Global trade growth has proven surprisingly resilient in the face of recent disruptions triggered by escalating trade tensions in some of the world's largest economies, according to results of the DHL Trade Atlas 2025.

The German logistics giant said this pattern is "likely to continue" even as the U.S. begins a campaign of tariff increases against some of its biggest trading partners, including China, Canada, and Mexico.

The DHL Trade Atlas, published by DHL in collaboration with the New York University Stern Business School (NYU Stern), said that global trade recovered in 2024 and is forecasted to grow faster over the next five years than during the preceding decade despite current market risks.

"Even if the new U.S. administration implements all of its proposed tariff increases and other countries retaliate, global trade is still expected to grow over the next five years – but at a much slower pace," the report said.

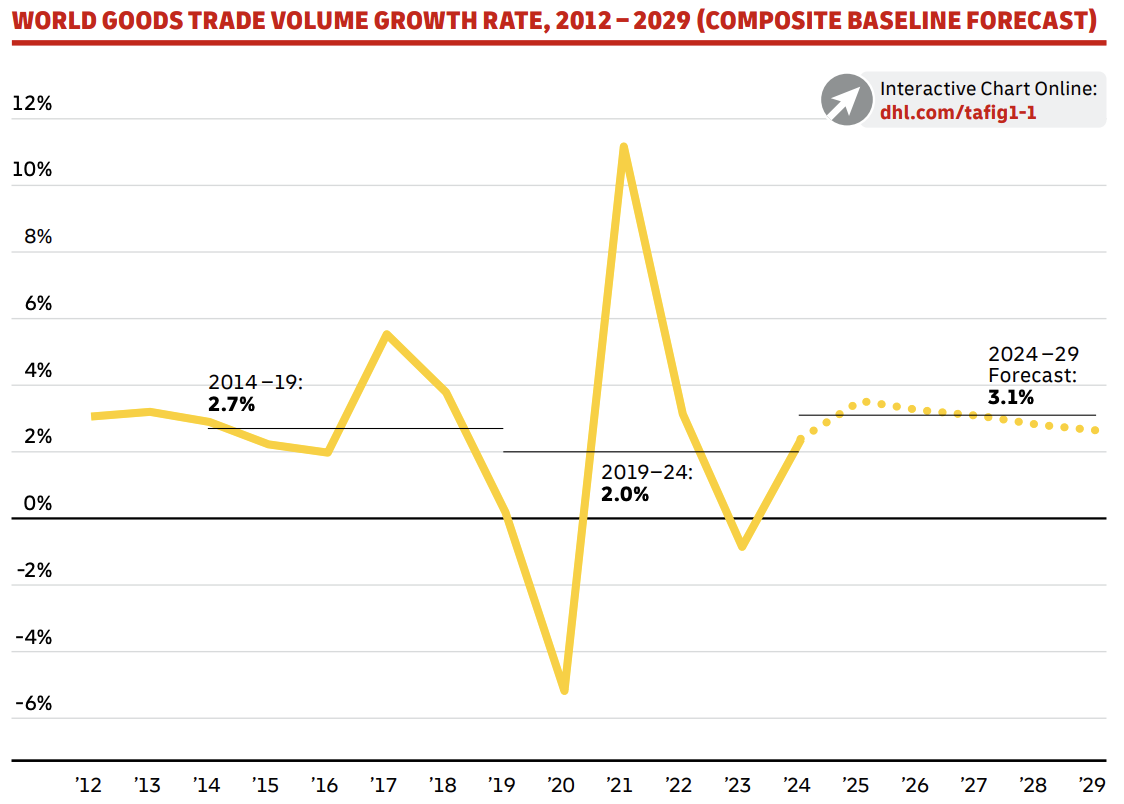

Recent forecasts predict that goods trade will grow at a compound annual rate of 3.1% from 2024 to 2029. This roughly aligns with GDP growth and represents modestly faster trade growth than the previous decade.

[Source: DHL Trade Atlas 2025]

"The DHL Trade Atlas 2025 reveals highly encouraging insights," said John Pearson, CEO, DHL Express. "There is still significant potential for trade growth in advanced and emerging economies worldwide."

India, Vietnam, Indonesia, the Philippines to lead trade growth

The DHL Trade Atlas 2025 identified "new leaders in trade growth" as supply chains continue to evolve.

