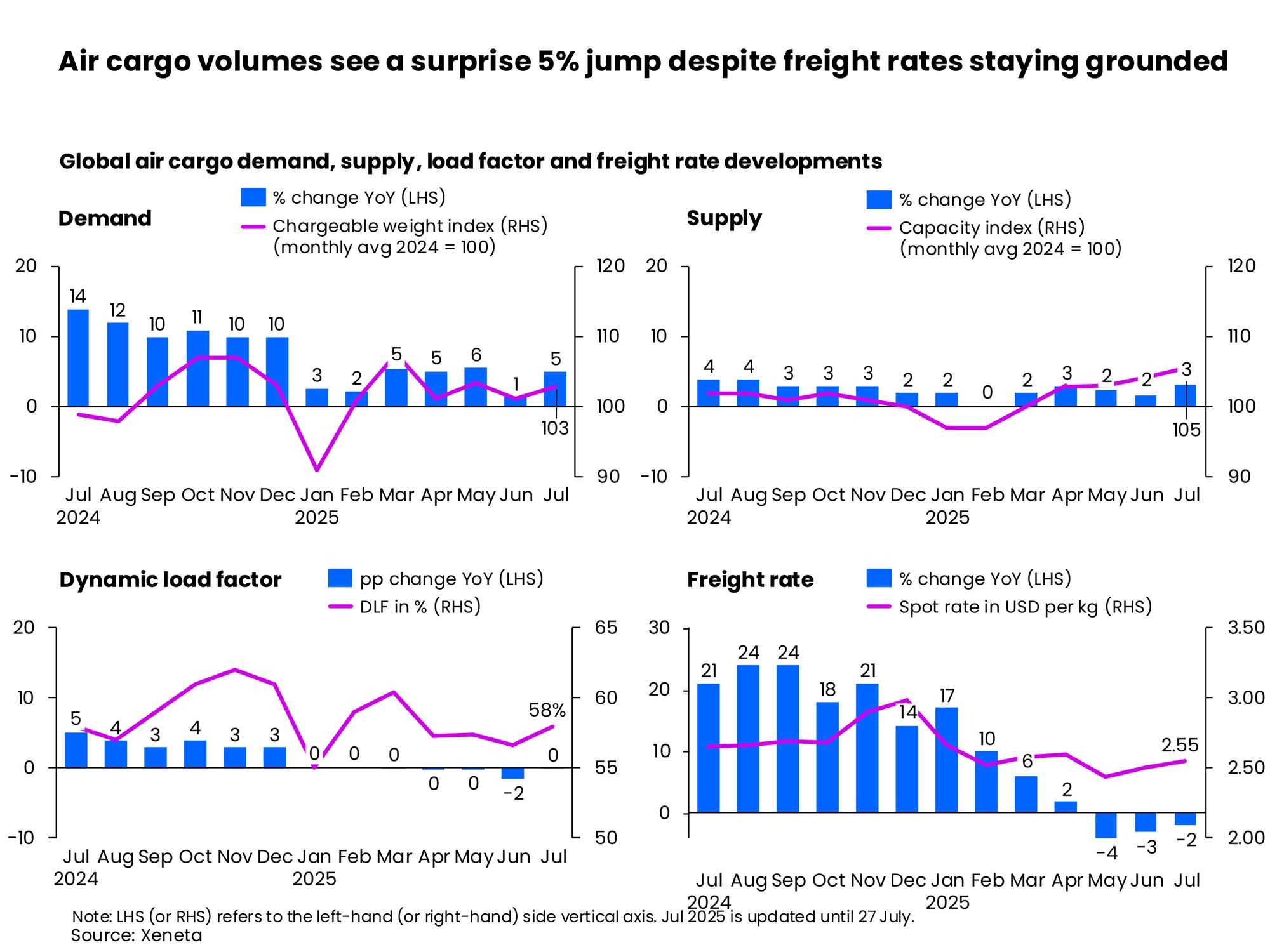

Global air cargo volumes jumped 5% year-on-year in July as more shippers opted for the speed of airfreight to help circumvent U.S. tariffs, according to the latest market analysis by Xeneta.

Market sentiment, however, remains subdued as tariff talks in Washington remain in flux, with a new deadline now set for August 7 for a broad range of trading partners.

The real-time ocean and air freight rate benchmarking and market analytics platform noted that the "lack of clarity" also continues to cast a shadow over global trade flows, particularly in the airfreight sector.

"Contrary to the usual seasonal lull, July saw a notable upturn in global air cargo demand following a modest 1% gain in June," the report said.

