Early last week, President Donald Trump rolled out 25% tariffs on all U.S. imports from Mexico and Canada only to issue a one-month reprieve for automotive goods covered by the USMCA (United States-Mexico-Canada Agreement) a day later and extend that suspension to all imports that fall under the USMCA by Thursday.

According to a recent Freightos analysis, around 50% of imports from Canada and 38% from Mexico are covered by the USMCA, encompassing automotive goods, food, and agricultural products, along with various appliances and electronics.

However, that leaves about US$1 billion worth of daily imports that fall outside the USMCA and do not face tariffs – and other goods that pay low-level tariffs – that are now subject to the 25% hike. This category includes items like phones, computers, and medical equipment.

"This latest tariff see-saw caused importers to pull forward cross-border shipments in February, leading to congestion at border crossings, with the implementation and then suspension also disrupting surface volume flows from both Mexico and Canada," commented Judah Levine, head of research at Freightos.

"This latest start and stop once again shows President Trump using tariffs and other threats as leverage for his desired trade or other policy goals: border security promises by Mexico and Canada led to the initial tariff pause in February. And though the stated goal of these measures is to stem the flow of fentanyl and illegal immigration, part of last week’s reprieve was reportedly due to auto manufacturer pledges to shift some manufacturing from Canada and Mexico to the US," he added.

The analysis noted that threats about China's presence along the Panama Canal led to the recent sale of Hutchinson Ports, and the USTR's proposed port call fee on Chinese-made vessels has already resulted in CMA CGM pledging to invest US$20 billion in the US, including some shipbuilding.

Rapidly approaching deadlines for new tariffs or trade barriers include March 24 for the USTR hearing that will inform a decision on the port call fees, April 1 when agencies will issue reports on the range of trade issues requested in the president's America First Trade Policy memo – including Trump's proposed 60% tariff on all Chinese goods and after which reciprocal tariffs are likely to follow – and now an April 2 deadline for 25% tariffs on USMCA goods.

But Levine noted that last week's rollout and suspension add to the "pervasive state of uncertainty" for logistics and supply chains and make planning and adjustments extremely difficult, with most shippers opting to wait and see before investing in significant changes to their supply chains.

"That being said, with the likelihood of some tariff increases for imports from China and other US trade partners still high, many US importers have been frontloading shipments to some extent since November, boosting ocean demand and freight rates," the Freightos head of research said.

[Source: Freightos]

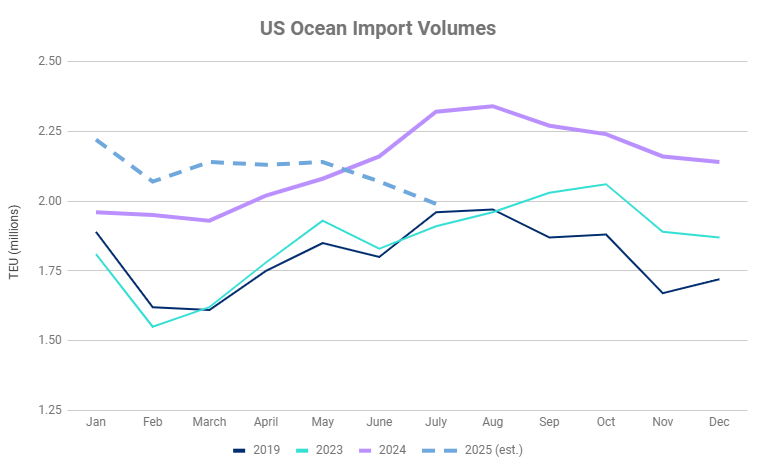

The report cited the latest National Retail Federation US ocean import report shows that volumes from November through February were about 12% higher than a year prior, suggesting a significant pull-forward ahead of expected tariffs.

Weaker demand likely at the start of the peak season

"Volumes that are projected to remain level and strong through May are expected to weaken in June and July, likewise implying weaker demand in what is normally the start of peak season due to the pull forward since late last year," Freightos analysis said.

Transpacific container rates have also continued to slide post-Lunar New Year. Prices to the West Coast were down to US$2,660/FEU and were at US$3,754/FEU to the East Coast last week.

Freightos said these rates are 40% lower than a year ago and at or just below the low for the 2024 seen post-LNY last year.

In addition to some post-LNY lull in demand, recent rate weakness, perhaps especially on the transpacific, may be due to the recent carrier alliance reshuffle, which is resulting in increased competition and less effective capacity management as carriers are still moving vessels into place for the newly launched services.

In air cargo, the Freightos analysis noted that on March 10, a one-day labor strike in Germany led to widespread flight cancellations.

More broadly, U.S. Customs and Border Protection has been charged with developing by April 1 a solution to handle the surge of formal entry parcels expected once the government suspends de minimis eligibility for Chinese imports.

The lack of this capability was the main reason de minimis for Chinese goods was quickly restored after being suspended by an executive order back in February, though many are skeptical a solution can be developed in such a short timeframe.

"Meanwhile, there are already signs that China-U.S. e-commerce air cargo volumes – largely dependent on de minimis – are easing and likely shifting to ocean logistics and domestic fulfillment," Levine said.

In addition to reports of canceled charter flights, he added that Freightos Air Index China - U.S. showed rates dipped to US$4.61/kg last week, 40% lower than at the start of the year, suggesting a gradual easing of demand on the lane. Asia - Europe prices are at about US$3.00/kg.