rates.

China-US tonnage slump continues

Meanwhile, Asia Pacific to US total air cargo tonnages continued their recovery in week 42 from the effects of China's Golden Week holiday, rebounding by a further 4% WoW, thanks to a 10% WoW increase from China.

However, WorldACD noted that compared with last year, China-US tonnages remain significantly down (18%, YoY)—part of a wider pattern of decline in China-USA tonnages in the second half of this year.

"That decline appears to have been triggered by tighter Customs rules and checks since July on inbound US air cargo traffic from China, especially at Los Angeles (LAX)," the report said, noting that China to LAX tonnages in week 42 were down by 37%, YoY.