"This unexpected boost, bucking seasonal patterns, appears driven in part by tariff-related frontloading, mode shift, and persistent uncertainty, prompting businesses to expedite shipments."

Xeneta noted that with cargo capacity in July increasing by a lower level of 3% year-on-year, the more robust 5% rise in volume helped lift the dynamic load factor, which has now returned to levels comparable with a year earlier (58%) and recovering the 2% point decline recorded just a month ago.

Dynamic load factor is Xeneta's measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

"As we said earlier in the year, air cargo is piggybacking on the chaos being caused by tariffs. While the growth in July will come as a pleasant surprise to many, this growth is not a consequence of increased trade. It is a sign of the creative ways companies are trying to circumvent the higher costs of tariffs," said Niall van de Wouw, chief airfreight officer at Xeneta.

Speed is vital to circumvent tariffs

"What we are seeing currently is a mode shift, and that is helping the airfreight market in the short term. If you're trying to circumvent tariffs, you're going to want to do it fast, and a plane is faster than a ship," he added.

"Having goods in an ocean container for 30 days will feel like a very long time for a lot of businesses right now," van de Wouw added. "Businesses are getting creative to try to avoid or lessen the impact of tariffs. It's a game of 'cat a mouse' between the US administration and companies."

Spot rates decline for a third month

Meanwhile, Xeneta said despite firmer fundamentals, global air cargo spot rates declined for a third straight month in July, falling 2% year-on-year to US$2.55 per kg.

Yet, it pointed out that the rate of decline has eased, due to a resurfacing demand-supply imbalance.

Xeneta said a modest 2% month-on-month uptick in July offered a glimmer of relief to airlines, although the mid-term trajectory remains muted.

The gap between seasonal rates—valid for over a month—and spot rates—valid for up to a month—has widened from 5 cents below spot in late May to more than 20 cents below by late July, signaling weaker mid-term market confidence.

"Further complications loom," Xeneta said, noting that the US is preparing to end the de minimis exemption for all countries by the end of August, a policy shift that could reshape small-parcel air trade.

Since May 2, the exemption has already been removed for shipments from mainland China and Hong Kong, which collectively account for an estimated two-thirds of all de minimis parcels entering the US, according to US Customs and Border Protection — resulting in a reported 50% drop in China's low-value and e-commerce exports to the US in June.

"The broader rollback will primarily affect Canada, the UK, and Mexico – countries that together make up most of the remaining one-third of affected volume," Xeneta said.

"Potential disruptions to US postal services, governed by international treaties, could add yet another layer of complexity, as reciprocal measures from foreign postal authorities remain a distinct possibility."

While the lack of detail around tariffs is 'creating a tremendous lot of headaches for people', van de Wouw said that it is, once again, pushing up airfreight volumes.

"Circumventing is about responding quicker, anticipating something else, and being prepared to pay a little bit more for airfreight transportation because it is still better than paying a much higher tariff on goods," he said.

Chaos to benefit airfreight

"When there is a mess and chaos in international trade, it is to the benefit of airfreight, as we have seen before. And, right now, we have it on an unprecedented global scale," van de Wouw said.

"Yes, tariffs are only to and from the U.S, but the lack of clarity is affecting a lot more trade lanes as companies try to reduce their financial risk."

This continuing uncertainty, he said, is "one of the few things that might protect air cargo demand in the coming months" because hardly anything has been finalised related to tariffs.

"Businesses are seeing the news headlines and intentions, but not the details and commitments."

