Cathay maintained its year-on-year cargo growth in April despite ongoing U.S.-China trade tensions, though the pace slowed compared to March.

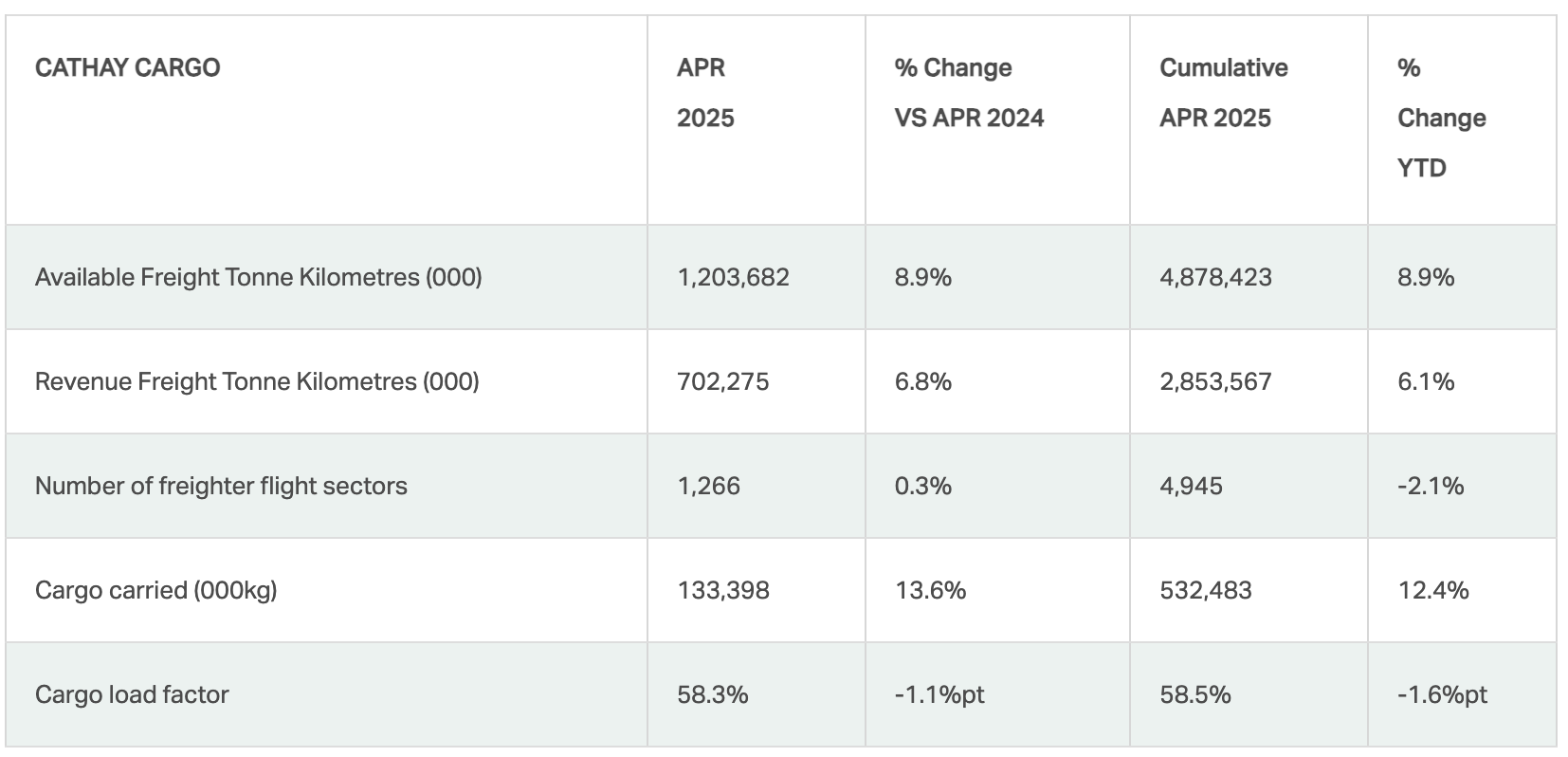

The cargo arm of Hong Kong flag carrier Cathay Pacific said it carried 133,398 tonnes, up 13.6% compared to the same period in 2024.

Last month's cargo volume declined from the 148,807 tonnes recorded in March, reflecting a month-on-month slowdown.

"Tonnage in April was 10.4% lower than in March, primarily due to the traditional first quarter-end peak in March and the various holiday periods in April. However, our specialist solutions maintained their growth momentum and we saw increased demand for our Cathay Priority solution on the Asia Pacific-United States trade lane ahead of the implementation of trade tariffs," Lavinia Lau, chief customer and commercial officer at Cathay, said.

"Demand for our Cathay Expert solution continued to grow, supported by robust exports of semiconductor machinery from North Asia as well as ad hoc demand out of Europe to Hong Kong," she added.

Photo courtesy of Cathay Pacific

According to traffic figures released by the airline group for April, Available Freight Tonne Kilometres (AFTKs) increased by 8.9% while load factor decreased by 1.1 percentage points year on year.

In the first four months of 2025, the total tonnage increased by 12.4% compared to the same January to April period in 2024.

Cathay noted that while Transpacific volumes have slowed due to tariff-related challenges, the airline has stabilized cargo flow by sourcing shipments from other regions, including Southeast Asia.

"Turning to May, we have seen steady replacement cargo from other parts of our network including Southeast Asia during the first half of the month amidst reduced demand from Hong Kong and the Chinese Mainland," Lau said.

"We will continue to closely monitor the ongoing developments in the second half."

Meanwhile, Cathay welcomed the recent 90-day tariff pause between the U.S. and China, noting it provides short-term stability amid ongoing trade uncertainty.

"On the cargo front, the latest announcements regarding the tariffs between China and the United States provide some reassurance to the market in the near term," Lau said. "We will continue to closely monitor the market conditions and leverage our built-in flexibility to adjust freighter capacity."

The US and China recently agreed to a 90-day pause on reciprocal tariffs, marking a temporary de-escalation in their ongoing trade tensions.

As part of the agreement, the U.S. significantly reduced its "de minimis" tariff on low-value Chinese shipments from 120% to 54%, while maintaining a flat fee of US$100 per package.

Previously, the "de minimis" exemption allowed goods valued under US$800 to enter the U.S. duty-free, but recent tariff hikes disrupted e-commerce models, particularly for companies like Shein and Temu. The tariff pause aims to stabilize trade relations, though uncertainty remains about long-term policy shifts once the 90-day period ends.