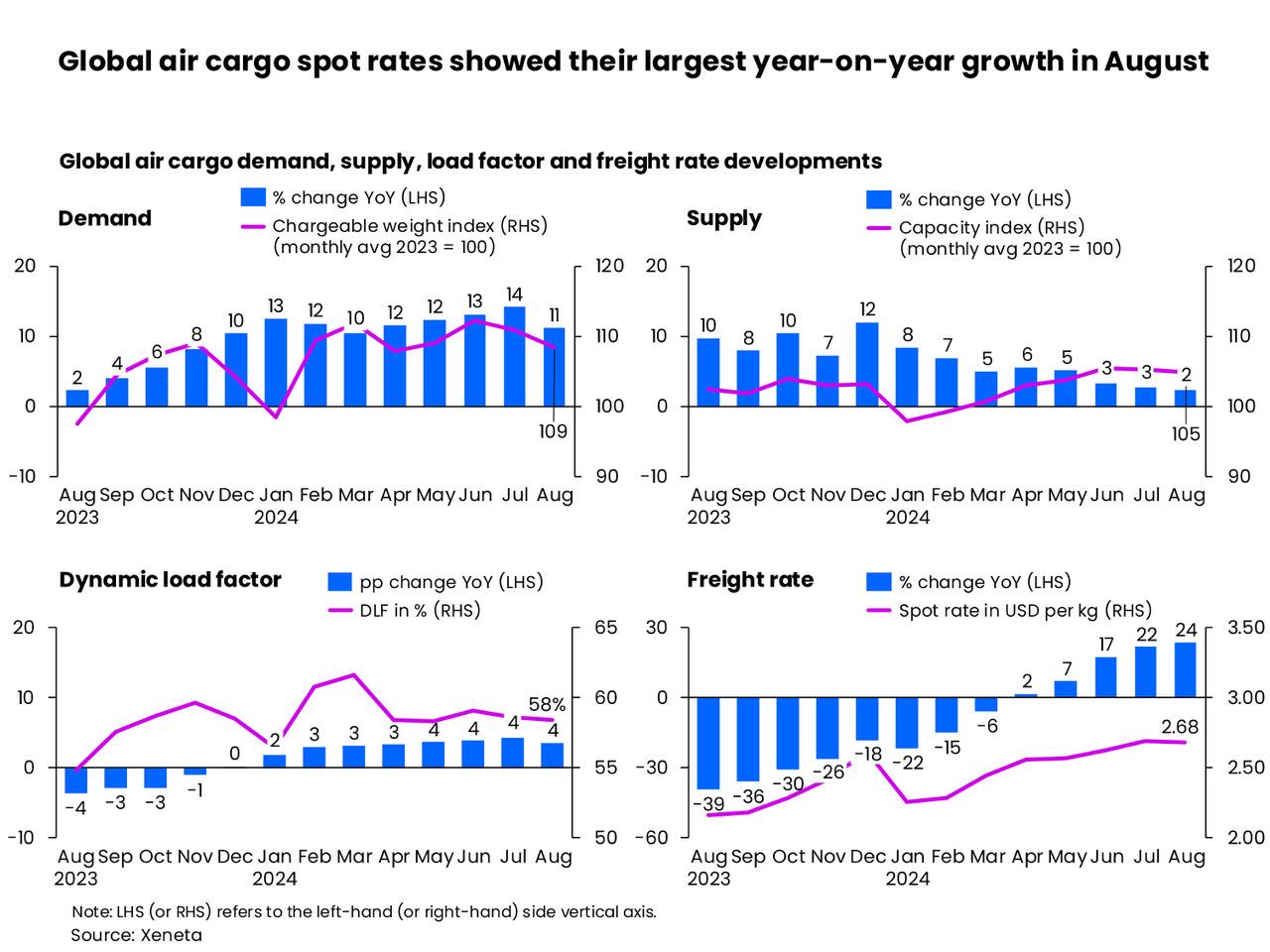

The global air cargo market's double-digit demand growth continued in August, according to the latest weekly analysis by Xeneta, with average spot rates showing their largest year-on-year growth of 24%.

Global average air cargo spot rates of US$2.68 per kg in August were boosted by a continuing supply and demand imbalance. Global cargo supply grew at its slowest ratio in 2024 to date, while global cargo demand continued its double-digit growth.

The increase was further supported by the ocean-to-air shift due to Red Sea disruptions and e-commerce demand.

"E-commerce continued to show strong growth as the air cargo market continued to cruise towards its hotly anticipated peak season," Xeneta said.

Citing data from Trade and Transport Group, it noted that e-commerce and low-value goods exports from China in the first seven months of 2024 increased 30% year-on-year, with shipments to Europe and the US showing an increase of 38% and 30%, respectively.

No summer slack season

"Typically, air cargo market performance in August tends to follow the July trend. But another month of double-digit demand growth and the strongest rate growths of the year means there was definitely no summer slack season in 2024," said Niall van de Wouw, Xeneta's chief airfreight officer.

"Rates we saw bottoming out in late July started picking up again in mid-August. This is too short a period to call a season. This has been a busy summer, and now we’re at the threshold of Q4. It will be interesting to see what will happen and if all the anticipation of a red-hot peak season materialises," he added.

The analysis from the ocean and air freight rate benchmarking and market analytics platform noted that it is worth noting that the growth momentum of global air cargo volumes did slow in August compared to earlier this year — although this was anticipated, with the following months likely to follow suit.

Xeneta said this is in part because demand in the corresponding months earlier in 2023 was weaker compared to the peak in volumes in Q4 2023.

Looking at month-on-month (M/M) developments, the global air cargo market saw spot rates soften (drop 1%) in August, which is likely reflecting a slight cooling of the ocean-to-air shift due to ocean shipping frontloading of imports.

Inbound North American air cargo rates registered the largest increases from a month ago during what is usually considered to be the industry's traditional slack season.

Peak season outlook

van de Wouw said September results will be a "good indicator" of what Q4 will bring.

"Let's see if the peak surcharges some carriers plan to implement will hold," he said, adding that freight forwarders are more prepared this year and are spending a lot of time with shippers on how to manage the unpredictable nature of these market conditions.

"We see financial and operational derisking going on, but if the heat is on, let's see what happens with all the contracts that are being negotiated," Xeneta's chief airfreight officer further said.

van de Wouw noted that rates have been increasing throughout the summer, which is not typically the case. He also noted that Q4 is expected to be busy in terms of volumes, but it's uncertain how busy it will get.

"E-commerce demand will play a big role. With 30% growth already this year ex-China and a reported 37 million new downloads of just the TEMU app in July, the indicators already suggest strong demand for capacity, and this will impact the entire market on major corridors," he said.

"I said to a shipper last week if you are not already a little bit nervous, I would recommend you get a little bit nervous for Q4 when you look at all the signals out there."

"Especially out of Asia, we should not be surprised if the market really heats up again in Q4. We expect to see a seller's market out of Asia and across the Atlantic due to the latter's reduction in winter capacity. We've had a hot summer, and we may have an even hotter autumn ahead," van de Wouw further said.