Frankfurt Airport (FRA) saw cargo volumes decline anew in February as global economic uncertainty and persisting geopolitical tensions continued to weigh on its operations.

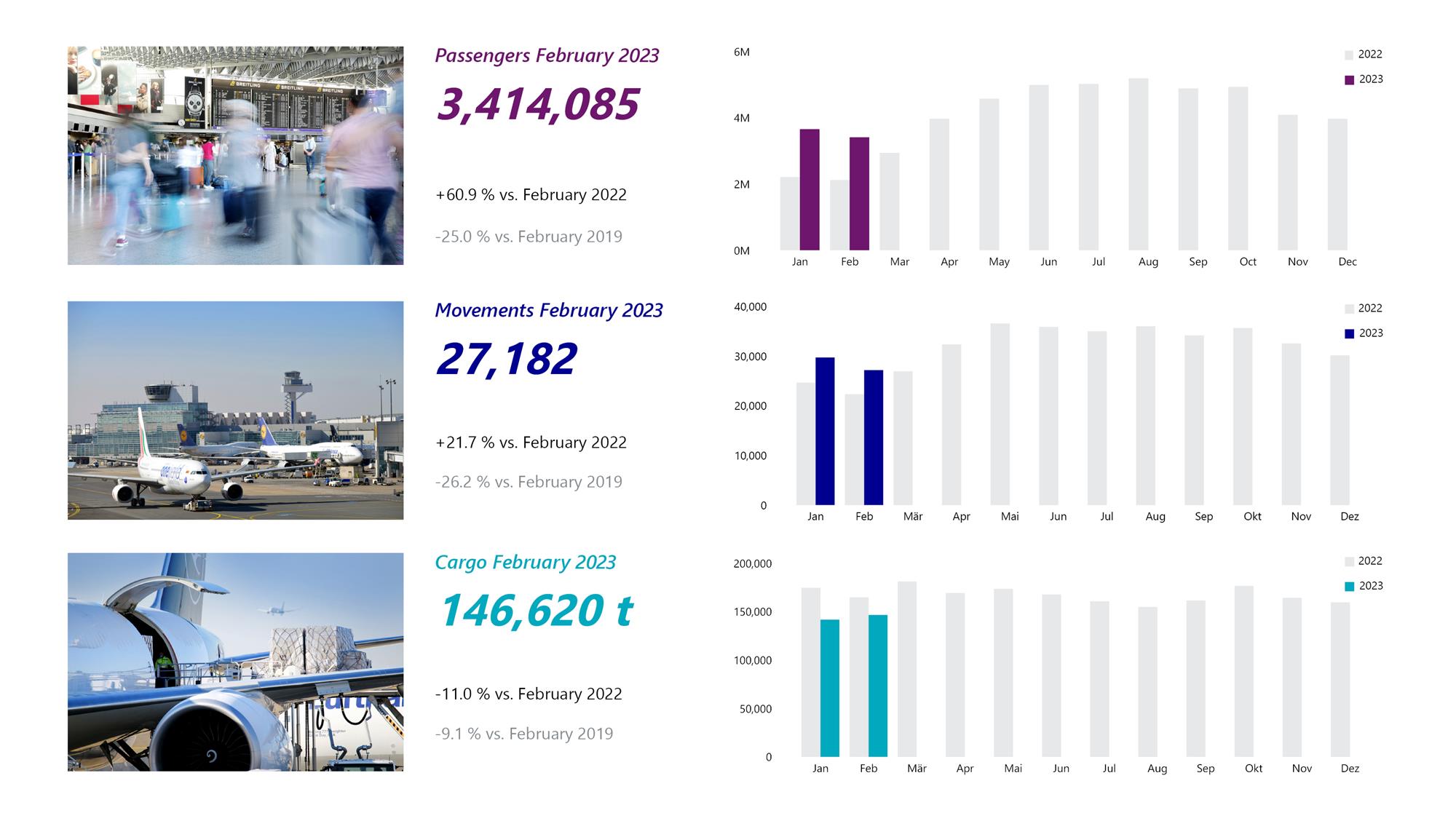

Europe's busiest cargo airport said cargo traffic — comprising airfreight and airmail — continued to decrease by 11.0% year-on-year in February 2023.

This followed a decline of 18.8% year-on-year in January which FRA attributed to the overall economic slowdown caused by the pandemic and the suspension of flights to Russia.

For the full year 2022, cargo volumes at the airport also dropped 13.3% to two million metric tonnes compared to 2021. This is also 5.6% lower than the pre-Covid level seen in 2019.

"As in the previous months, the decline was attributable to the overall economic slowdown and the discontinued air traffic to/from Russia," FRA said of the slowdown in cargo traffic for February.

Nonetheless, it added that FRA's aircraft movements climbed by 21.7% year-on-year to 27,182 takeoffs and landings in the reporting month as more passenger flights were operated.

Accumulated maximum takeoff weights (MTOWs) grew by 18.0% year-on-year to about 1.7 million metric tons.

Source: Fraport

Frankfurt Airport seeks to maintain stable operations

Meanwhile, in a separate release, FRA — which operates Frankfurt Airport — said its main goal this year is to maintain stable operations amid ongoing geopolitical tensions, further compounded by current labour market pains in Germany.

Dr Stefan Schulte, Fraport's CEO, made the comment as the Group reported its performance for 2022, confirming preliminary data released in January, which saw cargo throughput at about 2.0 million metric tons in 2022 or 13.3% lower than the previous year's record.

"Main factors contributing to this decline included the discontinuation of air traffic with Russia in line with EU measures related to the war in Ukraine and the zero-Covid strategy pursued by China for almost the entire year, as well as the overall economic slowdown," Schulte said.

Despite this difficult market environment, the FRA chief executive said Frankfurt Airport was still able to outperform its European competitors, defending its position as the continent’s number-one freight hub.

"Our primary goal is to maintain stable operations and enhance our resilience in responding to irregular situations," Schulte added. "This remains a challenging task in view of the structural factors we are facing, such as the geopolitically-related airspace restrictions and the current constraints on the German labour market."

FRA also gave an update on the hub's ongoing decarbonization program as the gateway further intensifies its climate measures.

"Having successfully progressed with decarbonization in 2022, we are now aiming to reduce CO2 emissions in Frankfurt to 50,000 metric tons by 2030," Schulte said.

"This corresponds to a reduction of 78% compared to the 1990 reference year. Our goal is to become carbon-free across the Group by 2045," he added.

Sustainability initiatives

Fraport is accelerating climate action at Frankfurt Airport.

By 2030, the aim is for a maximum of just 50,000 metric tons of CO2 to be emitted in areas that fall under Fraport’s direct control in Frankfurt.

Previously, Fraport had its sights on an interim target that would have reduced carbon emissions at FRA to 75,000 metric tons by 2030.

In the fiscal year 2022, Fraport AG lowered its CO2 emissions in Frankfurt by 3.9% year-on-year to 113,199 metric tons. Despite rising energy demand, the airport operator noted that it had already achieved a 50% reduction compared to the 1990 base year.

For 2023, Fraport projects Group EBITDA to reach between approximately €1,040 million and €1,200 million.

The Group result (net profit) is forecast to be in a range of between around €300 million and €420 million.

It added that the net debt-to-EBITDA ratio for 2023 is expected to maintain the level of 2022 because of ongoing investments made for expansion measures.