Despite high interest rates and modest economic growth, global mergers and acquisition (M&A) deal activity surged during the third quarter (Q3) of 2024, driven by the resilience of the supply chain.

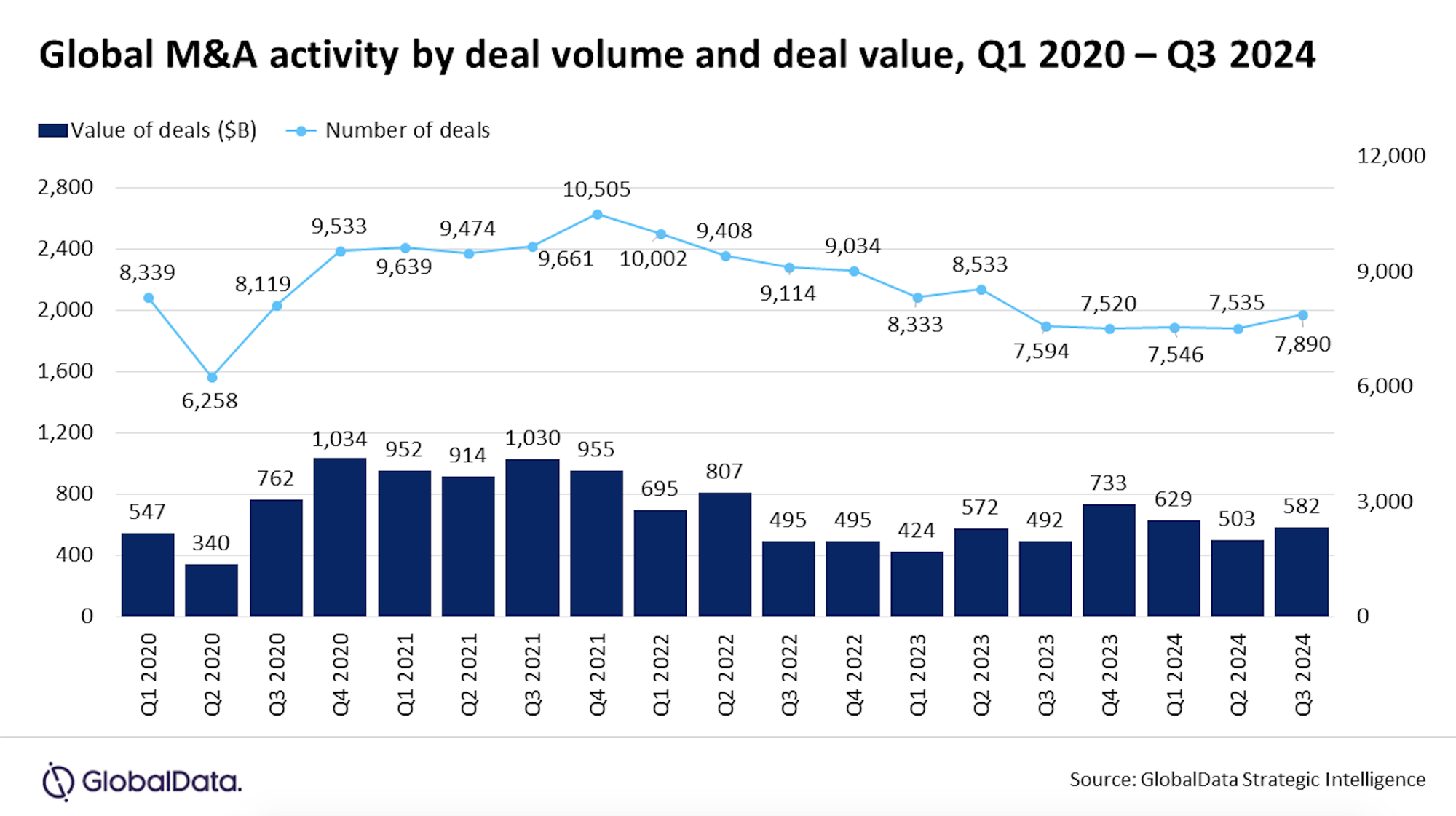

Data analytics company GlobalData said M&A activities registered an 18% increase in total deal value year-over-year (YoY).

"Supply chain resilience drove this momentum, with US$71 billion in supply chain-related transactions across 38 deals, spotlighting sectors like automotive, healthcare, and industrials," GlobalData said.

GlobalData's latest Strategic Intelligence report, "Global M&A Deals in Q3 2024 - Top Themes by Sector," found that in terms of deal volume, there was a 4% increase from Q3 2023 to record 7,890 deals in Q3 2024.

"An increase in geopolitical tensions, population growth, environmental, social, and governance (ESG) considerations, labour shortages, and digital transformation have all contributed to a greater focus on supply chain-related deals," said Priya Toppo, analyst of strategic intelligence at GlobalData said.

Toppo noted that this was especially true in the automotive, consumer, basic materials, healthcare, transportation, infrastructure, logistics and industrial sectors.

"The biggest supply chain deal was China First Heavy Industries' merger with China Shipbuilding for US$16 billion," the report said, adding that this deal was also the biggest in the industrial sector in Q3 2024.

It was followed by TowerBrook Capital Partners and Clayton, Dubilier & Rice's acquisition of R1 RCM for US$9 billion and Boeing's acquisition of Spirit AeroSystems for US$8 billion.

"An ongoing trend is the dominance of North America in M&A deal activity, accounting for 3,112 deals worth US$325 billion during Q3 2024. However, Europe, China, South America, and the Middle East and Africa saw a YoY decline in deal value," Toppo said.

Looking ahead, Toppo indicated a mixed outlook for the future of M&A deals.

"The M&A forecast for the last quarter of 2024 is cautiously optimistic, as potential rate cuts in certain markets and a generally improving global economic outlook could drive the activity," the GlobalData analyst said.

"Nonetheless, mega-deals may encounter obstacles, especially in the US, where antitrust issues remain a priority for regulators," Toppo added.