Widespread congestion at ports and inland facilities has led to increased opportunity for thieves according to a new report from insurer, TT Club, noting that global cargo theft trends have shifted in emphasis from the risk of in-transit, vehicle-based attacks to losses while cargo is at rest.

The transport and logistics insurer said with this, storage locations are critical at-risk areas.

"Globally cargo thefts from or of vehicles in transit declined as incidents at storage facilities rose to nearly 30%," TT Club said, adding that in North America prevalence of port congestion and railhead delays is seen as a crucial factor for the rise in theft incidents.

It added that idle times in European locations also augmented theft and stowaway risk.

TT Club added that strict Covid-19 protocols at Asian ports, particularly in China created delays and backlogs leading to theft opportunities. The insurer also cited "increased influence of insider infiltration" into operator organizations such as haulage companies and warehousing facilities.

The annual report for 2021 has been compiled by TT Club and global provider of supply chain intelligence, BSI.

"Constant vigilance is required in order to combat the growing risk divergence in theft trends," said Mike Yarwood, managing director, Loss Prevention at TT Club. "Criminals are quick to adapt to prevailing conditions and have swiftly responded to the increased opportunities that supply chain congestion presents through the amount of cargo laying idle."

Yarwood added that the transport industry's growing reliance on technology and a rapidly changing market for sourcing materials and components have opened up new avenues for criminals to take advantage of companies' increased vulnerabilities.

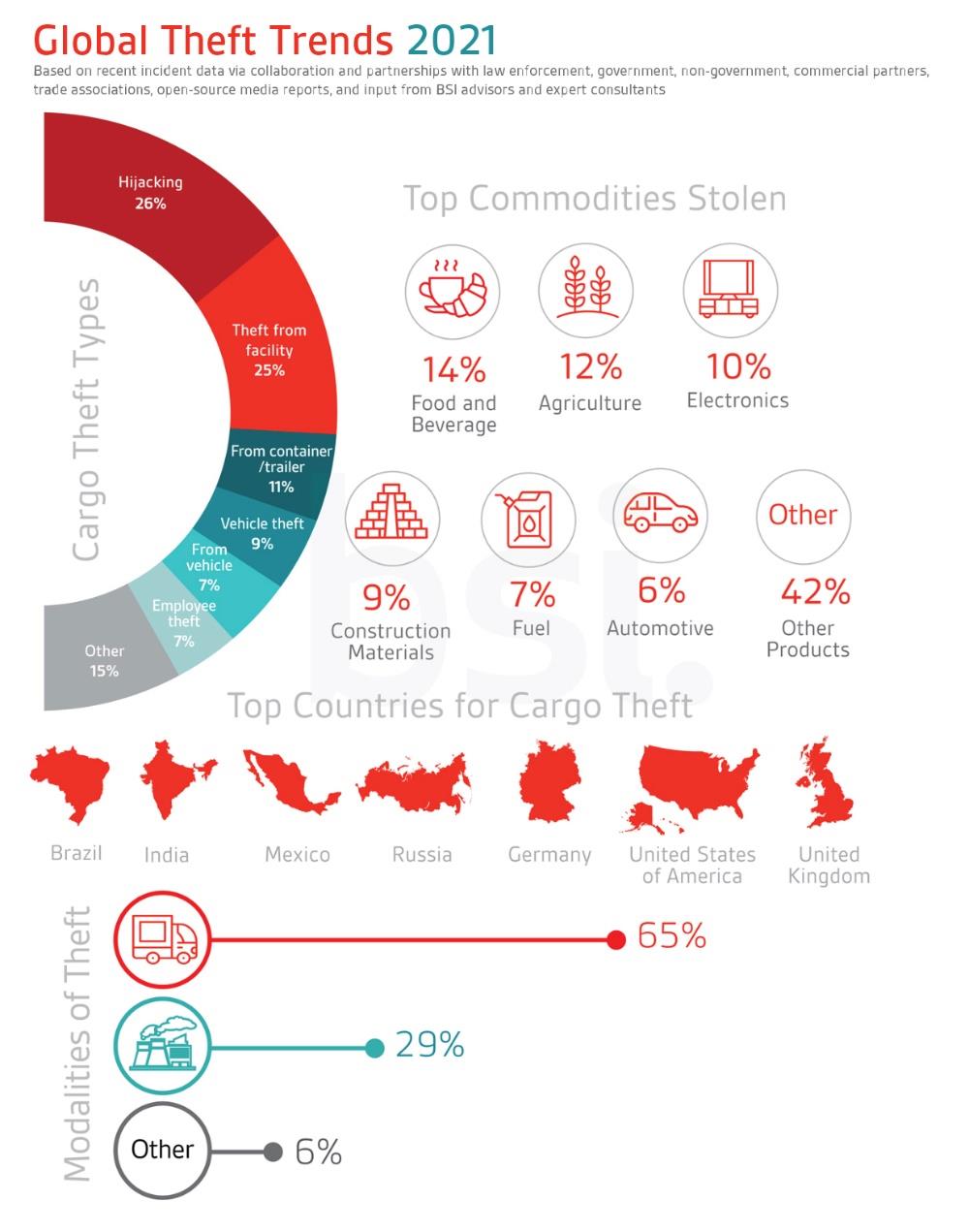

"As the graphic above illustrates the products most frequently involved in global cargo thefts overall last year, included agricultural produce (12%), food and beverage (14%), construction materials (9%), electronics (10%)," the report said.

It added that significantly, many of the materials used to produce the latter two, such as nitrogen, iron ore, lumber, steel, and semiconductors, have all experienced sharp price increases since the outbreak of the global pandemic due to shortages with a consequent increase in the value of the manufactured products.

Increased cargo theft in EMEA

Thorsten Neumann, president & CEO, of TAPA EMEA, noted of increasing cargo theft incidents in the EMEA region.

"What we are seeing in EMEA is a heightened level of risk to virtually all types of goods moving in supply chains across our region. This comes from increasingly active and sophisticated organised crime groups which often regard supply chains as an easy and lucrative target," Neumann said. "Sadly, too many companies wait to seek solutions until they become a victim of a cargo crime but, by then, they will have suffered a significant financial and reputational loss."

He noted that the way forward is to recognise the risks which exist and to learn about the industry standards, training, and intelligence solutions that are available today and which are already key to the supply chain resilience of leading manufacturers and freight transport and logistic providers.

"All is not lost, but it is a time for action to manage these risks and prevent rising product losses," the TAPA EMEA chief added.