Changes to trade policy are shaking up the air cargo market, and the looming cancellation of de minimis eligibility for Chinese imports is expected to significantly reduce the surge of e-commerce goods arriving in the U.S. by air, which has kept planes full and air cargo rates highly elevated since late 2023, according to a new Freightos analysis.

This would also lead to increased delivery times and push price tags up by as much as 50% for items that continue to ship by air.

U.S. President Donald Trump early in February announced the suspension of the exemption as part of new tariffs that impose an additional 10% tax on Chinese goods but later quickly reinstated de minimis eligibility for Chinese e-commerce imports to the U.S. early this month due to the lack of infrastructure and workable solutions for customs and postal services to manage the volume and procedure.

Chinese e-commerce giants like Temu and Shein largely rely on the savings and speed they realize by using the de minimis exemption to export low-value goods by air cargo directly from China to U.S. consumers, and both companies had already begun preparations for a shift away from reliance on de minimis and air cargo.

Judah Levine, head of research at Freightos, noted, nonetheless, that these platforms are scrambling to adjust to the coming policy change by raising prices, pushing sellers to build up US inventories, and incentivizing manufacturing shifts to Vietnam and other China alternatives.

"The temporary reprieve of the de minimis suspension for Chinese goods was aimed to allow US Customs and Border Protection to prepare for an anticipated surge of formal entry parcels, but it may also allow time for air cargo e-commerce import volumes to decrease to a more manageable level," Levine said in the analysis.

"There are already reports of e-commerce companies canceling freighter flights," he added.

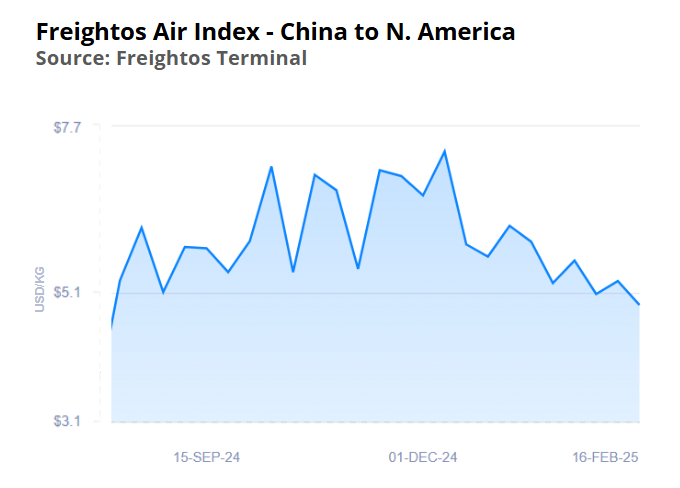

The report said that though China - U.S. air cargo rates have yet to collapse, Freightos Air Index data shows they have decreased below the US$5.00/kg mark for the first time since August of last year, and are 7% lower than a week prior though prices typically increase just after Lunar New Year.

"This trend may suggest that air rates could decline gradually up until de minimis is canceled and then more sharply once the change goes into effect," Levine said.

Meanwhile, many importers, exporters, and other businesses in the U.S. are breathing another, though possibly temporary, tariff-related sigh of relief after President Trump’s planned reciprocal tariffs implementation was pushed back.

On February 13, Trump signed a memorandum instructing federal agencies to research and develop a comprehensive plan for reciprocal tariffs on countries with duties on U.S. exports or other barriers to American businesses and trade.

But the memo specifies that those investigations commence only after these agencies submit their findings on the state of American trade that the president requested in his wide-ranging inauguration day America First Trade Policy memo.

Levine noted that with those trade reports – which could include support for President Trump's proposed 60% tariff on all Chinese goods – due on April 1st, reciprocal tariff actions can only come after that.

"Some experts are hopeful that this runway will provide time for U.S. trading partners to lower their tariffs and avoid US reciprocation," he said.

"But the threat of these tariff increases continues to impact global trade both by accelerating the shift of US sourcing away from targeted countries like China and by pushing shippers to pull forward orders from those that could face tariff hikes soon, including Mexico."

The Freightos analysis said for US ocean freight this frontloading remains apparent both in import container volume levels since the election and projections for the coming months and in ocean rates that remain elevated – at about US$5,000/FEU to the West Coast and US$6,000/FEU to the East Coast – even as we enter the typical slow season for the transpacific container market.

"In the absence of these tariff considerations, Asia - Europe and Mediterranean container rates are falling more significantly than on the transpacific post-Lunar New Year as demand eases," Levine said.

Asia - Europe rates have fallen nearly 45% since early January to about US$3,000/FEU, its lowest level since the start of the Red Sea crisis, and daily rates to the Mediterranean are nearing the US$4,000/FEU level.

The analysis said carriers are increasing blanked sailings and have announced March 1st GRIs of about US$1,000/FEU to attempt and push rates back up on these lanes, though there is skepticism that the increases will succeed.