WorldACD reported that global air cargo volumes increased by 8.2% compared to June, but is still lower by 18.5% compared to levels seen during a comparable period in 2019.

Air cargo rates, however, increased 62% year-on-year to US$2.83 per kg in July but also decreased 9% compared to June.

Lack of capacity

In a statement, WorldACD said combined airline cargo revenues decreased slightly, the first decline since the start of 2020.

"So, are things getting a bit more normal? One of the other pointers to find the answer is to be found in capacity data. There is such a lack of capacity in the market that ‘normality’ still seems a long way off," it said.

Pointing at the gap between the huge capacity drop, and the much smaller drop in cargo transported, WorldACD said: "the overall gap still hints at a worldwide market trying to find a new footing: ‘normality’ will not seem what it used to be."

Regional performance

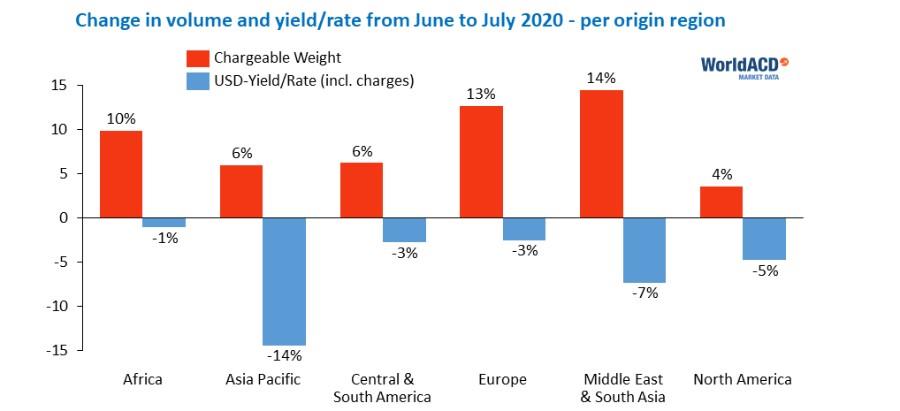

WorldACD said the origins Europe and MESA (Middle East & South Adia) added most kilograms to their June figures, whereby Europe managed to keep its prices reasonably stable.

Asia Pacific was the region performing least in month-on-month percentual changes: a 6% volume growth was accompanied by a 14.4% drop in USD prices per kg.

"Business from China has captivated the air cargo world more than ever since the start of the COVID-19 crisis. Coupled with a lack of capacity, this business has indeed attracted very high prices," WorldACD said.

"Yet, the sky-high prices posted on the internet as so-called evidence of what happens in the China market, are often based on limited numbers of shipments (sometimes even ‘one-offs’), and therefore at best 'anecdotal evidence'," it added.

WorldACD said prices (in USD/kg) from the Asia Pacific as a whole fell by 41%, from 5.71 to 3.38; prices ex-China dropped by 53%, from 7.80 to 3.63; and prices ex North-East Asia lost 32%, falling from 4.66 to 3.19.

Meanwhile, prices from South Asia fell by only 13%, and now stand at 3.84 USD/kg, at the highest region-to-worldwide level.

It noted that most of the pricing frenzy of the past months bypassed the Americas and Africa, where monthly deviations were much more measured than in other parts of the world.

WorldACD said revenues from air cargo in USD rose month-on-month by 10% for business originating in Europe, by 9% from Africa, by 6% from MESA, by 3% from Central & South America, but it fell by 1% from North America and by 9% from the Asia Pacific region.

Near-shoring

"In times of supply chain disruptions, as experienced strongly this year, there is always talk about the need to shorten the chains in order to become less dependent on events that business cannot influence. Whilst plans may be made, our figures for the year so far do not show any trend toward near-shoring yet," WorldACD said.

"Lastly, taking a first preliminary view of the month of August, the first full week of the month showed a 0.3% volume drop week-over-week and a 2% drop in worldwide prices. Having said that, prices ex-China seem to go up again, whilst prices from South Asia dropped," it added.