Danish maritime data analytics firm Sea-Intelligence has warned of a "worsening" trade imbalance in some of the world's largest deep-sea trades, a trend that started before the Covid-19 pandemic.

In a recent analysis, Sea-Intelligence noted that all deep-sea trades, to some degree, tend to be lopsided, with one end of the trade importing more than they are exporting as they looked into developments in trade imbalances and back-haul utilisation in the post-pandemic period.

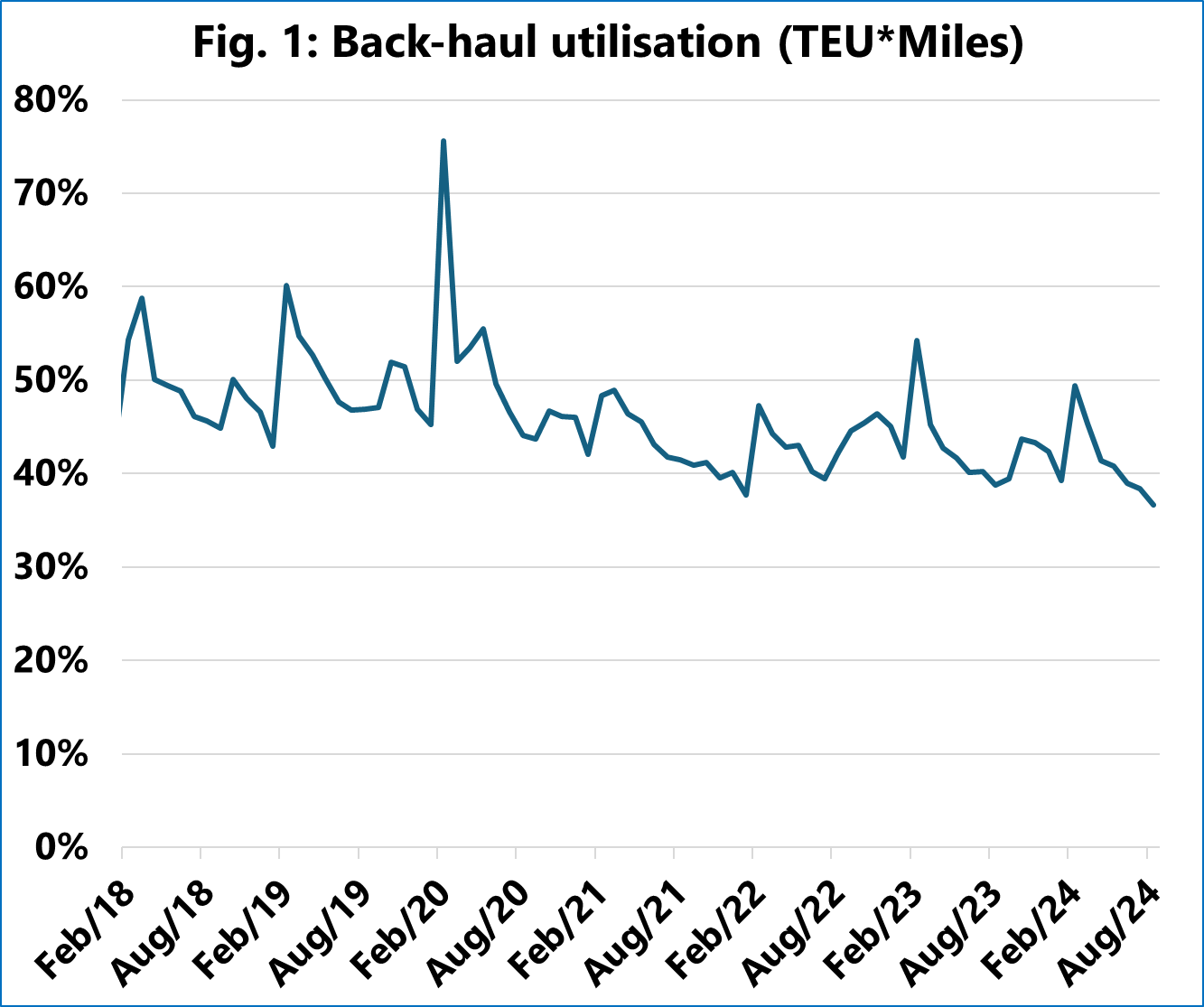

"Pre-COVID, the back-haul vessel utilisation was hovering around the 50% mark but has been declining since then and dropped below 40% in August 2024 for the first time," Alan Murphy, CEO of Sea-Intelligence, said.

In this context, the head haul is defined as the direction with the larger trade flow, and the return leg is referred to as the backhaul.

Sea-Intelligene calculated back-haul utilisation by assuming all head-haul vessels to be 100% full, which means that the volume of back-haul cargo, as a ratio to the head-haul cargo, becomes equal to the back-haul utilisation.

[Source: Sea-Intelligence]

"If we also factor in the distance travelled by the container vessels, measured as TEU*Miles, we see back-haul utilisation drop below 40% for three consecutive months, with a record-low number of 36.6% in August 2024," Murphy said.

"It is, therefore, very clear that the trade imbalances, from a global perspective, have worsened sharply since before the pandemic," the Sea-Intelligence chief said.

"This is especially true for the five largest deep-sea trades in terms of volumes shipped, which have all seen a significant worsening in trade imbalance compared to the situation pre-pandemic," he added.

Murphy went on to note that with this scenario, either the head-haul trades will increasingly have to "pay" more for the repositioning of empty containers, as there are fewer back-haul containers "paying their own way", or back-haul shippers will have to pay higher freight rates, as there are fewer paying back-haul containers, as a share of the vessel space.

"Whether a carrier will try to push this added cost imbalance onto the head-haul or the back-haul will depend entirely on their strategy for serving either market," the Sea-Intelligence chief added.