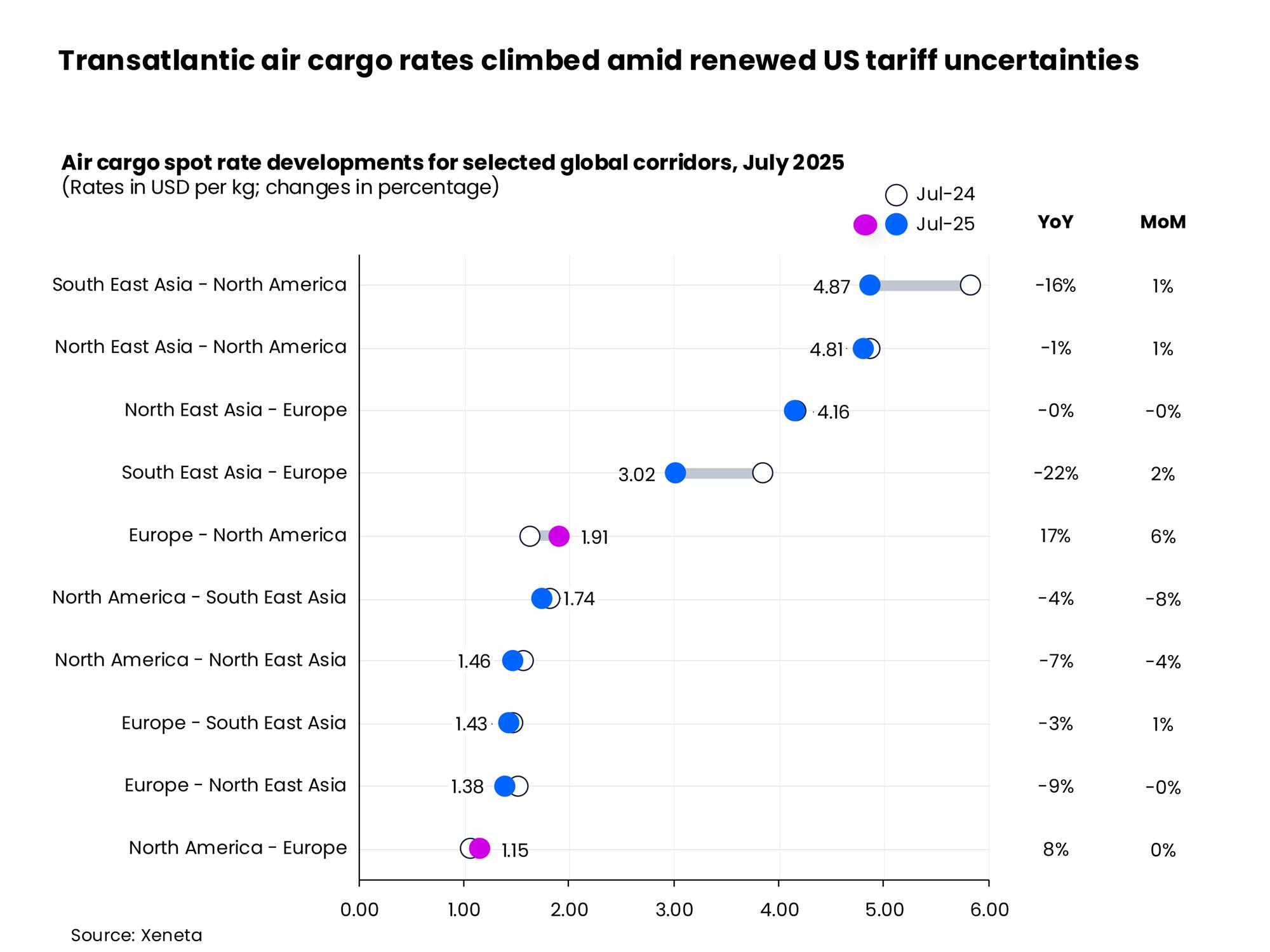

Airfreight rates along the transpacific corridor weakened markedly in July. Spot rates from Southeast Asia to North America fell by 16% year-on-year to US$ 4.87 per kg, as earlier capacity constraints eased.

Xeneta noted that in contrast, rates from Northeast Asia to North America remained relatively flat at US$4.81 per kg, buoyed by robust demand out of Taiwan. Mainland China, however, told a different story. Spot rates to the US declined by 11% to US$4.26 per kg, weighed down by both the de minimis ban, heightened tariffs, and market uncertainty.

Surge in China-Europe e-commerce volumes

On Asia-Europe routes, the report said spot rates from Northeast Asia to Europe held steady at US$4.16 per kg.

Yet beneath that calm surface lies a reshuffling of capacity: a notable shift of freighter capacity from the Pacific to Europe helped absorb a near 90% surge in cross-border e-commerce volumes from China to Europe, Xeneta said. "That reallocation has so far kept rates aloft."

By contrast, the analysis noted that Southeast Asia to Europe fared less well, with spot rates tumbling 22% year-on-year to US$3.02 per kg.

"While this state of flux exists, air cargo allows shippers to respond quicker, and 'that's what they're playing with," van de Wouw said of shipper's preference for air transport amid current trade uncertainty.

"My best assessment is that the confusion is encouraging more companies to use airfreight than would like to, but air cargo is proving its value once again."

However, he said that "the piggybacking will stop" — adding that all the positivity created by double-digit air cargo growth in 2024 "now feels like a very long time ago."

"There are still so many unanswered questions. How long will this uncertainty last? What will trade volumes look like in a few months? What happens when U.S. consumers start to feel higher tariffs impacting the cost of goods?"

"Economists agree this climate is not good for anyone and, sooner or later, something must give, and demand will fall. How long it will be before reality kicks in is hard to assess because this is one massive political dance. In the meantime, air cargo stands to benefit," van de Wouw added.