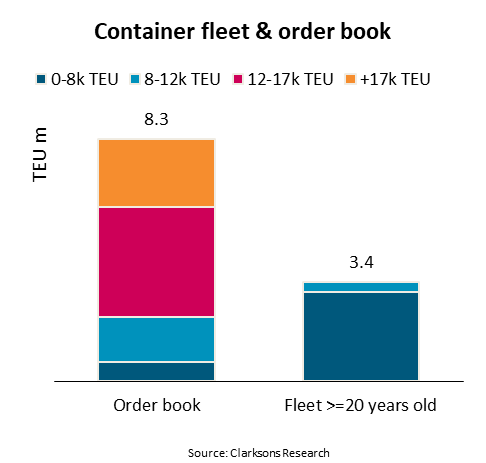

At the end of 2024, the container ship order book was 8.3 million Twenty-foot equivalent units (TEUs), a new record compared with the previous high of 7.8 million TEUs in early 2023.

Niels Rasmussen, chief shipping analyst at BIMCO, the world's largest direct-membership organisation for shipowners, charterers, shipbrokers and agents, said liner operators control 79% of the order book capacity.

In a statement, BIMCO noted that as 4.4 million TEU were contracted during 2024, the second highest ever, the order book grew despite deliveries hitting a new record high of 2.9 million TEU.

"Making up 92% of the order book capacity, ships 8k TEU or larger dominate the order book. The largest segment, 12-17k TEU, makes up 46% of the order book capacity," Rasmussen said.

Shipyards in China have benefitted the most from the last four years' contracting boom and currently hold 72% of the order book's 8.3 million TEU while South Korean and Japanese shipyards hold 22% and 5% respectively.

"Liner operators control 79% of the order book capacity, significantly higher than the 61% they control of the fleet capacity," Rasmussen said.

"Having already increased from 56% at the beginning of 2019, liner operators' share of fleet capacity is therefore set to continue growing in the coming years," he added.

Though five ships have already been contracted for delivery in 2030, 99% of the order book will be delivered during 2025-2029.

According to the current delivery schedule, 0.7 million TEU will be delivered in 2029 while an average of 1.9 million TEU will be delivered during 2025-2028, peaking at 2.2 million TEU in 2027.

BIMCO said that as recycling of ships during the past four years has been limited to 166 ships and 256k TEU, the average age of the fleet has increased by 1.4 years since the beginning of 2020.

Consequently, the number of ships 20 years old or older has risen, and they now make up 3.4 million TEU equal to 11% of the fleet.

If all ships 20 years old or older are recycled during the next five years, the fleet will grow to 35.8 million TEU by the end of 2029, assuming no more ships are contracted for delivery before 2030. BIMCO said that is equal to 16% growth or average annual growth of 3%.

Smaller containership orders to contract, bigger vessels to expand

Meanwhile, BIMCO said the segments smaller than 8k TEU would see an average annual contraction of 4% while the segments 8k TEU or larger would grow an average of 7% per year.

"It would require 680k TEU per year to recycle all ships 20 years old or older during the next five years (the current annual record is 657k TEU) but actual recycling is likely to end lower," Rasmussen said.

"As long as ships cannot fully return to the Red Sea, recycling will likely continue to be low and at the same time, the smaller ship segments tend to be recycled later than average. Therefore, average annual fleet growth during the next five years could end higher than 3%," he added.