The re-election of former US President Donald J. Trump is expected to disrupt supply chains with renewed concerns about a possible trade war with China.

Xeneta said in an analysis after the US presidential election closed on November 5 that Trump's victory is "a step in the wrong direction" for international trade as importers fear another spike in ocean container shipping freight rates.

The ocean and air freight rate benchmarking and market intelligence platform noted that Trump has vowed blanket tariffs of up to 20% on all imports into the US and additional tariffs of 60% to 100% on goods from China

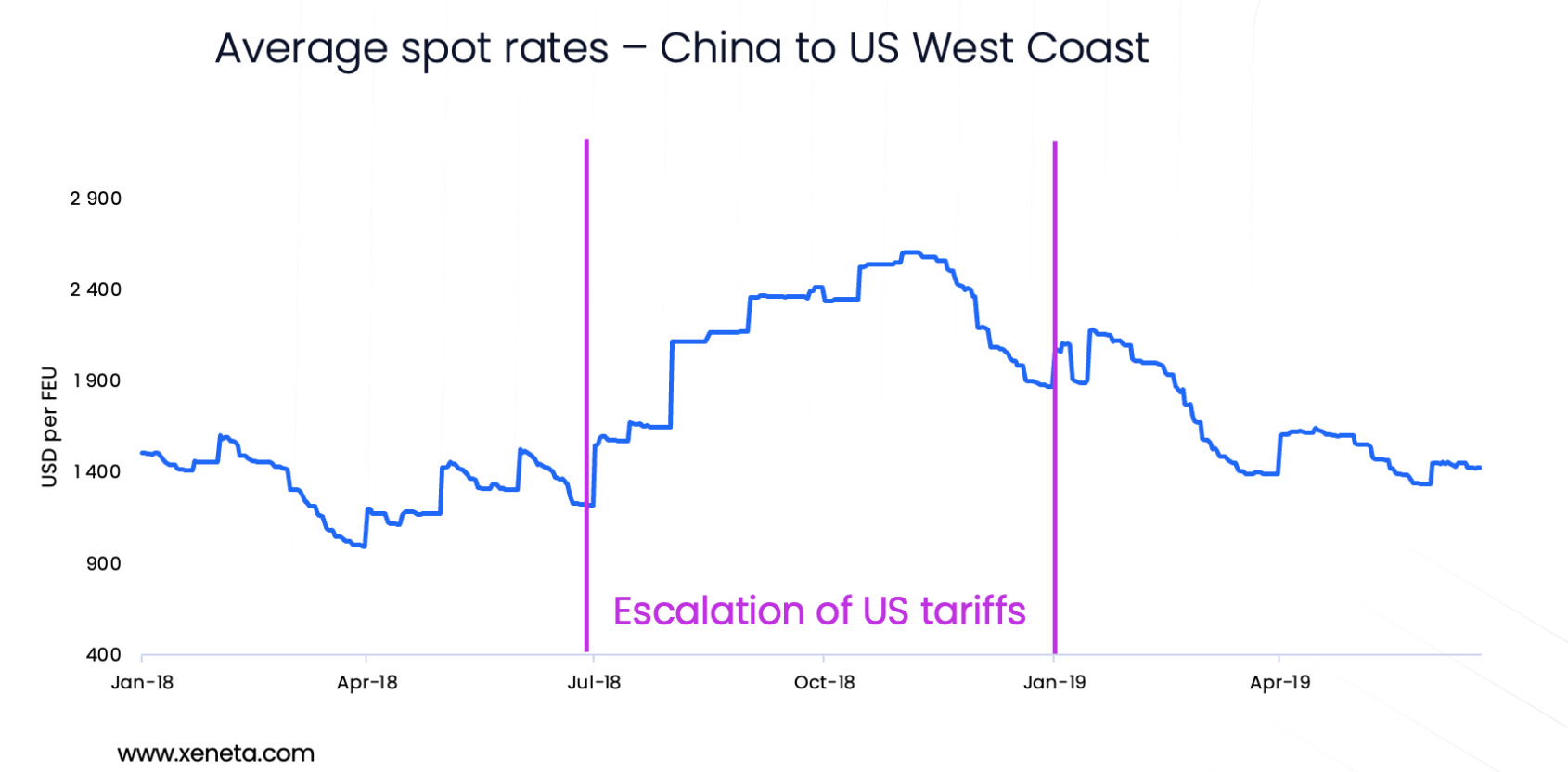

It added that based on Xeneta data, the last time Trump ramped up tariffs on Chinese imports during the trade war in 2018, ocean container shipping freight rates spiked more than 70%.

"Shipping is a global industry feeding on international trade, so another Trump Presidency is a step in the wrong direction," commented Peter Sand, chief analyst at Xeneta.

"The knee-jerk reaction from US shippers will be to frontload imports before Trump is able to impose his new tariffs. Back in 2018, the tariff on Chinese imports was 25%; now, it is increasing up to 100%, so the incentive to frontload is even greater," he added.

Sand noted that for those with warehouse space and the goods to ship, frontloading imports is the simplest way to manage this risk in the short term, although warning of this strategy having its "own problems."

"A sudden increase in demand on major trade lanes into the US when ocean supply chains are already under pressure due to disruption in the Red Sea will place upward pressure on freight rates," the Xeneta chief analyst said.

"We saw the negative impact of tariffs during Trump's first term in office in 2018 when ocean container shipping rates spiked 70%. Shippers will be fearing more of the same this time around," he added.

Fears of US-China trade war resurgence

In the longer term, Sand said another Trump presidency will reignite the trade war with China and provoke retaliatory action.

"In 2018, we saw China respond to US aggression by imposing tariffs of its own, which added even more fuel to the fire, so there is a risk this situation could escalate further in the months and years to come," Sand added.

The analysis said average spot rates from the Far East to the US West Coast and US East Coast have remained relatively flat in the weeks leading up to the US Election, down 3.5% and 2.5%, respectively, since October 15.

However, the current average spot rates of US$5,210 per FEU (40ft container) into the US West Coast and US$5,820 per FEU into the US East Coast are 167% and 134% higher than 12 months ago, primarily due to the ongoing impact of conflict in the Red Sea.

"2024 has been a brutal year for US shippers who have already endured massive disruption due to the Red Sea crisis and spiralling freight rates. There is also the looming threat of further strike action at ports on the US East Coast and Gulf Coast in January next year," Sand said.

"Another Trump presidency will not be welcomed by US importers and exporters, but they needed a swift and clear result in the election."

"Uncertainty is toxic for supply chains, so at least the industry now has a clearer understanding of the financial and operational risk and can execute the plans they will have prepared in the event of another Trump presidency," the Xeneta chief analyst added.