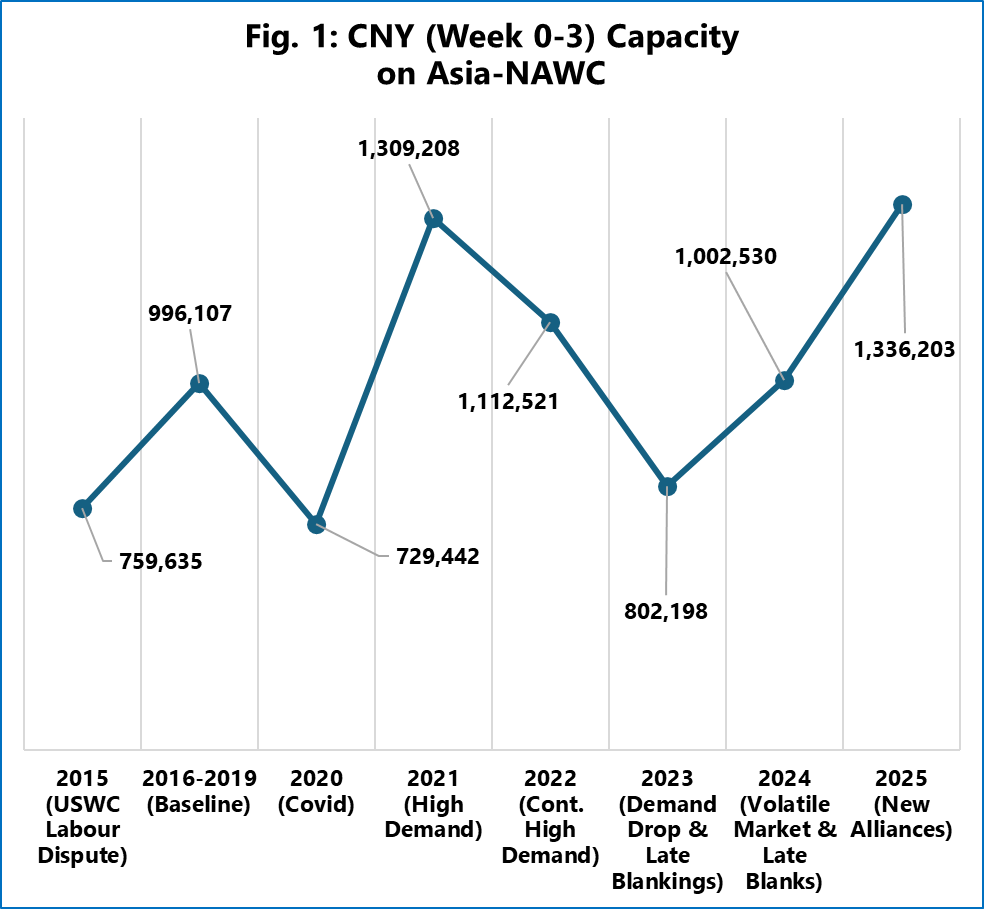

Sea-Intelligence noted that on the Asia-North America West Coast, looking at the capacity across the 4-week CNY period (the week in which CNY falls plus the following 3 weeks) for 2025 and comparing it to previous years, "there is a very sharp capacity growth for 2025, which cannot be explained by any current demand growth factors."

It added that the current capacity deployment for 2025 is just under 1.34 million TEU for the 4-week CNY period, which is the highest across the analysed period and even higher than during the high-demand period of 2021.

This corresponds to a 33.3% growth Y/Y and a growth of 34.1% when compared to 2026-2019.

[Source: Sea-Intelligence]

Meanwhile, in terms of blank sailings, carriers have so far scheduled blanked capacity of 9.0%, which is the lowest across the analysed period, and in sharp contrast with the 22.8% blanked in 2024, and the average 2016-2019 reduction of 18.3%.

"Just to put this into context, the blanked percentage in 2021 (where pandemic demand was surging) was higher at 10.7%," Murphy said.

Under normal circumstances, he added that this would mean significant blank sailing announcements in the upcoming weeks since it is highly unlikely that carriers would be satisfied with this level of excess capacity.

"This would result in a situation reminiscent of 2023 and 2024, where significant capacity cuts were made very close to CNY," the Sea-Intelligence chief added.

However, there is also a potential unknown: the phase-in of the new networks by MSC, Gemini Cooperation, and Premier Alliance.

Murphy noted that this introduces an uncertainty, whereby the carriers might prioritise getting their vessels phased into the new networks at the expense of not blanking as much capacity as usual.