September's global air cargo market lived up to analysts' expectations, becoming the first month of 2024 not to report double-digit growth due to a strong year-on-year comparison, but demand still rose 9% on last year, according to the latest industry data from Xeneta.

Airlines and freight forwarders now face a 'fine balancing act' between protecting customer relationships and being tempted by short-term revenue gains offered by increasing market volatility, including this week's strikes at ports on the US East Coast and Gulf Coast.

"September is already old news. October is a whole new ballgame," said Niall van de Wouw, Xeneta's chief airfreight officer.

"We could see rates rising very quickly on some trade lanes because of the fear-of-missing-out (FOMO) effect as air cargo capacity leaves the market for the winter, US port workers go on strike, and conflict is escalating in the Middle East, potentially bringing further Red Sea disruption for ocean freight."

van de Wouw noted reports suggesting that supply chains could take 4-6 weeks to recover from a one-week US ports strike. This would take the industry into November, the busiest month of the year for air cargo volumes.

"It's a difficult situation. Covid was worse, but this is an accumulation of many events, and things can change very quickly. FOMO is a powerful force," he said.

Growth eased (a little) in September

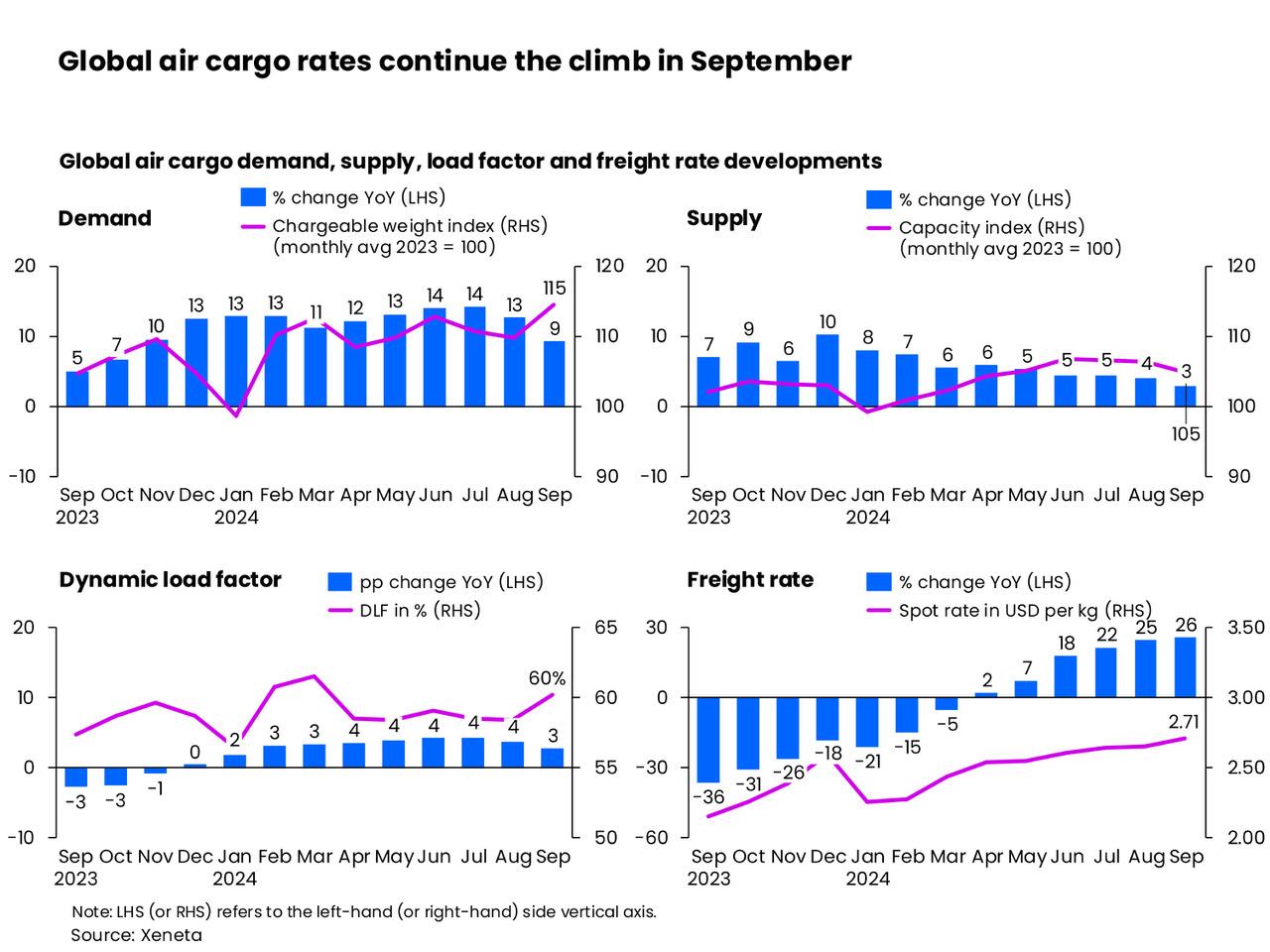

As expected, September's global air cargo demand growth showed signs of easing a little, up 9% year-on-year, reflecting the strong peak in demand, which commenced in September 2023.

The latest monthly volumes, however, were sustained by persistent e-commerce demand, ocean-to-air shift due to container shipping disruptions, typhoon disruptions, and a cargo rush ahead of China's Golden Week holidays (October 1-7).

Global air cargo supply grew by only 3% year-on-year in September—its slowest growth rate this year—as airlines began making flight schedule adjustments in preparation for winter.

Xeneta expects a 20% reduction in cargo capacity across the Atlantic this winter to reflect lower passenger demand.

Dynamic load factor—Xeneta's measurement of capacity utilisation based on the volume and weight of cargo flown alongside available capacity—continued to rise due to the persistent imbalance between supply (up 3%) and demand (up 9%) year-on-year growth.

It increased by 3 percentage points year-on-year and 2 percentage points month-on-month, reaching 60% in September.

As a result, it noted that September's average global spot rate increased 26% to US$2.71 per kg, the fourth straight month of double-digit growth and the highest increase this year.

Zooming into the corridor level, spot rates from Asia to North America and Europe topped the chart in September, exceeding the other major global corridors by over two US dollars per kg.

