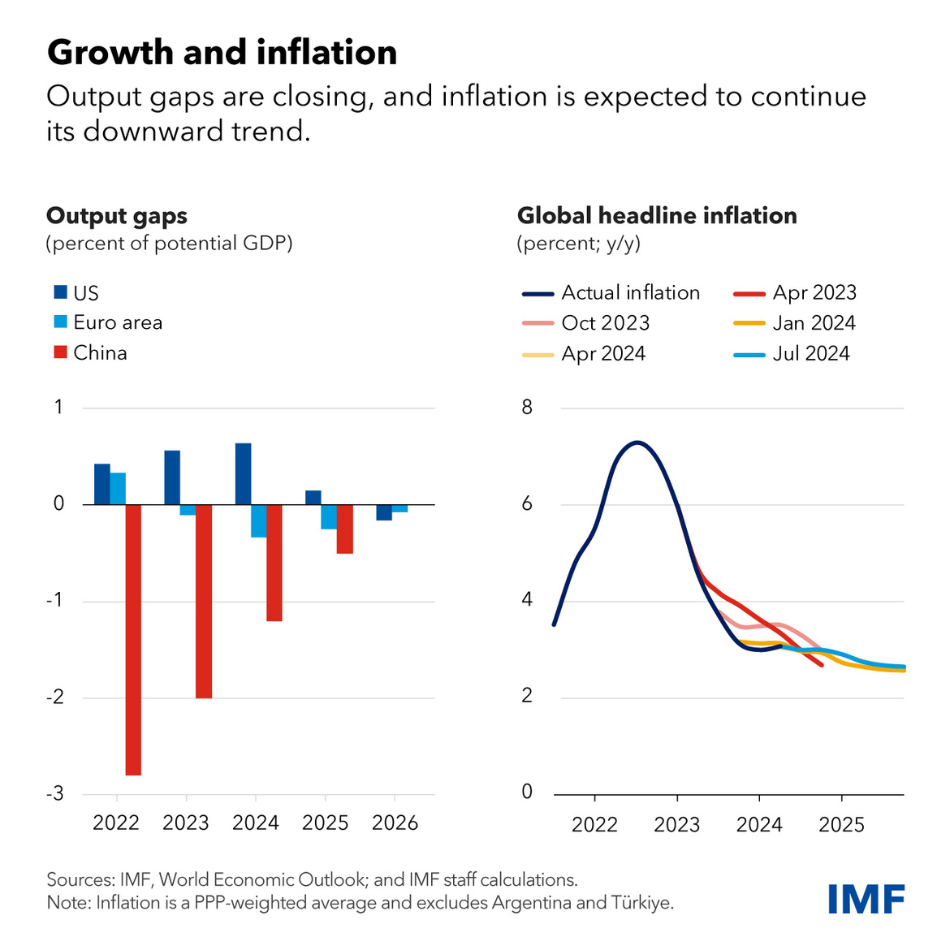

The report noted that growth in major advanced economies is becoming more aligned as output gaps are closing.

For instance, the United States shows increasing signs of cooling, especially in the labor market, after a strong 2023. The euro area, meanwhile, is poised to pick up after a nearly flat performance last year.

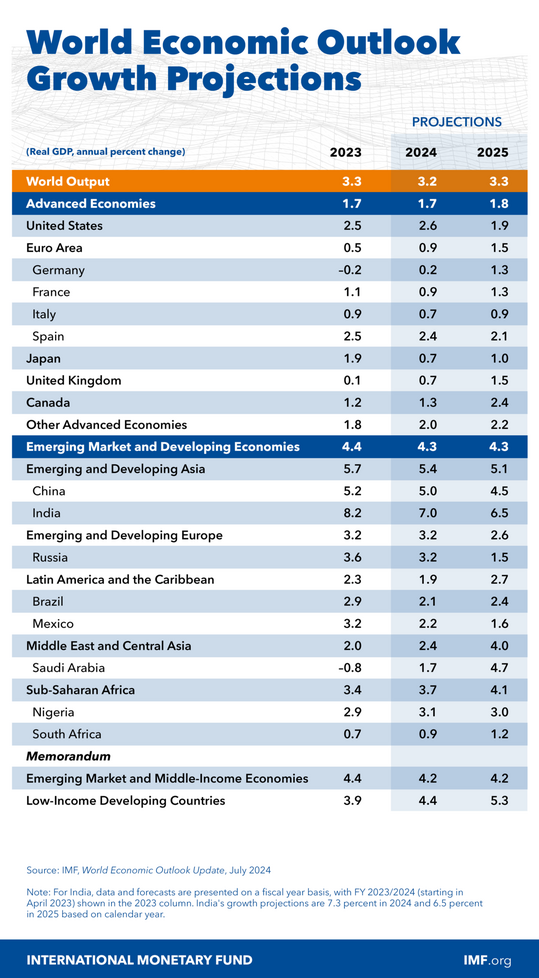

Meanwhile, the IMF said that Asia's emerging market economies remain the main engine for the global economy.

It noted that growth in India and China is revised upwards and accounts for almost half of global growth. Yet prospects for the next five years remain weak, largely because of waning momentum in emerging Asia.

"By 2029, growth in China is projected to moderate to 3.3%, well below its current pace," the report said.

Global inflation to slow this year

IMF noted that, as in its April report, it projects global inflation to slow to 5.9% this year from 6.7% last year, broadly on track for a soft landing. "But in some advanced economies, especially the United States, progress on disinflation has slowed, and risks are to the upside," the IMF said.

"We find that risks remain broadly balanced, but two downside near-term risks have become more prominent: First, further challenges to disinflation in advanced economies could force central banks, including the Federal Reserve, to keep borrowing costs higher for even longer. That would put overall growth at risk, with increased upward pressure on the dollar and harmful spillovers to emerging and developing economies; and second, fiscal challenges need to be tackled more directly."

The report noted that the deterioration in public finances has left many countries more vulnerable than foreseen before the pandemic.

"Unfortunately, economic policy uncertainty extends beyond fiscal considerations," the IMF said. It added that the gradual dismantling of the multilateral trading system is another key concern."

"More countries are now going their own way, imposing unilateral tariffs or industrial policy measures whose compliance with World Trade Organization rules is questionable at best. Our imperfect trading system could be improved, but this surge in unilateral measures isn't likely to deliver lasting and shared global prosperity."

'If anything, it will distort trade and resource allocation, spur retaliation, weaken growth, diminish living standards, and make it harder to coordinate policies that address global challenges, such as the climate transition," the major financial agency of the United Nations added.