Shipping companies will remain in profit in 2024 despite recent sharp declines in ocean freight rates in the Asia-Europe trade.

Transportation and supply chain technology company Upply said

as other routes continue apart from the Asia-Europe route, other east-west routes and north-south markets, although they are under pressure, are continuing to make money.

On transpacific routes, in particular, the shipping companies are still able to make a profit of around US$2,000 per container at the moment.

The results obtained by the shipping companies during the first three quarters should also be enough to enable them to increase their net income by about 10%, even taking into account the decline they are experiencing in the current quarter.

Upply said in a new analysis that freight rates are "falling fast" on Asia-Europe routes via the Cape of Good Hope, and shipping companies are now operating below break-even levels on these routes.

"The fourth quarter of 2024 promises to be a difficult one for the shipping companies in terms of profitability," the analysis said, adding that FAAK spot rates for cargo loaded on Asia-North Europe routes going around the Cape of Good Hope, which is currently the most used itinerary, are below the US$3,000/40' mark.

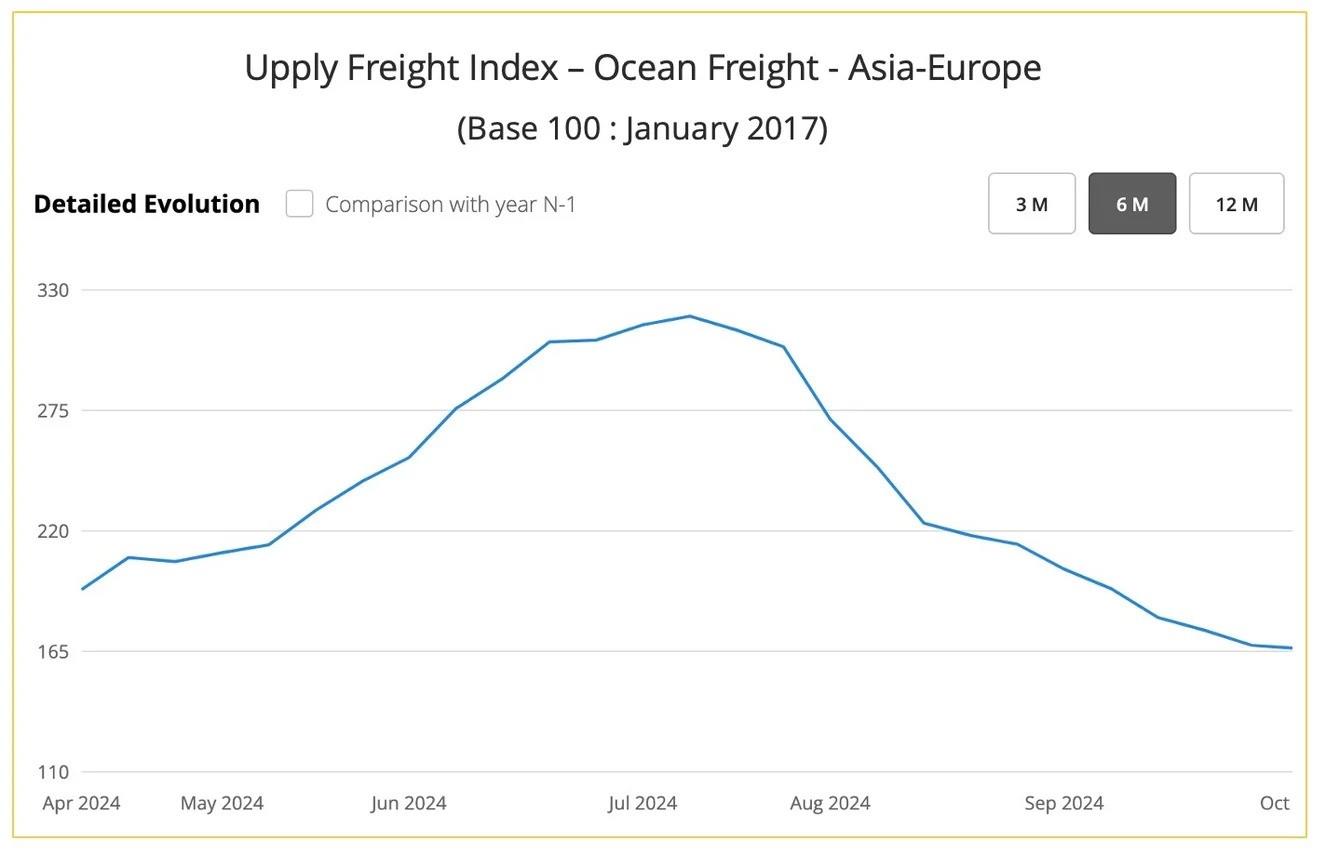

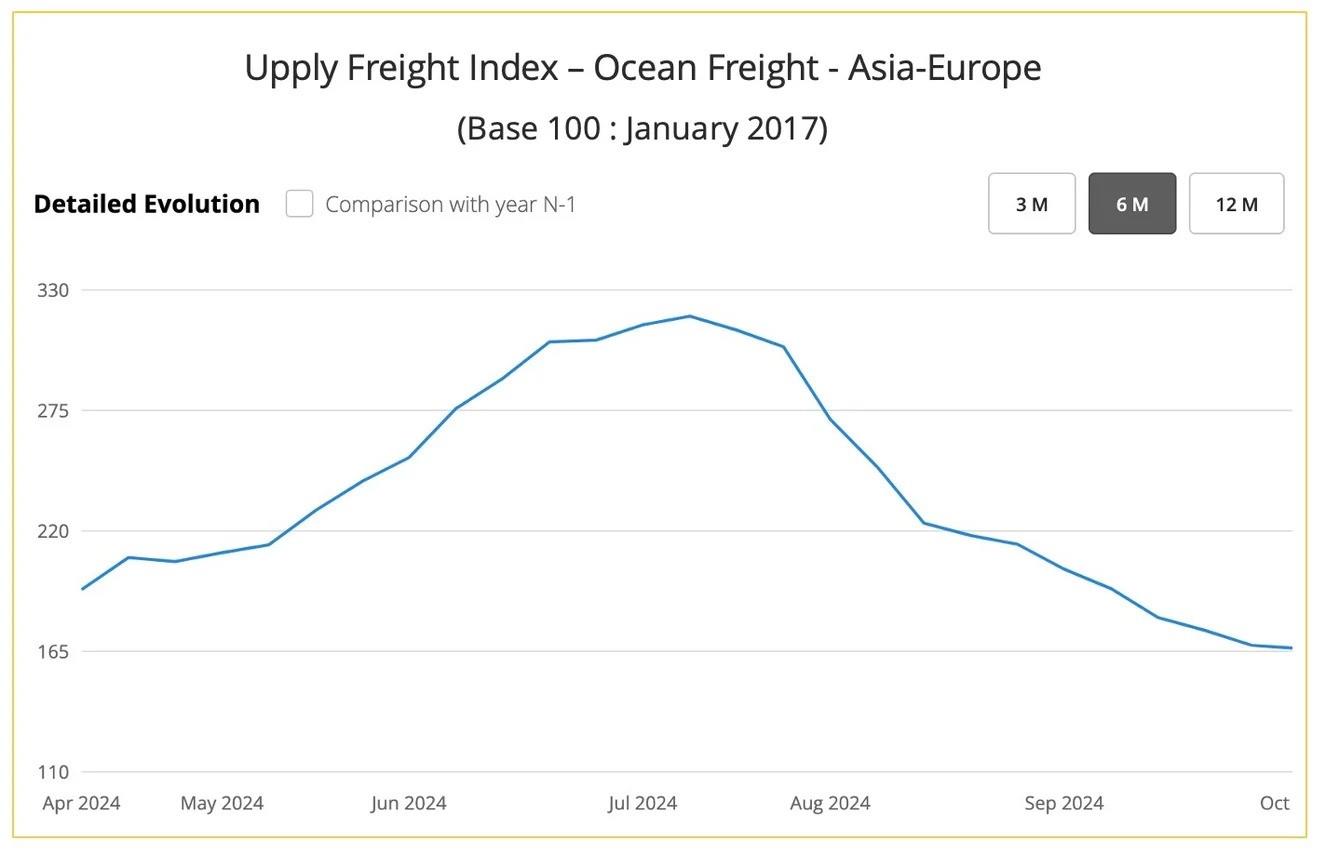

Upply's freight rate index for Asia-Europe routes, which merges spot and contract rates, also shows a marked fall from August on.

The analysis noted that the Asia-Europe market, which is of great importance to the shipping companies, is "starting to crack at the worst time" — just as the annual contract negotiations are starting to get into full swing and 2025 service schedules are being drawn up without any convincing improvement in quality having been offered to date.

Upply said it had been expected that shipping companies' profitability would come under pressure, but this was expected to happen later, sometime next year.

The report noted that the Asia-Europe/Cape of Good Hope market started to collapse so suddenly as European demand is still going in the wrong direction.