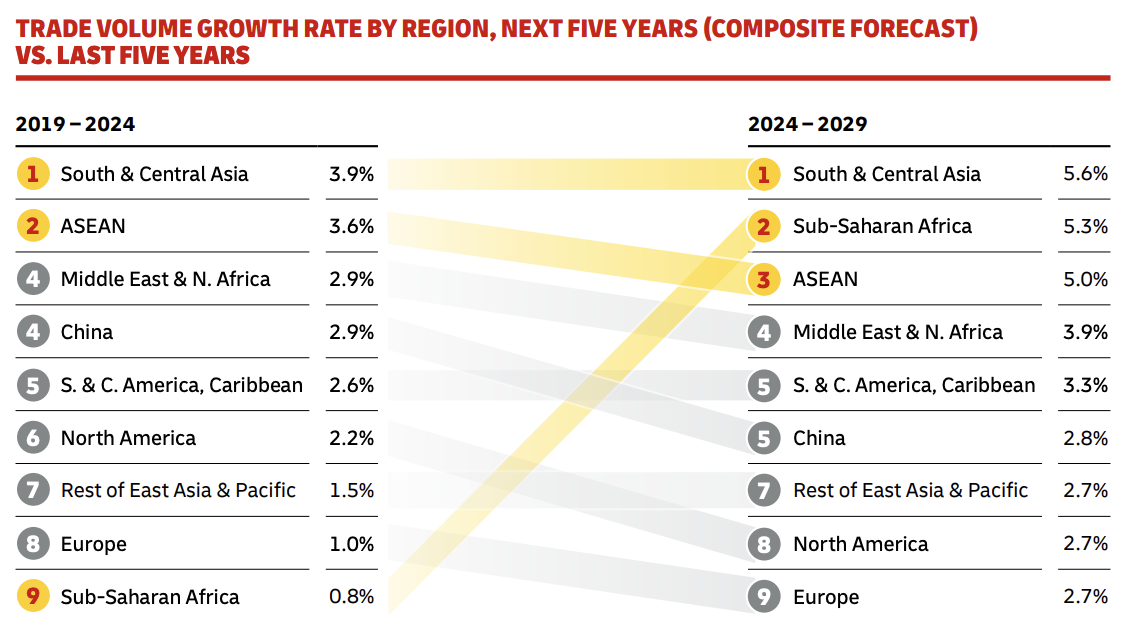

It said that between 2024 and 2029, India, Vietnam, Indonesia, and the Philippines are forecast to rank among the top 30 for both speed (growth rate) and scale (absolute amount) of trade growth.

India also stands out as the country with the third-largest absolute forecast trade growth (6% of additional global trade), behind China (12%) and the United States (10%).

"The countries expected to deliver the most absolute trade growth are spread across Asia, Europe, and North America," the report said, adding that at the same time, the countries with the fastest projected trade growth also include several in Africa and Latin America.

All other regions are forecast to grow at rates of 2% to 4%.

