Ocean peak season's early arrival, together with Red Sea diversions straining capacity and schedules, continued to result in worsening congestion, equipment shortages and elevated prices this week.

According to a new Freightos analysis, global congestion is estimated to be tied up about 7% of total capacity, with the worst example currently in Singapore, where diversions have resulted in increased transhipment volumes for Middle East and Red Sea destinations or from intra-Asia containers as carriers omit other port calls to try and recover schedules.

"The port is reactivating an out-of-use terminal to increase capacity and help get to the more than forty vessels currently waiting as many as seven days for a berth," Judah Levine, head of research at Freightos, said.

He noted that so far, hubs in North Europe and North America are not seeing Red Sea-driven vessel bunching or congestion. The recent but falling backlogs at the ports of Savannah and Charleston were attributed to slowdowns from infrastructure projects and software problems.

Freightos said in its analysis that in the last few weeks this demand increase/supply decrease convergence has pushed ex-Asia rates back to or just above their early-year peaks when Lunar New Year demand combined with the first weeks of the Red Sea crisis.

Though prices did not increase sharply last week and are level so far this week, additional, significant, early-June rate increases are anticipated.

Levine said with capacity and equipment scarce and spot rates now several thousand dollars above long-term contract levels; annual agreements are once again becoming "unreliable."

[Source: Freightos]

The report cited a recent Freightos Group survey of more than 50 logistics professionals, which found that since early May, nearly 70% of BCOs and forwarders with long-term ocean contracts have had containers rolled or pushed to the spot market or are facing contract renegotiations with carriers to increase their long term rate levels.

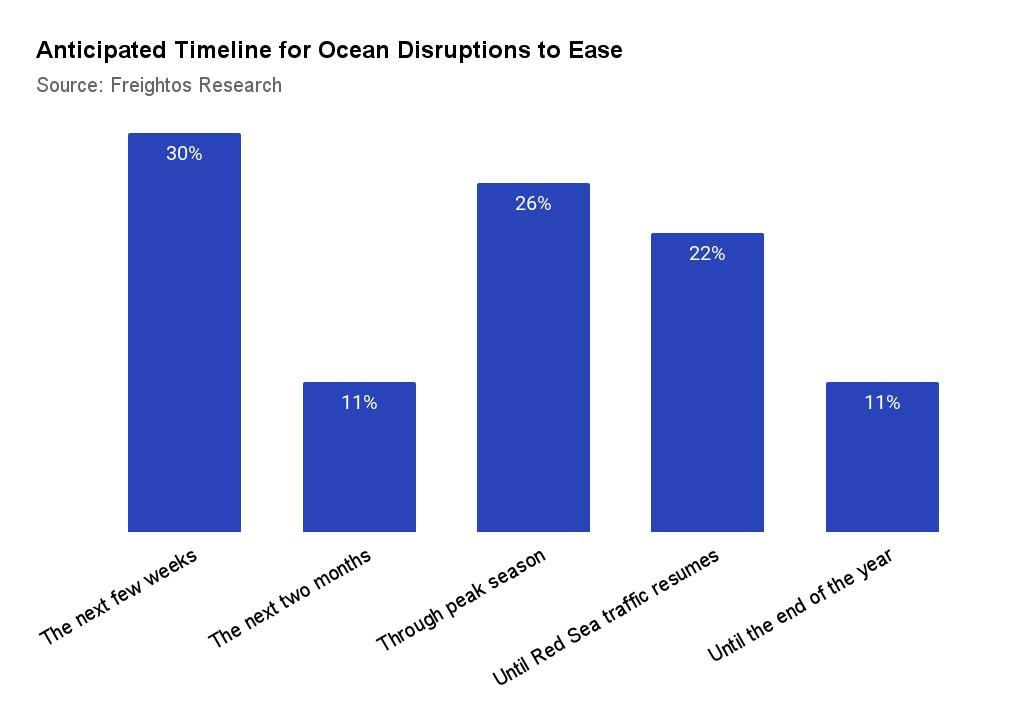

"And there's uncertainty as to how long this will last: Many (40%) think that the situation will improve within the next two months when peak demand could start to ease, while 26% expect these types of disruptions to last until the end of the typical peak season months in early Q4, and others think it could stretch longer," Levine said.

New air cargo e-commerce challenges

The report said demand remained strong for air cargo in May, though the new round of ocean disruptions does not appear to be causing a surge in air cargo volumes just yet.

Freightos Air Index rates from China to North America and Europe eased slightly, and ex-South Asia rates were level at the start of June.

Middle East export rates, however, have rebounded 12-25% since late May, possibly reflecting renewed sea-air demand due to worsening ocean conditions.

Levine said B2C e-commerce volumes from platforms like Temu and Shein have been the main drivers of strong demand, tight capacity and elevated rates from China to N. America and Europe. But Temu will reportedly pull back from the US market, and now Shein is facing challenges there as well.

"In addition, the US Customs and Border Patrol have now increased reporting requirements and the rate of inspections for de minimis exemption imports," he said.

"These steps reportedly led to congestion at LAX—a major hub for e-commerce imports from China—last week and cancelled flights and shipments as exporters adjusted to the new standards," the head of research at Freightos added.

Port of Singapore comments

In response to media queries over the continued surge in container volumes at the Port of Singapore, the Maritime and Port Authority of Singapore (MPA) confirmed that major container lines, including CMA CGM and ONE, have moved more container volumes through Singapore in the first five months of 2024, compared to the same period in 2023.

It said that the total container volumes handled in Singapore in the first five months of 2024 amounted to 16.90 million twenty-foot equivalent units (TEUs), a 7.7% increase over the same period last year.

"The demand for capacity remains strong as container lines continue to collaborate closely with PSA, MPA, the Ministry of Transport, together with the unions, to grow their container volumes through Singapore," it added.