The International Air Transport Association (IATA) released data for February 2023 on global air cargo markets showing that air freight demand rose above pre-pandemic levels.

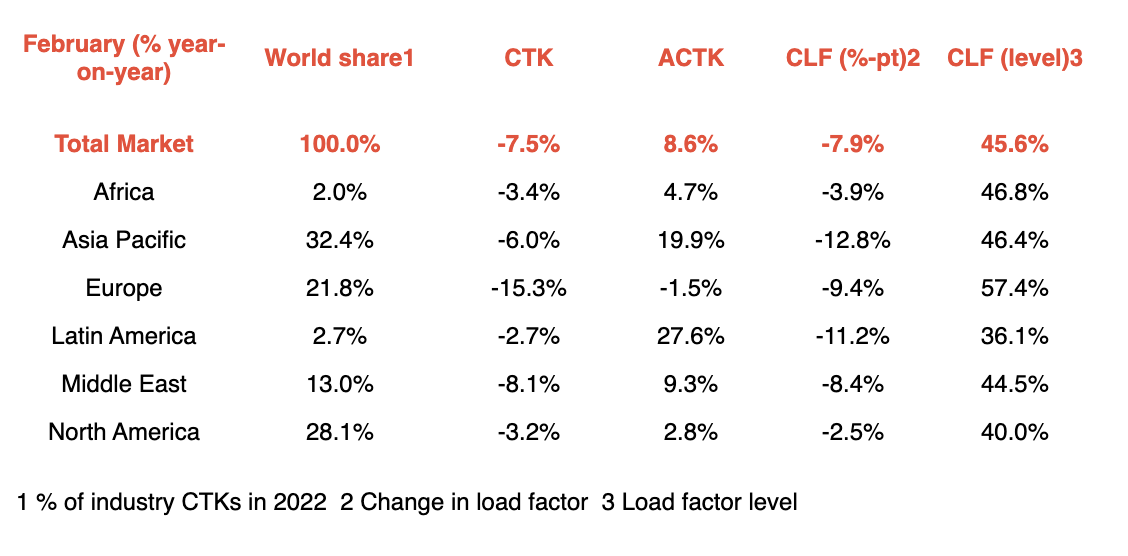

Global demand, measured in cargo tonne-kilometres (CTKs), fell 7.5% compared to February 2022 and was down 8.3% for international operations.

IATA noted that this was half the rate of annual decline seen in the previous two months (-14.9% and -15.3%, respectively). In January, CTKs declined 14.9% year-on-year.

Demand up 2.9% YoY

"February demand for air cargo was 2.9% higher than pre-pandemic levels (February 2019), the first time it has surpassed pre-pandemic levels in eight months," IATA said in a statement.

The trade association of the world's airlines noted that capacity — measured in available cargo tonne-kilometres (ACTK) — was up 8.6% compared to February 2022.

"The strong uptick in ACTKs reflects the addition of belly capacity as the passenger side of the business continues to recover," it said, noting that international belly capacity grew by 57.0% in February year-over-year, reaching 75.1% of the 2019 (pre-pandemic) capacity.

IATA said several factors in the operating environment should be noted for February, including the global new export orders component of the manufacturing PMI continued to increase in February; global goods trade decreased by 1.5% in January; and the Consumer Price Index (CPI) for G7 countries decreased from 6.7% in January to 6.4% in February.

"The story of air cargo in February is one of slowing declines," said Willie Walsh, director-general of IATA, adding that year-on-year demand fell by 7.5%.

Start of improvement trend

"That's half the rate of decline experienced in January. This shifting of gears was sufficient to boost the overall industry into positive territory (+2.9%) compared to pre-pandemic levels," the IATA chief said.

"An optimistic eye could see the start of an improvement trend that leads to market stabilization and a return to more normal demand patterns after dramatic ups and downs in recent years," Walsh further said.

Source: The International Air Transport Association