Global air cargo demand saw record growth in 2024, fueled by a surge in e-commerce volume and challenges in ocean shipping that drove more volumes to air transport.

The International Air Transport Association (IATA) released data for the full year 2024 and December global air cargo market performance, showing full-year demand, measured in cargo tonne-kilometers (CTK), increased by 11.3% (12.2% for international operations) compared to 2023.

Full-year 2024 demand exceeded the record volumes set in 2021.

Full-year capacity in 2024, measured in available cargo tonne-kilometers (ACTK), increased by 7.4% compared to 2023 (9.6% for international operations).

December 2024 brought the year to a close with continued strong performance.

Global demand was 6.1% above December 2023 (7.0% for international operations) and global capacity was 3.7% above December 2023 levels (5.2% for international operations).

"Air cargo was the standout performer in 2024, with airlines moving more air cargo than ever before," said Willie Walsh, director general at IATA.

"Importantly, it was a year of profitable growth. Demand, up 11.3% year-on-year, was boosted by particularly strong e-commerce and various ocean shipping restrictions."

"This combined with airspace restrictions which limited capacity on some key long-haul routes to Asia helped to keep yields at exceptionally high levels. While average yields continued to soften from peaks in 2021-2022 they averaged 39% higher than 2019," Walsh added.

[Source: IATA]

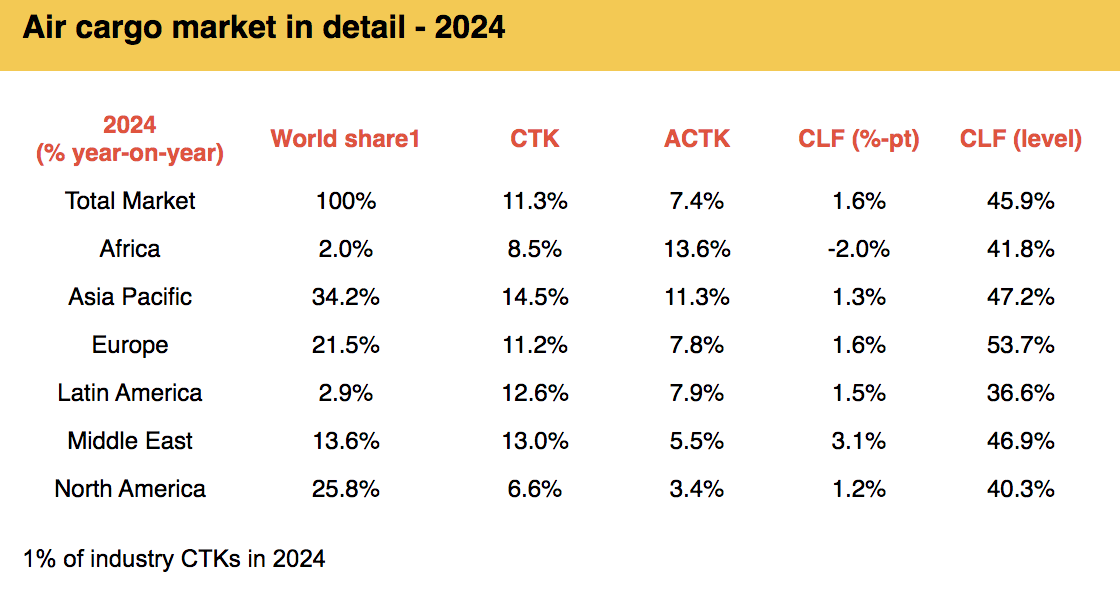

All regions reported growth in 2024

For 2024, all regions saw growth in cargo volumes. IATA said Asia-Pacific airlines saw 14.5% year-on-year (YoY) demand growth for air cargo in 2024, the strongest among the regions, as capacity increased by 11.3% year-on-year. December YoY demand increased 8.4%, and capacity increased 6.3%.

North American carriers recorded a 6.6% annual demand growth, the lowest of all regions, although capacity was up by 3.4% YoY. December demand increased by 5.3%, and capacity increased by 2.1%.

European carriers saw 11.2% demand growth over the same period a year ago, as capacity increased by 7.8% YoY. December demand was also up 5.1% YoY, and capacity increased 3.7%. Middle Eastern carriers recorded a 13% annual demand growth, with capacity growing 5.5% YoY. December saw a 3.3% growth YoY, while capacity increased 0.2%.

Latin American carriers saw a 12.6% air cargo demand growth in 2024 compared to the same period in 2023. Capacity increased by 7.9% YoY. December air cargo demand was up 10.9%, the highest of all regions and capacity increased 8.4%.

African airlines saw 8.5% YoY demand growth in 2024. Capacity increased by 13.6% during the same period. December demand, meanwhile, decreased by -0.9%, the lowest of all regions, and capacity increased by 1.8%.

IATA said international routes experienced exceptional traffic levels for the 17th consecutive month, with a 7% year-on-year increase in December.

It noted that airlines benefit from rising e-commerce demand in the US and Europe amid ongoing capacity limits in ocean shipping.

Moderate growth expected for 2025

Meanwhile, looking to 2025, IATA estimates growth to moderate to 5.8%, aligned with historical performance.

"Economic fundamentals point to another good year for air cargo with oil prices on a downward trajectory and trade continuing to grow. There is no doubt, however, that the air cargo industry will be challenged to adapt to unfolding geopolitical shifts," Walsh said.

"The first week of the Trump administration demonstrated its strong interest in using tariffs as a policy tool that could bring a double whammy for air cargo, boosting inflation and deflating trade," the IATA chief added.