Aviation market intelligence and consultancy company IBA has warned of a potential oversupply of the Boeing 737-800 passenger to freighter (P2F) aircraft, with 60 conversions forecast for this year alone.

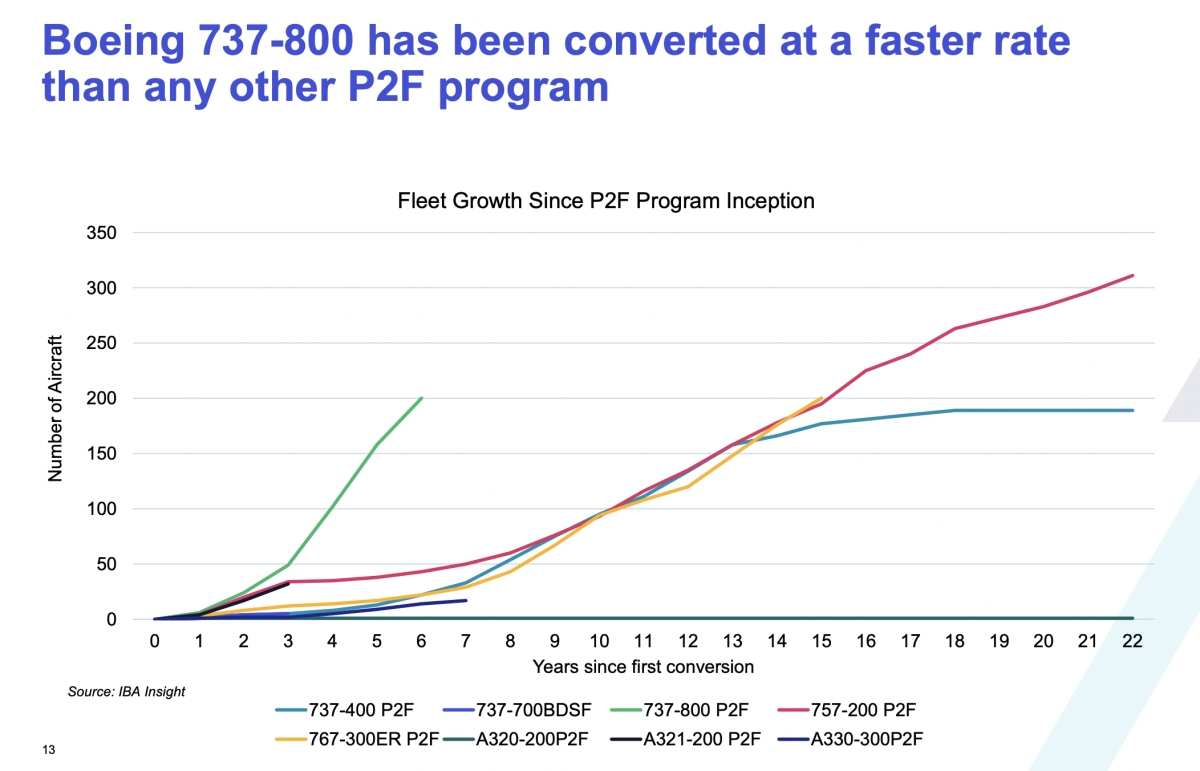

In its latest freighter webinar, IBA said there are signals of oversupply, as it highlighted data from its aviation intelligence platform, IBA Insight, which shows that the 737-800 has been converted at a faster rate than any other P2F programme.

It said that in the six years since the first conversions, the 737-800 P2F has grown rapidly to 200 aircraft. Comparatively, it took the 757-200 P2F and 767-300ER P2F fleets 15 years to reach this size.

Risk of oversupply

IBA said the total 737-800 P2F fleet is on course to surpass the 757-200 P2F fleet of 311 aircraft, which IBA believes "suggests a risk of oversupply based on the rapid fleet growth."