It said that current cargo volumes are at mediocre levels at all the shipping companies surveyed, and reservations-based forecasts for the full fourth quarter indicate that the situation will change in the short term.

Fresh capacity is also continuing to come onto the market, with too many giant new vessels on Asia-Europe routes.

"Shippers no longer believe that service quality will be restored. They want, therefore, to buy space at the lowest possible price, even though they know sometimes that carriers are operating at a loss," Upply said.

It noted that the Cape of Good Hope route is now part of the normal functioning of the Asia-Europe container shipping market, and the disruption affecting the Suez Canal does not figure in the negotiations between shipping companies and shippers since it no longer generates any surprise or associated market tension.

Ocean freight rate collapse to continue

"At this stage, unless there is an unforeseeable major event like a pandemic, war or climate catastrophe, we cannot see that anything will stop the freight rate collapse on Asia-Europe routes," Upply said in its analysis.

The report noted that resuming use of the Suez Canal could, however, improve freight rates a little, but the risks are "too great."

"It is not at all sure that shippers would agree to this, and the shipping companies would be liable if they exposed the merchandise in their care to known risks, given that the Red Sea is still officially recognised by the international institutions as a war zone," Upply said.

Meanwhile, the analysis said when conditions get rough, MSC generally does better than average.

"The company has been designed from the start to face adversity, thanks to its size and tight control of its operating costs, which are still among the lowest on the market, thanks partly to the extensive installation of scrubbers on its ships," Upply said.

It added that the company also currently controls a "large part of the value chain" since it relies on its own port terminals, whereas its competitors remain too dependent on outside service providers.