Air cargo markets from Asia Pacific and worldwide weakened further in the week to April 20 due to the effects of Easter holidays and uncertainty caused by US changes in tariffs and trade policies.

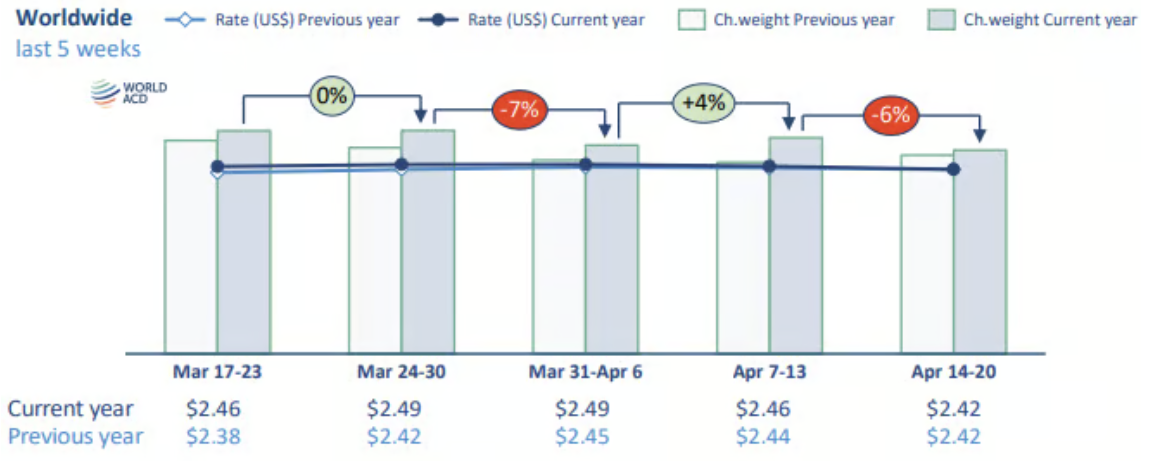

According to the latest weekly figures from WorldACD, air cargo tonnages and rates from Asia Pacific fell, week on week (WoW), by 4% and 3%, respectively, in week 16 (April 14-20), with worldwide chargeable weight dropping 6%, WoW.

That 6% WoW drop in demand is similar to the 5% decline in the equivalent Easter week last year, which took place in week 13.

In both cases, WorldACD said demand from each of the origin regions fell, WoW.

"The big difference from last year is the development of rates, which last year were on the rise, but this year prices fell, Wow, from all the origin regions in week 16, except for Central & South America," the air cargo market data provider said.

[Source: WorldACD]

[Source: WorldACD]

It said that average global prices, based on a full-market average of spot and contract rates, dropped by 2% to US$2.42 per kilo in week 16, including a 4% decline in spot rates to US$2.58, led by 6% WoW declines in spot prices from Asia Pacific, Europe and Africa origins.

Compared with last year, WorldACD said average global rates in week 16 were very similar to the same week the previous year, both in terms of spot rates and full-market average rates, with the one exception being prices from Middle East & South Asia origins — which are down by around 16% this year compared with their inflated levels this time last year.

Asia Pacific to the US declines

Meanwhile, despite reports of a surge in e-commerce sales ahead of the May 2 end of ‘de minimis’ customs duty exemptions for low-value US imports from China and Hong Kong, traffic from China and Hong Kong to the US fell for the fourth consecutive week, losing 7%, WoW.

WorldACD said compared with week 16 last year, China and Hong Kong to the US combined traffic is down by -16% – contrasting with a -3% drop for the Asia Pacific region as a whole to the US, driven by stronger exports from Vietnam (42%), Taiwan (30%), Thailand (24%) and Japan (12%).

There were also notable declines on the pricing side as well from Asia Pacific to the US – and particularly from China and Hong Kong, where combined average rates dropped by 5%, on a WoW basis, to US$4.72 per kilo, although that follows seven consecutive weeks of rate rises since Lunar New Year (LNY).

WorldACD said there were big WoW price drops from several other major Asia Pacific origins to the US, including from Vietnam (-28%), Singapore (-11%), Taiwan (-9%) and Thailand (-9%). However, those week 16 declines follow some strong rises the previous few weeks.

"For the Asia Pacific region as a whole to the US, overall average rates were down 8% in week 16, WoW, to US$4.93 per kilo," it said.

WorldACD said demand and pricing from Asia Pacific, and notably China and Hong Kong origins, to Europe have been more stable than to the US.

China to Europe tonnages edged down 2%, WoW, in week 16, while Hong Kong tonnages crept back upwards (1%) following two weeks of declines, although Japan to Europe traffic fell for a third consecutive week – as did Asia Pacific to Europe tonnages as a whole, dropping by a further -4% in week 16.

On pricing side, it said that average overall Asia Pacific to Europe spot rates have hovered close to US$4 per kilo for the past 10 weeks, dipping by 2% in week 16 to US$4.06 per kilo – which is around -10% below their level in January prior to LNY.

China to Europe spot rates were stable in week 16 at US$4.23 per kilo, with Hong Kong to Europe and Japan to Europe rates losing -3%, Wow, to US$4.77 and US$4.43, respectively.

Capacity still up on last year

Worldwide air cargo capacity remains up compared to last year, as it has since week 7. However, the gap with the previous year has narrowed to 3% in weeks 15 and 16 combined.

WorldACD said compared with the previous week, capacity was down slightly (1.2%) in week 16.

"With the withdrawal of the de minimis exemption for low-value imports to the US from China set for 2 May, there may be a late flurry of e-commerce traffic in the final days of April. But after that, there may be some diversion of freighter capacity onto other markets," WorldACD said.