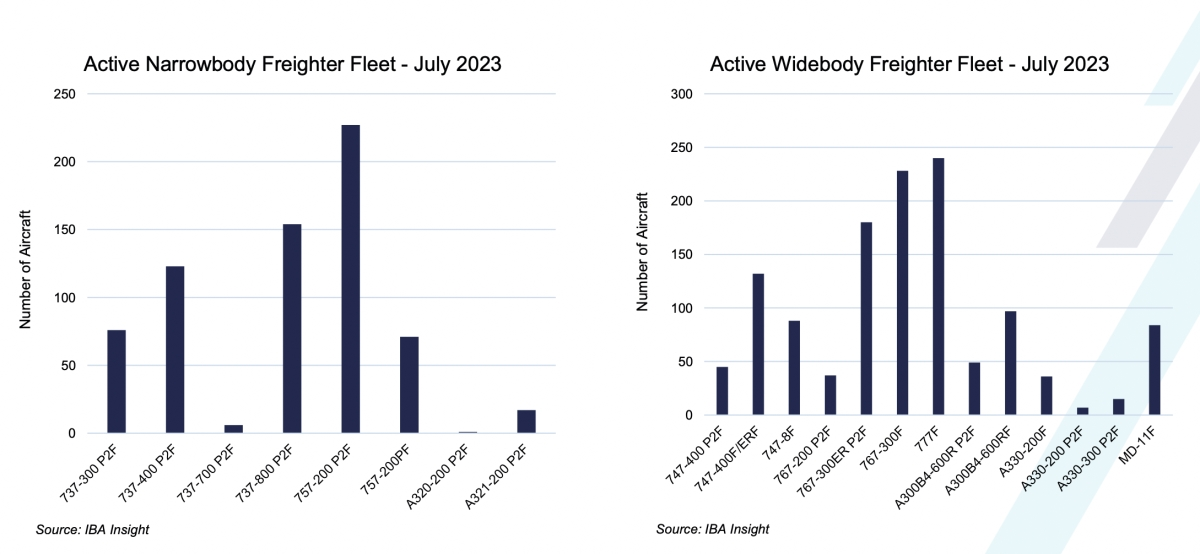

"Indeed, the 737-800 continues to lead the narrowbody conversion market, with conversions of the A321-200 remaining steady as expected — with 20 planned for this year," the aviation consultant said.

Meanwhile, it noted that in the widebody market, Boeing 767-300ER conversions continue to outpace A330-300s, which IBA Insight forecasts to be 30 and seven, respectively, in 2023.

For the active widebody freighter fleet, it said that the Boeing 777F continues to grow its leading position with a fleet of 240 in July 2023.

The 767-300F was ranked close behind with 228, but the MD-11F declined to 84 freighters in July 2023.

Air cargo rates to remain elevated despite decline

IBA also provided an update on cargo traffic, capacity and load factors.

It highlighted that in the first quarter of 2023, Available Freight Tonne Kilometres (AFTKs) were at 2% below 2019 levels, but IBA forecasts they will be 4% above 2019 levels at the start of 2024.

IBA also forecasts that load factors will return to pre-Covid levels as capacity recovers through 2023.

The aviation consultant said it recognised that near-term headwinds to demand and consumer spending, coupled with the ongoing recovery in belly capacity, will likely result in yields softening over the next two years.

However, IBA anticipates that this will still remain elevated to 2019 levels by around 58% for 2023.

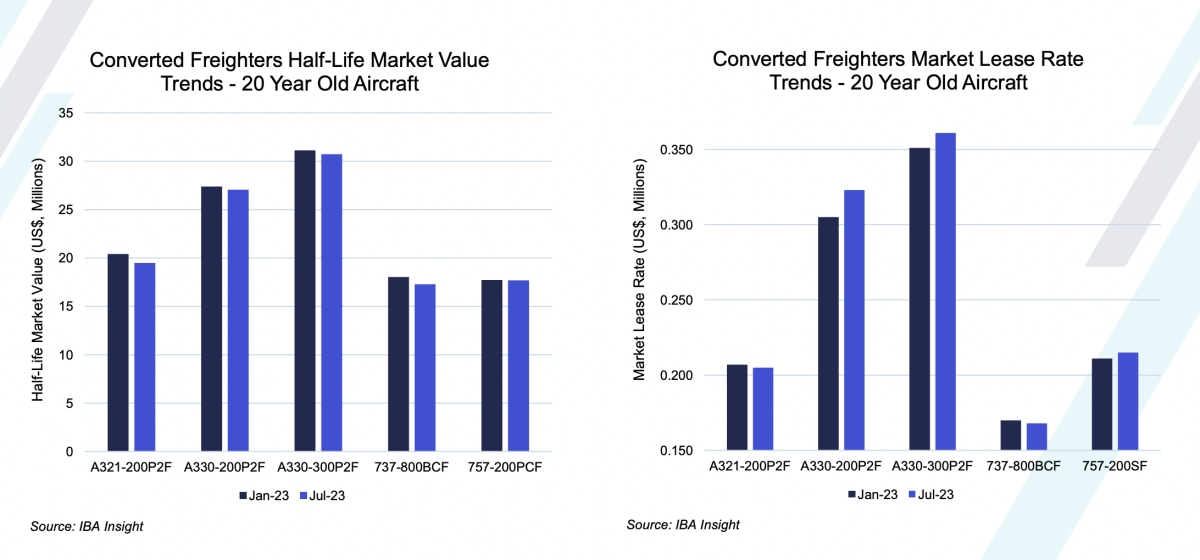

Turning to Lease Rates, IBA said converted narrowbody values and Lease Rates have softened compared to widebodies which are tighter in supply.

This is exemplified by the A330-300P2F, which had a Lease Rate of US$351,000 per month in January of this year. By July, it had increased by almost 3% to US$361,000.