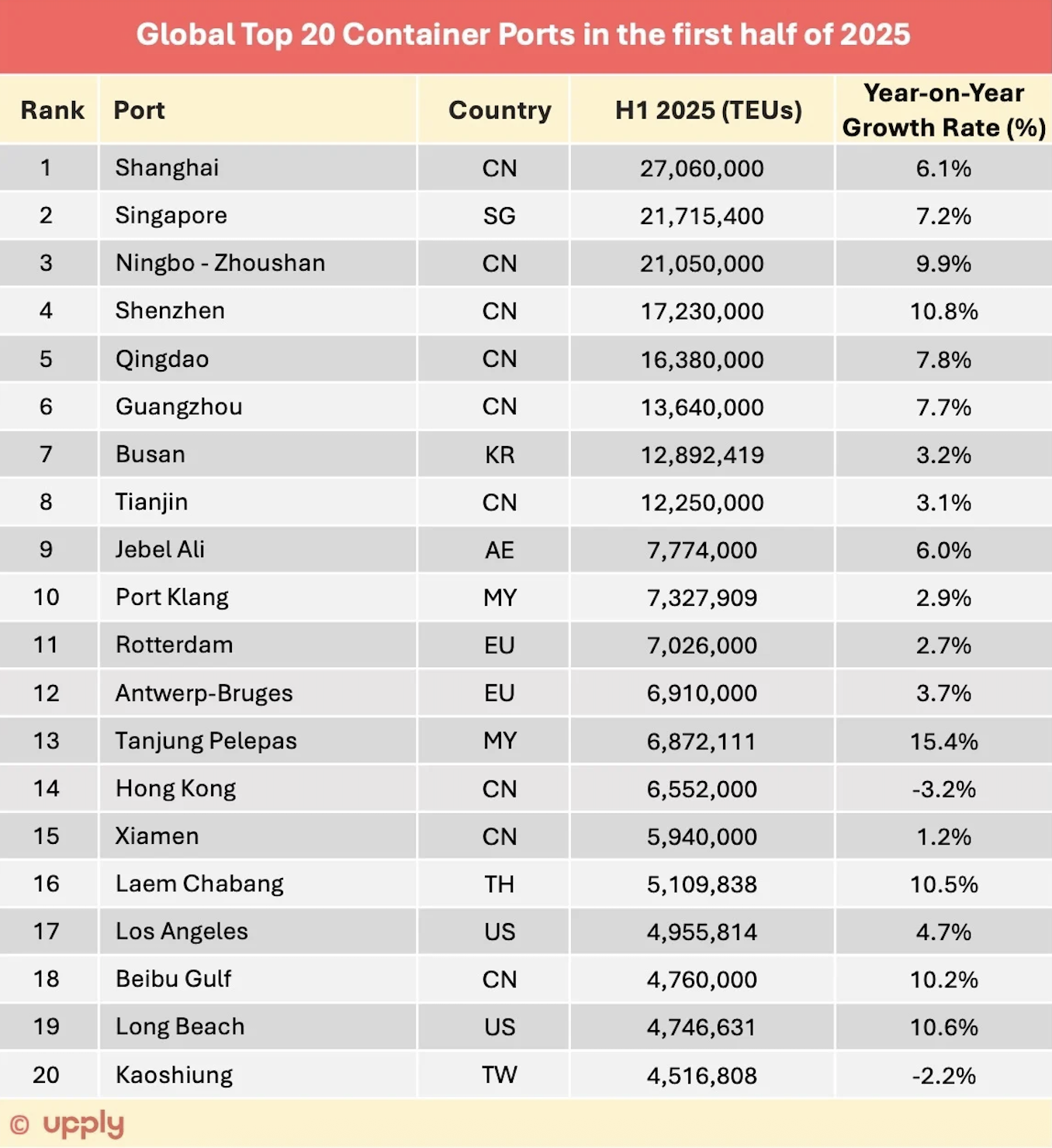

Almost all major global ports recorded growth in container traffic in the first half of the year as frontloading, in anticipation of higher US tariffs, offset sluggish demand.

A new analysis by market intelligence platform, Upply found that Chinese ports retain six of the top 10 positions in the global ranking, with Shenzhen boasting the highest growth rate among the nine Chinese ports in the Top 20.

At the bottom of the ranking, Beibu Gulf continues to gain ground, moving from 20th place in the first half of 2024 to 18th place in H1 2025.

Tanjung Pelepas, meanwhile, has the strongest increase in the Top 20. The Malaysian port has benefited from the reorganisation of maritime alliances, with Gemini making it one of the main hubs of its new system.

"In the first half of 2025, almost all the ports in the world's Top 20 (excluding Tanger Med, which has not published half-yearly data) recorded growth in activity. Only Hong Kong and Kaoshiung suffered a year-on-year decline," the Paris-based freight market intelligence platform that provides data, pricing benchmarks, and analysis for global road, air, and ocean transport, added.

The two European representatives in the Top 20, Rotterdam and Antwerp-Bruges, are side by side in 11th and 12th place, with Antwerp gaining one place thanks to the decline of Hong Kong.

Meanwhile, the American ports of Los Angeles and Long Beach experienced very significant growth, clearly benefiting from a rebound in traffic linked to frontloading in anticipation of additional tariffs.

Upply said in its analysis that the combined traffic of these two ports is 9.7 million TEUs, which ranks it as the United States' leading port and takes the 9th place in the world.

"Nearly all U.S. ports experienced growth in the first half of 2025, even though the reference period, that of the first half of 2024, was already experiencing strong growth. Los Angeles/Long Beach, the leading gateway to the United States, strengthened its position with cumulative growth of 14.7%," it said.

The first-half growth obviously owes much to the frontloading of orders, before the imposition of additional, sometimes crushing, tariffs: the three main ports in the United States — Los Angeles, Long Beach, New York and New Jersey — recorded growth in results during the first four months of the year, before a sharp decline in May when tariffs imposed on Chinese imports briefly rose to 145%. Growth then resumed thanks to the truce, still in anticipation of a scenario that could turn dark.

For Chinese ports, Upply said they benefited from demand for frontloading of orders in the United States. Most of them are recording rather dynamic growth, which has also been fueled by the development of flows with other parts of the world.

Beibu Gulf, which includes three ports located in coastal cities in the Guangxi Zhuang region, continues on a very positive trajectory since it is the only one, along with Shenzhen, to exceed 10% growth.

"This increase is fueled by the increase in trade between China and Southeast Asia, which increased by 13.5% in value between January and July 2025," the report said.