The growth of 'general cargo' air freight tonnages in 2024 is surpassing that of 'special cargo' products, according to the latest analysis from WorldACD Market Data.

This marks a reversal of the recent trend of demand outperforming general cargo, with demand from air cargo shipments requiring special handling and shipping generally outperforming general cargo.

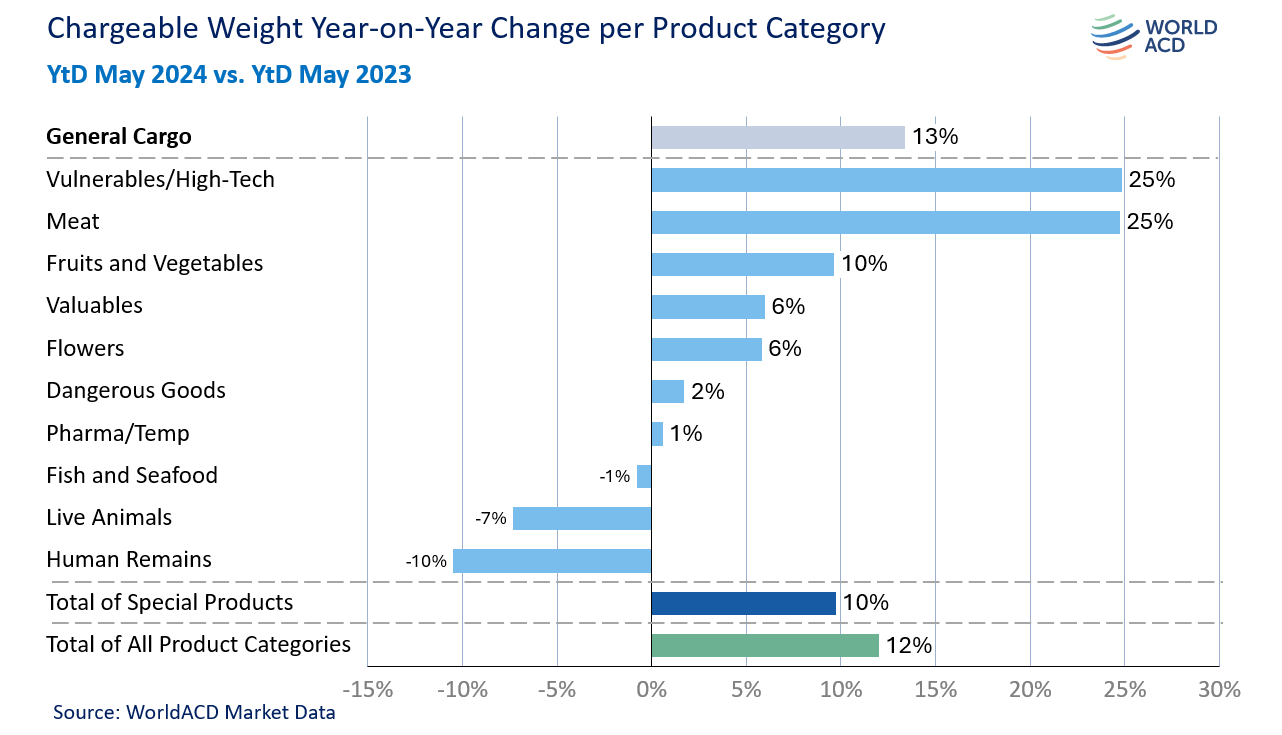

Analysis of the first five months of 2024 by WorldACD indicates that total worldwide chargeable weight from January to May 2024 was up 12% compared with the equivalent period last year, with general cargo demand up by 13% year over year (YoY) and special cargo growth trailing at 10%.

"This contrasts with WorldACD's findings late last year that in the first eight months of 2023, general cargo tonnages fell by 12% YoY, whereas tonnages of special cargo products as a whole grew by 3%, on a worldwide basis, at a time when the market as a whole was down by 7% YoY," the announcement said.

WorldACD noted that one factor for this is the strong growth since the start of last autumn in cross-border e-commerce traffic, which often flies in bulk as general cargo rather than within a special product category, as well as the conversion of sea freight to air cargo and sea-air resulting from disruptions to container shipping since last November due to the attacks on vessels in the Red Sea.

These two factors have contributed to significant YoY rises in chargeable weight in the five months to May 2024 (year-to-date May, or YtD May) from Asia Pacific (20%) and Middle East & South Asia (MESA, 22%), as shown below

Examining the performance of some of the major air cargo product categories so far this year highlights some interesting trends, including extremely strong (25%) growth in worldwide shipments of vulnerable/high-tech cargo, along with a 25% increase in meat shipments.

Fruit and vegetable traffic grew by 10%, valuables and flowers by 6%, dangerous goods traffic by just 2%, and pharma/temperature-controlled traffic by 1%.

Meanwhile, fish and seafood saw a small decline (1%), while live animal shipments dropped by 7% and human remains dropped by 10% YoY.

Globally, the proportion of special cargo products within the total market averaged 35% in the five months to May 2024.

However, analysis according to the cargo's origin region reveals some significant differences in their ratios and respective rates of growth.

In contrast, for the MESA origin market – which has been particularly impacted by disruptions to container shipping this year – general cargo growth (31%) far outpaced the growth of special cargo (8%).

Hong Kong leads May growth rankings

Examining specific countries or sub-regional markets showing the largest increases and decreases worldwide also highlights some interesting developments.

Ranked according to the markets' absolute changes in weight, Hong Kong tops the May rankings in terms of outbound traffic increases, with an increase of over 30 million kgs (30,000 tonnes) YoY. It is followed by China South East, China East, India, and the United Arab Emirates—meaning four out of the top five outbound YoY growth markets in May were in Asia.

On the inbound side, the United Arab Emirates subregion tops the rankings in May for total increases in chargeable weight, with a YoY increase of plus 10 million kilos, followed by Saudi Arabia, the USA Pacific States, Germany, and China East.

Of those top-five inbound growth markets, Saudi Arabia recorded the biggest YoY percentage increase at 44%, followed by the United Arab Emirates (28%), Germany (19%), USA Pacific States (16%), and China East (17%).