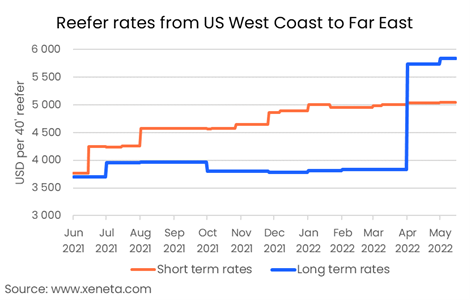

Long-term rates for reefer containers from the US West Coast to the Far East are at their "highest ever level" according to a recent report from Xeneta.

The ocean and air freight rate benchmarking and market intelligence platform said the average rate for all valid contracts stands at US$5,850 per 40' reefer on May 15.

Long term rates rose nearly by US$2,000 in April, as last year's long term contracts ran out and were replaced by higher rates on long term contracts covering the next twelve months, it added.

Xeneta said the vast majority of long term contracts on this trade last 12 months, the majority of which run from the start of April to the end of the following March.

It added that the average rate for 12-month contracts running from Q2 2022 to the end of Q1 2023 is US$5,945 per 40' reefer, up by almost 60% from the 12-month contracts which ended on March 31 last year.

"In contrast to what we have seen on many of the major dry trades, signing a 12-month contract on this reefer trade doesn't offer a discount compared to a 3-month contract," Peter Sand, chief analyst, Xeneta said, noting that of the contracts starting in April this year, the average rate for contracts with a 3-month validity is more than US$2,000 per container, cheaper than the average rate for contracts lasting 12 months.

"The long-term rates being signed are considerably higher than current rates on the spot market, which have, in fact, never been as high as long-term rates are currently," Sand added.

Xeneta noted in the report that on May 14, the spot rate for a reefer container from the US West Coast to the Far East was US$5,050, flat since the start of the year and almost US$900 lower than the average rate for long term contracts from the past three months.

High rates for long-term contracts

However, the market intelligence platform noted that as the spot market develops, most shippers on the long term market will be paying these high rates until it comes to looking at contracts starting in Q2 2023.

"The higher rates come despite a very poor start to the year in terms of export volumes," Xeneta said.

In the first quarter of 2022, the number of reefer containers exported from the US West Coast to the Far East was down 37%.

On the long-term market, Xeneta said rates for reefers are US$4,300 more expensive than dry containers, while on the spot market, the premium stands at US$3,850 on May 14.

Xeneta noted that a year ago, the difference between dry and reefer containers was US$2,500 on both the long and short-term markets.