U.S. policy shifts to impact but not deter global trade

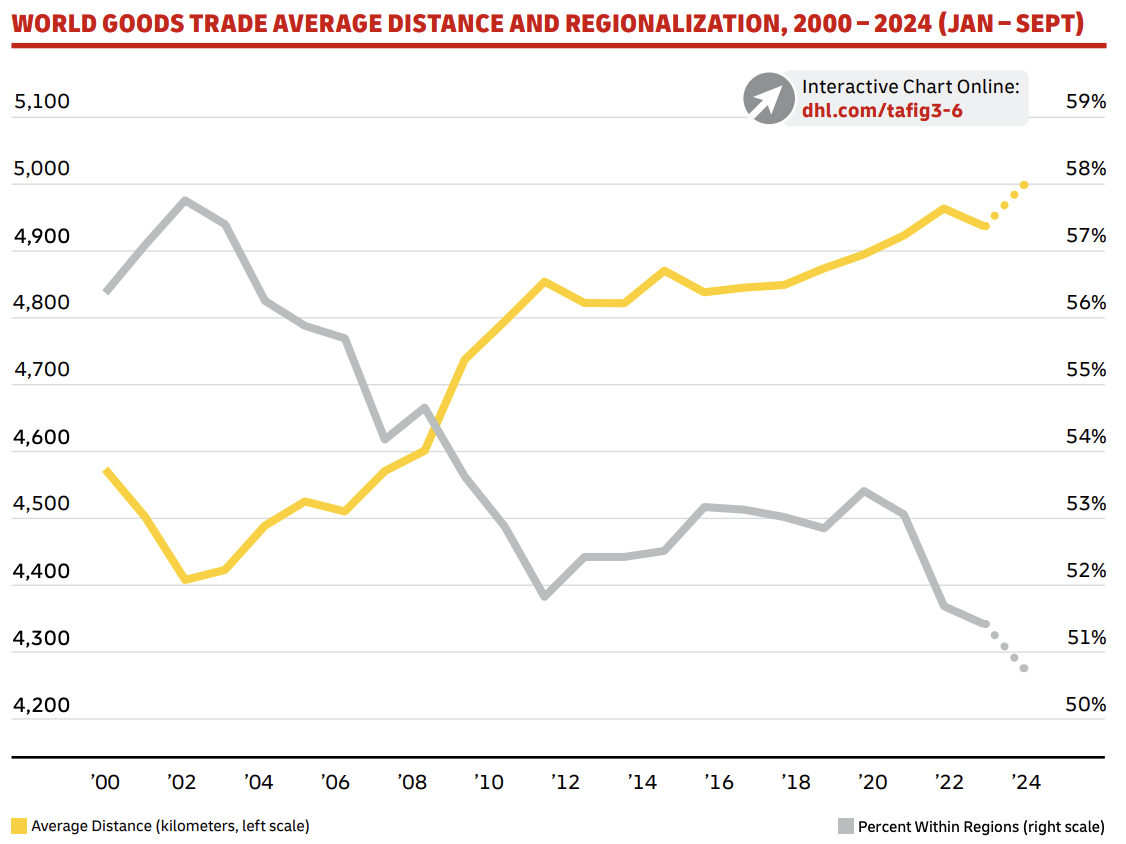

Despite widespread interest in nearshoring and producing goods closer to customers, the DHL Trade Atlas 2025 also found that trade "has not become more regionalized overall."

"Actual trade flows indicate the opposite trend," it said, adding that in the first nine months of 2024, the average distance traversed for all traded goods reached a record 5,000 kilometers, while the share of trade within major regions fell to a new low of 51%.

[Source: DHL Trade Atlas 2025]

Meanwhile, the latest iteration of the DHL Trade Atlas cited several reasons for optimism in the face of the U.S. policy shifts and uncertainty over future trade policies following U.S. President Donald Trump's re-election last year.

"Most countries continue to pursue trade as a key economic opportunity, and U.S. trade barriers could strengthen ties among other countries," the report said, adding that many of Trump’s tariff threats may end up different than originally proposed or delayed to prevent a spike in domestic inflation.

"Moreover, the U.S. share of world imports currently stands at 13%, and its share of exports is 9% – enough for U.S. policies to have substantial effects on other countries but not enough to unilaterally determine the future of global trade," it added.

Steven A. Altman, senior research scholar and director of the DHL Initiative on Globalization at NYU Stern's Center for the Future of Management, noted that while threats to the global trading system must be taken seriously, global trade has shown great resilience because of the large benefits that it delivers for economies and societies.

"While the U.S. could pull back from trade – at a significant cost – other countries are not likely to follow the U.S. down that path because smaller countries would suffer even more in a global retreat from trade," he said.

The report also pointed out evidence suggesting that the U.S.–China trade conflict "has not substantially cut U.S. reliance on Chinese goods," as it cited an update on geopolitically driven shifts in trade patterns.

The DHL Trade Atlas 2025 found that while trade between blocs of close allies of the U.S. and China declined in 2022 and 2023 relative to trade within these blocs, those declines were minor and did not continue in 2024.

"The U.S. and China have reduced their shares of trade with each other, but not enough to constitute a meaningful 'decoupling,'" the report said.

Direct U.S.–China trade has fallen from 3.5% of world trade in 2016 to 2.6% over the first nine months of 2024. However, the U.S. still brings in as high a share of its imports from China as the rest of the world does.

"There is [also] evidence suggesting that U.S. imports from China are underreported. Moreover, data that also considers Chinese inputs in goods the U.S. imports from other countries suggests no meaningful drop in U.S. reliance on goods made in China."

[Source: DHL Trade Atlas 2025]

DHL and NYU Stern School of Business published the new DHL Trade Growth Atlas, which maps the most important trends and prospects of global trade in goods. The report covers nearly 200 countries and territories that comprise over 99% of world trade, GDP, and population. The report commissioned by DHL was finalized in February 2025 using data and forecast updates through January 2025.

In 2022, the DHL Trade Growth Atlas found that global trade volumes stayed strong, bouncing back quickly following the COVID-19 pandemic and geopolitical and economic shocks.