The report said most Asia to North America and Europe rates showed single-digit month-on-month increases in September, except for a slight dip from Southeast Asia to North America.

As for year-on-year trends, it noted that all registered double-digit growth.

"The Middle East and Central Asia to Europe market saw the most striking rise in rates in September. Boosted by continued Red Sea disruptions, this traditional backhaul route saw a 112% year-on-year increase," the report added.

As for Europe-to-North America trade, the spot rate was on par with a month ago but is expected to come under severe upward pressure if the US East and Gulf Coasts and Canada port strikes are not resolved quickly.

A testing time in Q4

Global events, van de Wouw noted, will now put preparations for this year's peak season to the test.

"As we've said before, companies are more prepared this year and the rules of the game have been clarified between airlines and forwarders as well as between forwarders and shippers. There are now more precise agreements in place on how to navigate the storm the market is likely entering," he said.

"There are agreements around rates, surcharges, and the timeframes in which they can be applied, but there's going to be a fine balancing act between maintaining relationships and being tempted by the short-term benefits these market conditions are creating," Xeneta's chief airfreight officer, added.

"The macroeconomic outlook for 2025 is not fantastic, particularly as it impacts the general freight market. That may make the current volatility and opportunities for rate increases very tempting for carriers. We are already picking up signals that peak surcharges are being accepted by forwarders and shippers because the capacity providers clearly have the upper hand."

"The rules that have been agreed upon mean there's less room for the temptation of large rate increases during a hot peak. But we do see a piece of the market where you've got to 'pay to play', and that could become a potential 'wild west'," van de Wouw added.

He noted that shippers or forwarders may end up there due to unforeseen demand, and it could be an expensive game.

He says an enduring US ports strike may produce a significant bonus for airlines across the Atlantic from the US to Europe, where load factors would otherwise likely remain below 65% even after the removal of surplus summer capacity.

"Because of the low base, there's a lot of room for those rates to go up if conditions become tougher and goods absolutely need to be shipped. Then we could see rates tripling," he pointed out.

These factors combined, van de Wouw said, continue to support a potential double-digit growth rate for the global air cargo market across 2024.