Asia‑Pacific carriers continued to expand cargo volumes in October, with demand supported by supply chain realignments, robust e‑commerce and restocking ahead of holiday sales events, though growth moderated from earlier months.

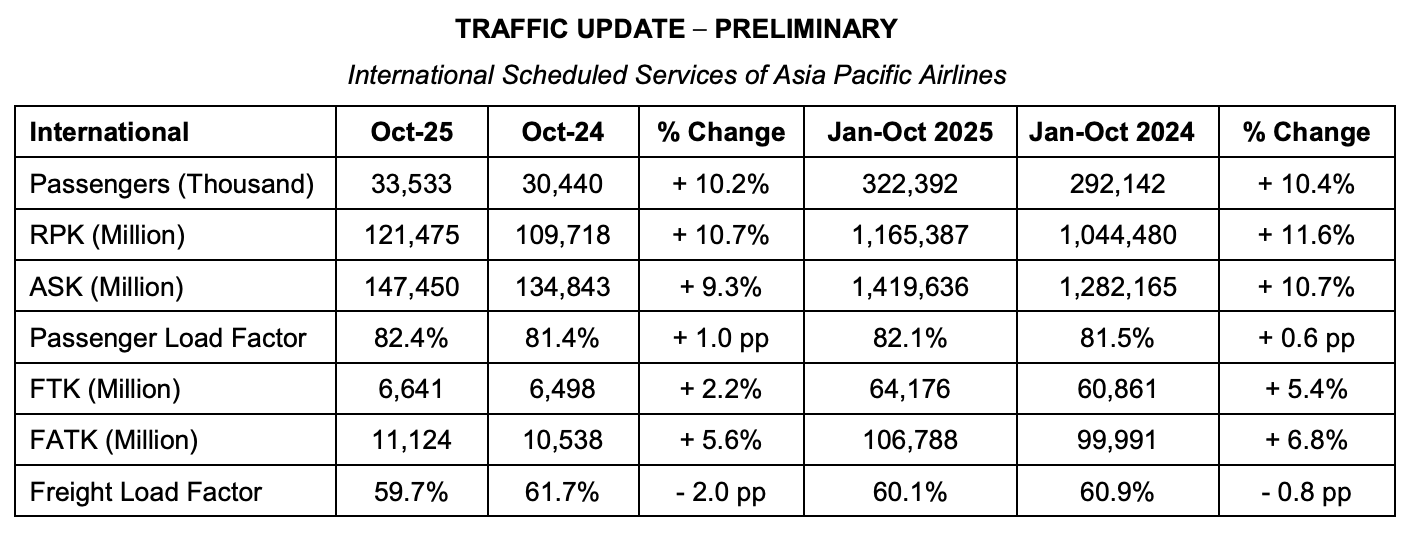

Traffic figures released by the Kuala Lumpur-based Association of Asia Pacific Airlines (AAPA) showed that international air cargo demand — measured in freight tonne-kilometers (FTK) — was up 2.2% compared with the same month last year.

October's 6.64 million metric tonnes was also higher than September's 6.4 million metric tonnes and the 6.5 million metric tonnes transported in August.

It was nonetheless lower than July's 6.8 million tonnes and was at the same pace with the 6.6 million tonnes carried by Asia Pacific airlines in June. In May, carriers transported 6.42 million tonnes, and in April, they moved 6.24 million tonnes of cargo.

"International air cargo markets delivered another month of resilient growth, with Asia Pacific carriers reporting a 2.2% year-on-year increase in international air cargo demand, as measured in freight tonne kilometres (FTK)," AAPA said.

"Shifting supply chains together with robust e-commerce volumes supported demand," it added.

(Source: AAPA)

For October, offered freight capacity expanded by 5.6% year-on-year, mainly on the back of increased belly-hold space, resulting in a 2.0 percentage point decline in the average freight load factor to 59.7%.

Subhas Menon, director general of AAPA, said "Asia Pacific airlines began the final quarter on stable ground, supported by continued expansion in the services sectors, while Asia’s export activity remained resilient as businesses diversified supply sources in response to trade tariffs."

Overall, cargo demand rose by 5.4% for the year to October, helped by the restocking of inventory ahead of major on-line sales events.

Looking ahead, Menon of AAPA said broad-based growth in the global economy should underpin continued growth in both passenger and cargo markets in the coming months.

"However, this outlook is moderated by ongoing geopolitical and trade risks, despite relatively stable business confidence," he added.

"In an increasingly competitive economic environment, Asian carriers remain committed to strengthening financial performance through improved efficiency, without compromising safety excellence or customer care standards," Menon further said.