Worldwide average air cargo spot rates rose to a new 2024 high in the first full week of September, boosted by a surge in tonnages and spot rates from Asia Pacific origins, particularly to North America and Europe, according to the latest figures and analysis from WorldACD Market Data.

The air cargo data provider said average global spot rates increased by 6% to US$2.85 per kilo in week 36 (September 2-8), compared with the previous week, up 30% higher than the equivalent week last year.

This is driven by a week-on-week (WoW) increase of 6% from Asia-Pacific origins and 7% from the Middle East & South Asia (MESA) origins, taking spot rates from those regions 41% and 101% higher, year on year (YoY).

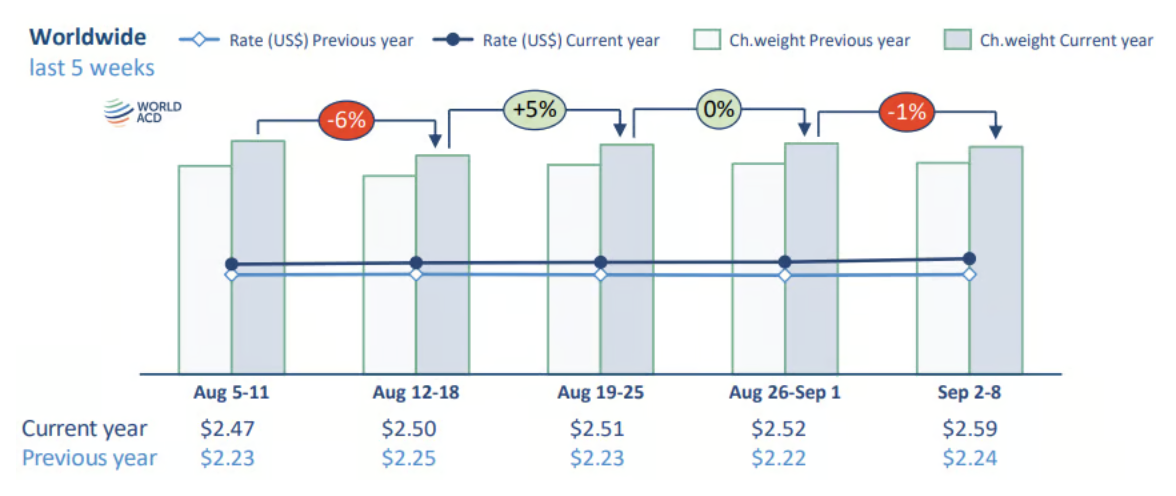

For the period, average worldwide contract rates also edged up by a further 3% to US$2.48 a kilo, generating a US$2.59 per kilo full-market average of spot rates and contract rates — a WoW 3% rise and a YoY increase of 16%.

"That's an increase of 51% compared with the last pre-Covid equivalent period, September 2019," WorldACD said in its latest report.

Worldwide tonnages edged downwards by 1% in week 36, due largely to a 12% decrease from North America origins linked to the Labour Day holidays on September 2 in the US and Canada.

China-Europe spot rates soar

WorldACD said among the biggest price increases in week 36 was an 18% WoW jump in spot rates from China to Europe to US$4.39 per kilo—one of the highest levels this year and 46% above their level this time last year.

That accompanied a 4% WoW rise in China to Europe tonnages.

[Source: WorldACD]

Meanwhile, spot rates from Thailand to Europe surged by a further 14%, WoW, to US$3.73 per kilo — a rise of more than one-third (34%) in just three weeks — taking Thailand to Europe spot rates to almost double (up 86%) their level this time last year.

Average spot rates from Asia Pacific to the USA crept up by a further 3%, WoW, to US$6.16 per kilo — the highest level for several months, and a YoY increase of 64% — while chargeable weight flown remained stable, WoW.

"There are no clear signs of any overall drop in tonnages from Asia Pacific to the USA resulting from new security changes introduced in the USA last month," WorldACD said.

It noted, however, that tonnages from China to the US, and particularly to LAX airport, have been significantly down, YoY, in the last eight weeks, most likely due to tighter customs checks of Chinese origin cargo at LAX since the start of the summer.

From MESA, tonnages have been somewhat volatile in the last few weeks — including a 21% WoW drop from Dubai to Europe and a 21% WoW increase from Colombo to Europe in week 36.

But the report said spot rates from MESA origins to Europe remain exceptionally high and rose by a further 7% in week 36 to an average of US$3.42 per kilo — more than double (up 116%) their level last year — thanks to further increases from Dubai (up 8%, WoW) and Bangladesh (up 5%, WoW), to US$2.30 and US$5.33 per kilo, respectively.